Arbitrum TVL Hits YTD High as Rising Ethereum Activity Fuels Layer-2 Demand

Arbitrum’s TVL hits $3.39 billion, fueled by Ethereum’s surge. ARB price rises 12%, backed by strong trading volume and bullish MACD.

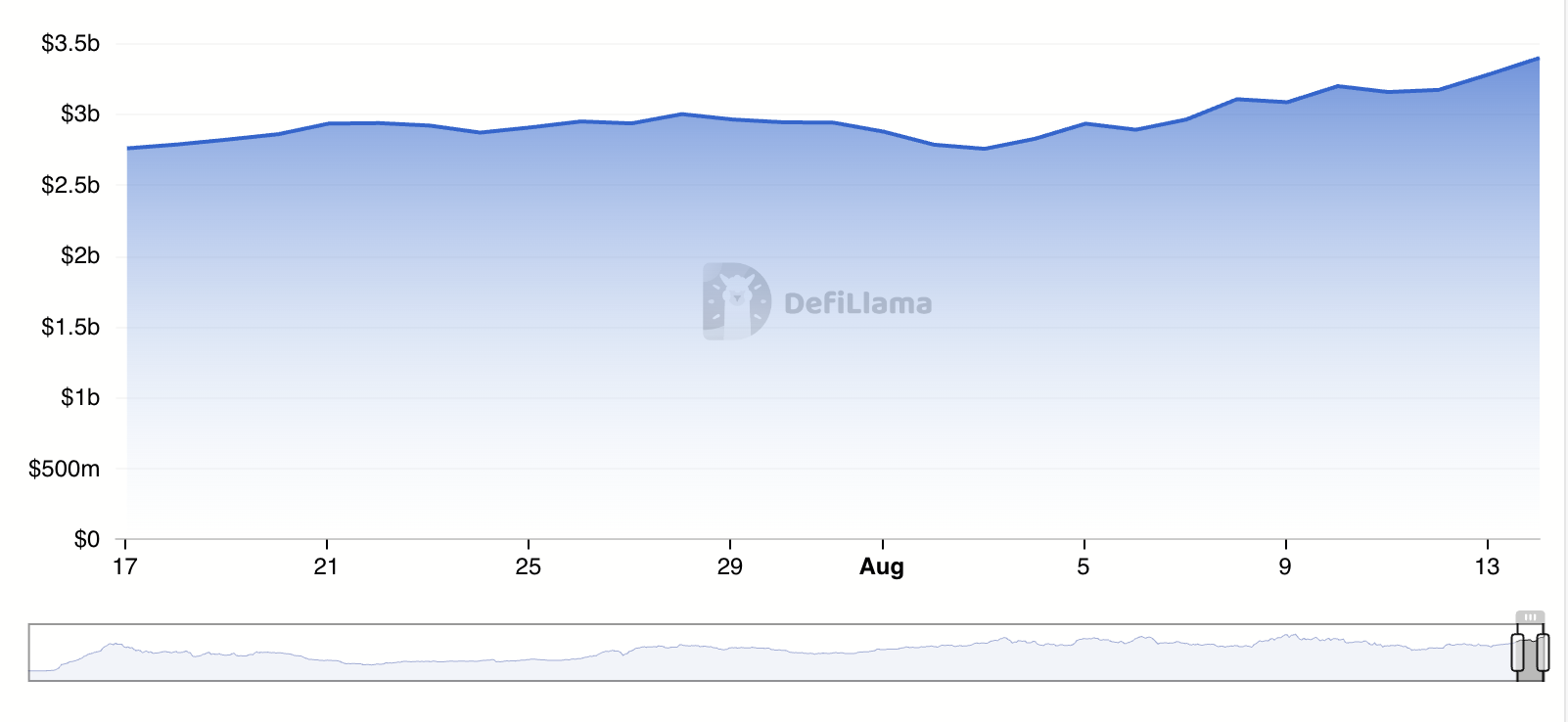

Arbitrum’s decentralized finance (DeFi) total value locked (TVL) has reached a year-to-date high of $3.39 billion.

The growth comes as increased activity on the Ethereum network—fueled by rising trading activity—spills over to Layer-2 solutions (L2s) like Arbitrum.

Arbitrum Sees Record Liquidity Amid Ethereum Network Uptick

According to DeFiLlama, Arbitrum’s TVL has reached a year-to-date high of $3.39 billion, climbing steadily over the past four weeks.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Arbitrum TVL. Source:

Arbitrum TVL. Source:

Arbitrum TVL. Source:

Arbitrum TVL. Source:

A rising TVL indicates greater liquidity and usage on a network. It suggests that more capital is being locked into smart contracts for trading, lending, or other decentralized finance activities.

