Ethereum (ETH) Rally Fueling Appetite for Riskier Altcoin Plays: Analytics Firm Glassnode

Analytics platform Glassnode says that Ethereum’s ( ETH ) sudden breakout has investors now moving capital into riskier altcoin projects.

According to the analytics platform, Ethereum’s historical correlation with altcoins suggests multiple alts will soon enter significant uptrends as well.

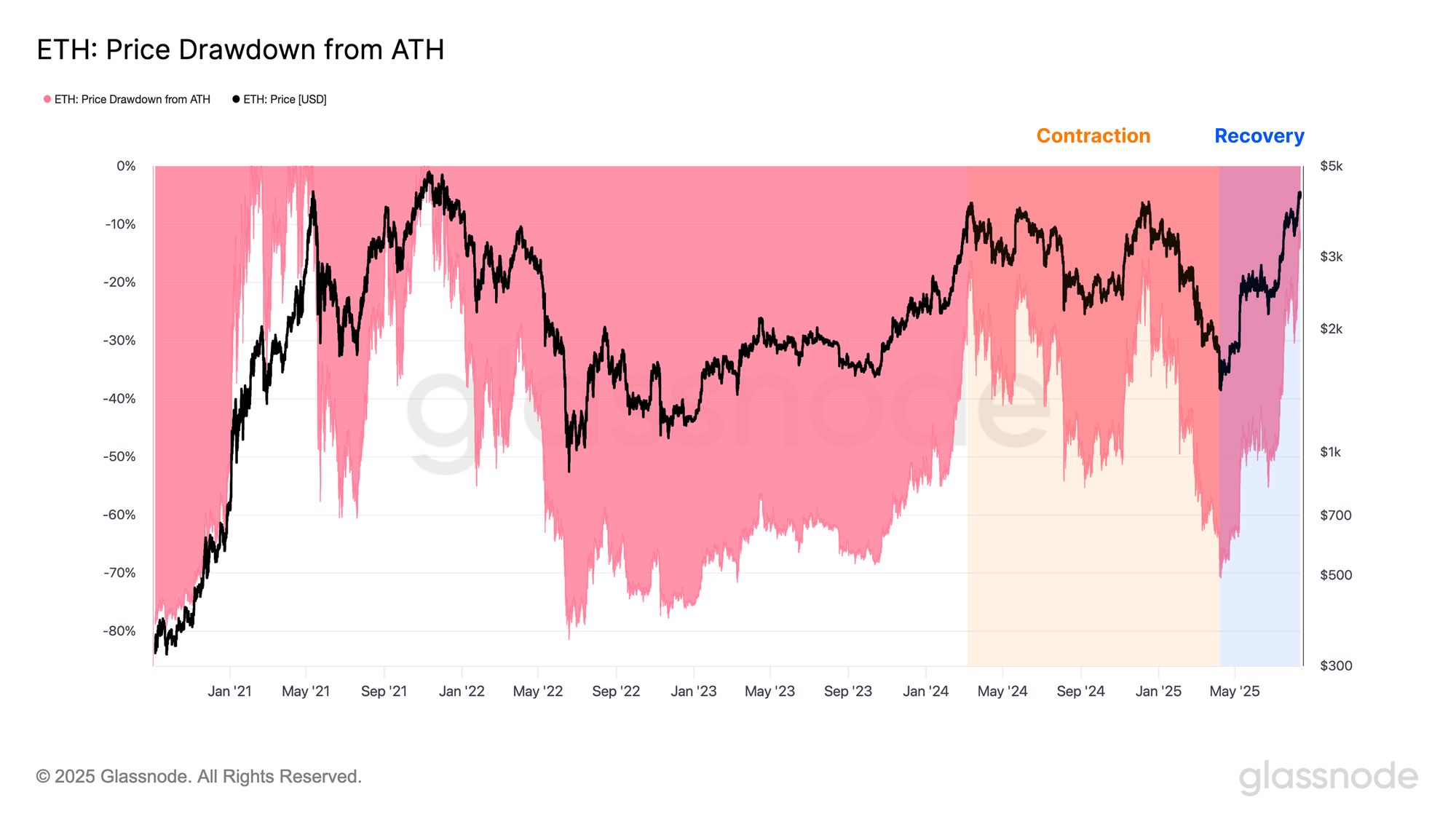

“Momentum in digital asset markets continues to accelerate, with Ethereum at the forefront. The asset has climbed from $1,500 in April to $4,300, its highest level since December 2021 and only 12.5% below its all-time high of $4,800.

Historically, Ethereum has served as a bellwether for broader altcoin performance, and its recent strength is now fueling increased speculation further along the risk curve.”

