Wealth manager Choreo discloses first Bitcoin ETF holdings

Key Takeaways

- Choreo LLC reports its first-ever Bitcoin ETF holdings valued at around $6.5 million.

- The firm's largest position is in iShares Bitcoin Trust ETF, with significant allocations to GBTC, FBTC, and BTC.

Choreo, an independent wealth management firm with over $27 billion in assets under management, has officially entered the Bitcoin ETF rush, revealing around $6.5 million invested across multiple funds.

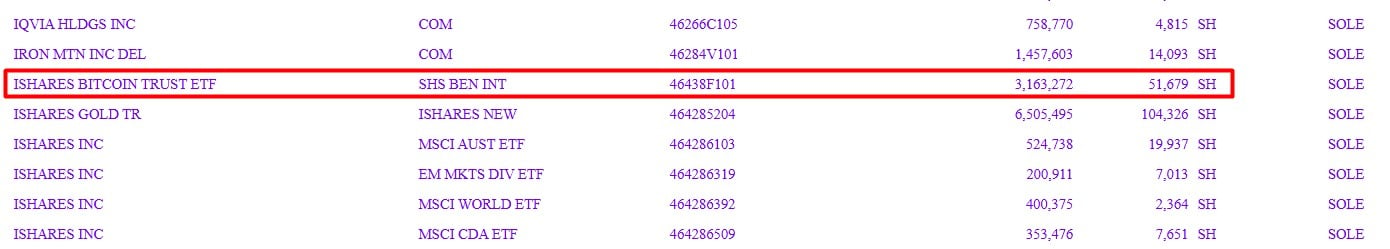

According to a Wednesday filing with the SEC, Choreo’s largest stake was in BlackRock’s iShares Bitcoin Trust ETF (IBIT), with 51,679 shares valued at over $3 million as of June 30.

The firm also held 22,976 shares of the Grayscale Bitcoin Trust ETF (GBTC), worth approximately $1.9 million, and 8,314 shares of the Grayscale Bitcoin Mini Trust ETF (BTC), valued at nearly $397,000.

Rounding out its Bitcoin exposure, Choreo owned 13,607 shares of the Fidelity Wise Origin Bitcoin ETF (FBTC), worth around $1.3 million, during the second quarter of this year.

The new disclosure places Choreo among a growing list of wealth managers and institutional investors adding Bitcoin ETFs to their portfolios.

Not just fund managers and pension funds, but university endowments are also wading into Bitcoin ETFs.

Harvard Management Company disclosed last week that it had bought about 1.9 million shares of BlackRock’s iShares Bitcoin ETF, worth more than $116 million, as of June 30. The position was the fifth largest in its $53 billion endowment, after Microsoft, Amazon, Booking Holdings, and Meta.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Is the moat of public blockchains only 3 points? Alliance DAO founder's remarks spark heated debate in the crypto community

Instead of worrying about "moats," perhaps we should focus more on how cryptocurrencies can meet the real needs of more market users faster, at lower cost, and with greater convenience.

Digital Finance Game: Unveiling the US Cryptocurrency Strategy

Glassnode: Bitcoin weakly fluctuates, is major volatility coming?

If signs of seller exhaustion begin to appear, it is still possible in the short term for bitcoin to move towards the $95,000 level and the short-term holder cost basis.

Axe Compute (NASDAQ: AGPU) completes corporate restructuring (formerly POAI), enterprise-level decentralized GPU computing power Aethir officially enters the mainstream market

Predictive Oncology officially announced today that it has changed its name to Axe Compute and will trade on Nasdaq under the ticker symbol AGPU. This rebranding marks Axe Compute's transition into an enterprise-level operator, officially commercializing Aethir's decentralized GPU network to provide robust, enterprise-grade computing power services for AI companies worldwide.