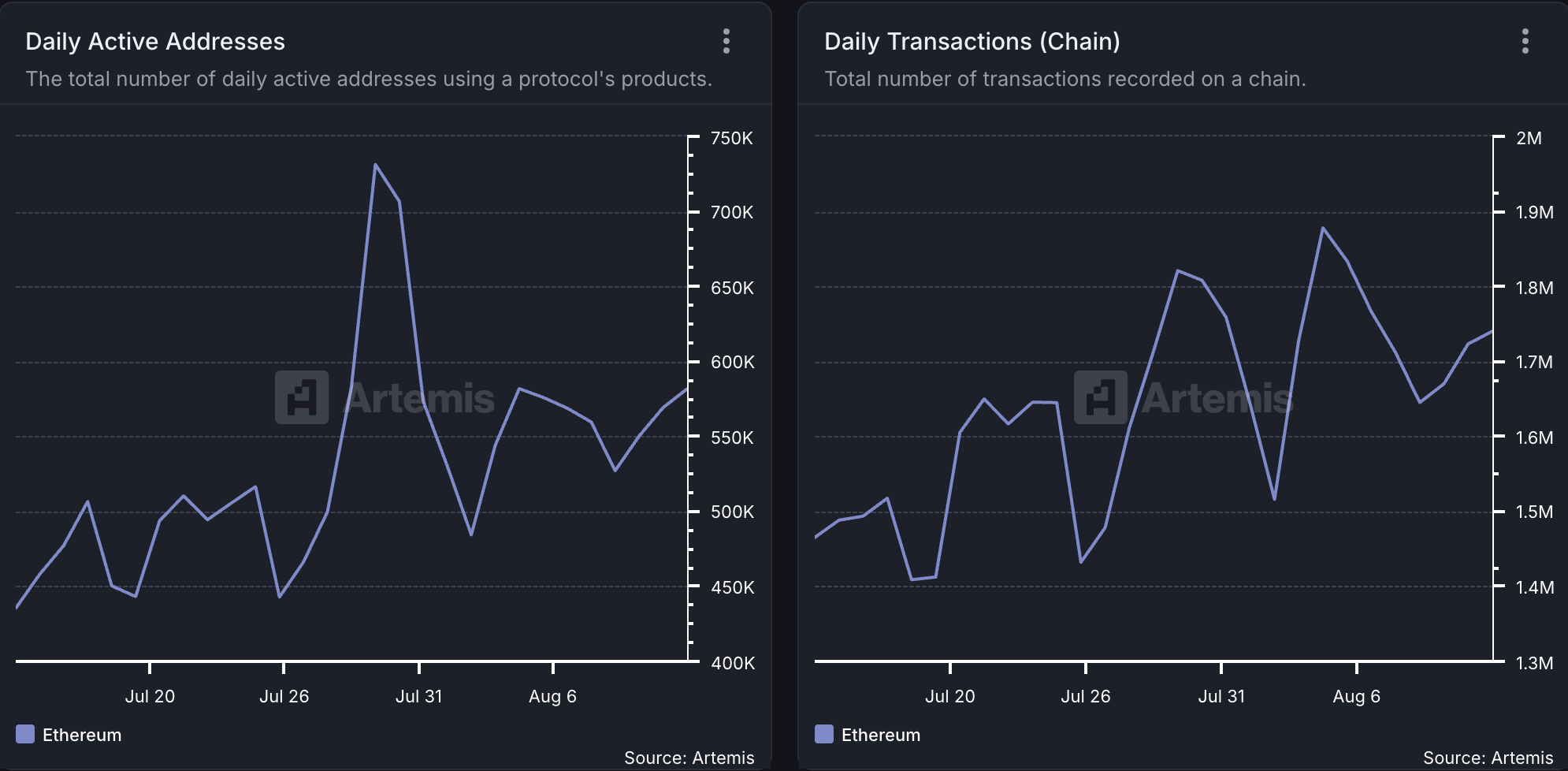

For Arbitrum, its rising user demand mirrors Ethereum’s recent network activity. According to Artemis, Ethereum’s daily active address count has surged 33% over the past few weeks, with transaction volume up 10%.

