Trump-backed American Bitcoin orders 16K Bitmain ASICs amid ongoing trade war

American Bitcoin, a Bitcoin (BTC) mining company backed by members of US President Donald Trump’s family, exercised an option to purchase up to 17,280 application-specific integrated circuits (ASICs), hardware for crypto mining, from Bitmain earlier this month.

The mining company purchased a fleet of 16,299 Antminer U3S21EXPH units from Bitmain, capable of 14.02 exahashes per second (EH/s) of computing power, for about $314 million, according to TheMinerMag.

The deal also excluded any potential price increases from the Trump administration’s sweeping trade tariffs and import duties, which will impact Bitmain mining hardware manufactured in China.

In response to the tariff pressures, Bitmain announced it will open its first ASIC production facility in the US by year’s end. The company also plans on opening a headquarters in either Florida or Texas.

Trade tariffs and other macroeconomic pressures have created a strain at all levels of the Bitcoin mining supply chain, as miners and hardware producer alike adjust their economic calculations in response to the shifting financial landscape.

Related: Jack Dorsey’s Block targets 10-year lifecycle for Bitcoin mining rigs

Mining industry responds to trade tariffs and economic uncertainty

The tariffs have spurred the leading mining hardware manufacturers to consider relocating at least a portion of their operations to the US to avoid import taxes slapped on their products.

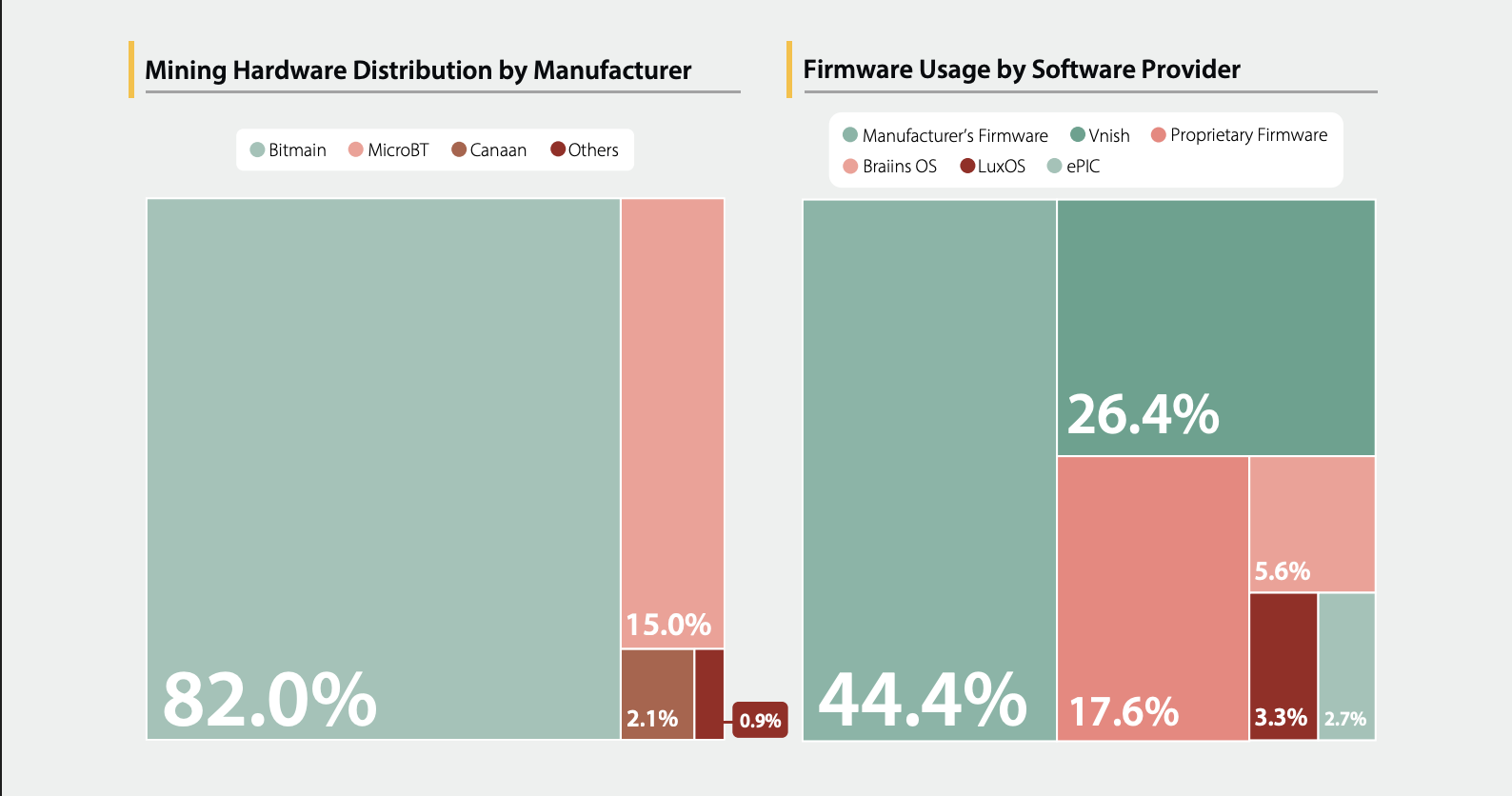

Over 99% of all Bitcoin mining hardware is produced by three manufacturers: Bitmain; MicroBT; and Canaan, according to a study published by the University of Cambridge.

Bitmain is the largest mining hardware manufacturing company in the world by a wide margin, with about 82% of the total market share.

The Trump administration’s strategy of using trade tariffs to bring manufacturing back to the US has been met with mixed reactions.

Critics say the policies are inflationary in the long term and could backfire. Jaran Mellerud, CEO of BTC mining company Hashlabs, said the price increases from the tariffs could lead to a collapse in demand from US miners.

ASIC manufacturers will then have inventory, without demand, which they can export to other countries at cheaper prices, Mellerud said.

This would drive mining back to other countries and place US miners at a competitive disadvantage, contrary to the Trump administration’s goal of reshoring the crypto industry in the United States.

Magazine: US risks being ‘front run’ on Bitcoin reserve by other nations: Samson Mow

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After a 1460% Surge: Re-examining the Value Foundation of ZEC

Are ZEC's miner economic model, network security, and on-chain activity truly sufficient to support an FDV of over 10 billions USD?

Glassnode: BTC drops to 89,000, risk aversion remains strong in the options market

In the short term, the $95,000 to $97,000 range may form a local resistance. If the price can reclaim this range, it indicates that the market is gradually returning to balance.

Is the Base co-founder launching a token this time reliable?

How should we view this celebrity token from Base?

Data Insight: Bitcoin's Year-to-Date Gains Turn Negative—Is a Full Bear Market Really Here?

The market has entered a comprehensive defensive phase.