Ethereum Network Activity. Source:

Ethereum Network Activity. Source:

Ethereum Network Activity. Source:

Ethereum Network Activity. Source:

When Ethereum experiences a rise in user demand like this, much of the activity spills into L2s. These networks provide faster transaction times and lower fees, attracting users who want to avoid congestion on the main Ethereum chain.

As a result, L2s like Arbitrum often see increased liquidity and engagement whenever Ethereum experiences heightened activity.

ARB Rockets as Market Interest Heats Up

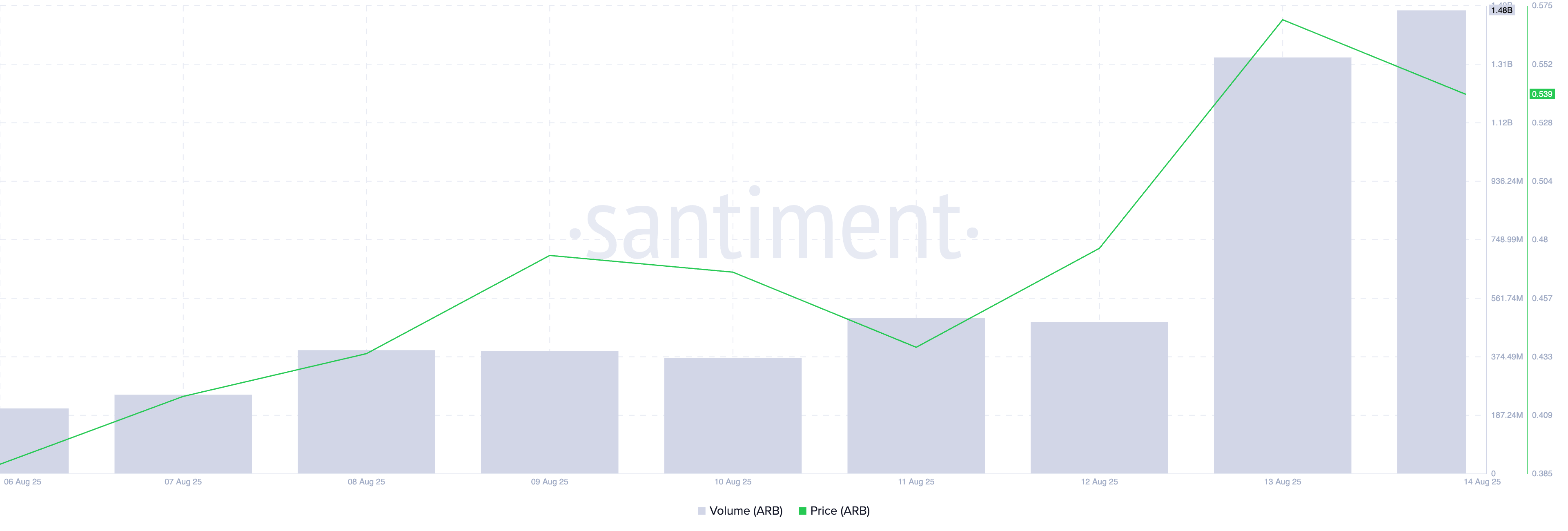

At press time, ARB trades at $0.54, climbing by 12% in the past 24 hours. During that period, its trading volume is up by 155% and currently totals $1.48 billion.

ARB Price and Trading Volume. Source:

ARB Price and Trading Volume. Source:

ARB Price and Trading Volume. Source:

ARB Price and Trading Volume. Source:

When an asset’s price and trading volume climb simultaneously, it signals strong market interest and bullish sentiment.

ARB’s rising price shows that demand outpaces supply, while its high trading volume confirms that the movement is backed by significant participation rather than thin liquidity. This trend often attracts more traders and investors, and could drive further gains for ARB in the short term.

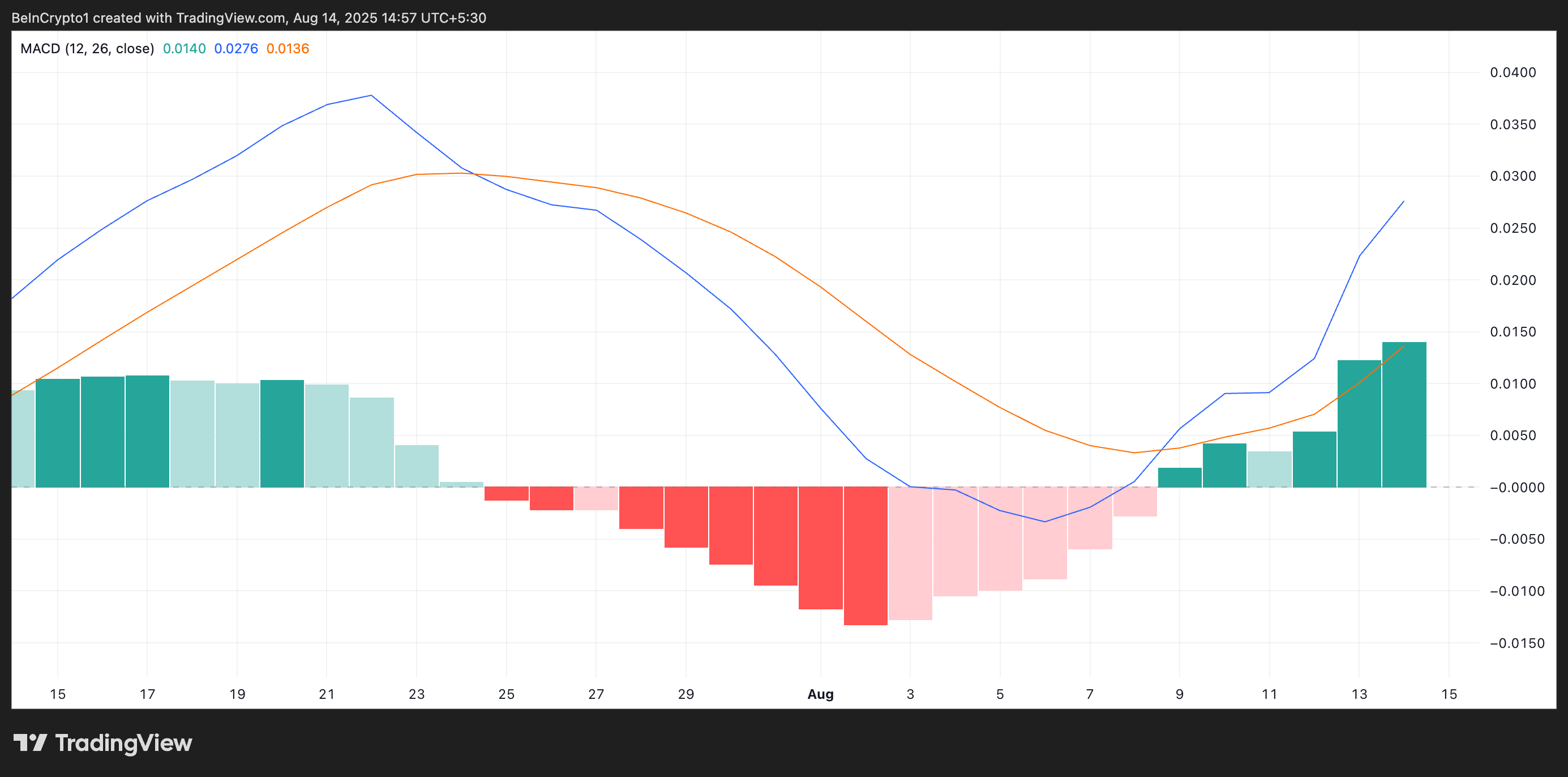

Further, the bullish crossover of ARB’s Moving Average Convergence Divergence (MACD) setup supports this bullish outlook. As of this writing, the token’s MACD line (blue) rests above its signal line (orange), confirming the buy-side pressure.

ARB MACD. Source:

ARB MACD. Source:

ARB MACD. Source:

ARB MACD. Source:

Moreover, the histogram bars that make up the MACD indicator have been gradually growing since August 6, with the green bars expanding in size. When this happens, it suggests that the upward trend is gaining strength.

Can Bulls Push ARB Toward $0.74?

Sustained ARB accumulation could drive its price toward $0.62. A successful breach of this resistance level could propel ARB’s price toward $0.74, a high it last reached in January.

ARB Price Analysis. Source:

ARB Price Analysis. Source:

ARB Price Analysis. Source:

ARB Price Analysis. Source:

However, if selloffs begin, the altcoin’s price risks plunging to $0.45.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP price may grow ‘from $2 to $10’ in less than a year: Analyst

Ethereum rising to $3.3K proves bottom is in: Is 100% ETH rally next?

Bitcoin hikes volatility into ‘tricky’ FOMC as $93.5K yearly open fails

New Ethereum Privacy Infrastructure: In-depth Analysis of How Aztec Achieves "Programmable Privacy"

From the Noir language to Ignition Chain: a comprehensive breakdown of Ethereum's full-stack privacy architecture.