Source: Glassnode

Source: Glassnode

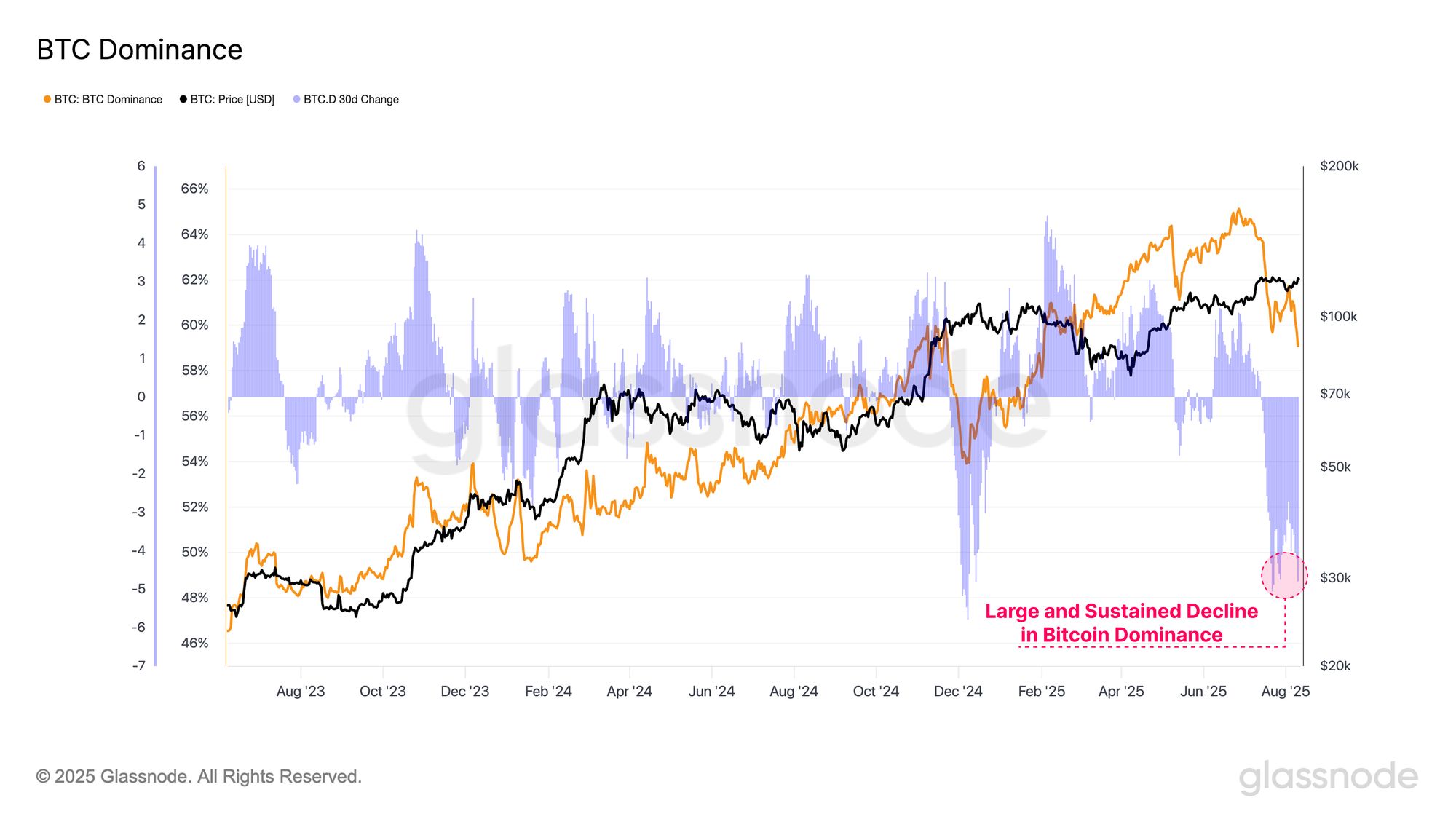

Glassnode also says that the Bitcoin dominance ( BTC .D) chart is signaling that Ethereum and other altcoins may start outperforming the flagship crypto asset.

BTC.D tracks how much of the crypto market cap belongs to Bitcoin. A bearish BTC.D chart indicates that altcoins are gaining value faster than Bitcoin.

“This rotation of capital is also reflected in the Bitcoin Dominance metric, which tracks Bitcoin’s share of total digital asset market capitalization. Over the past two months, dominance has fallen from 65% to 59%, underscoring an ongoing shift of capital further along the risk curve.”

Source: Glassnode

Source: Glassnode

Ethereum is trading for $4,712 at time of writing, up 2.4% in the last 24 hours.

Meanwhile, at time of writing BTC.D is hovering around 59.69%.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stacks Nakamoto Upgrade

STX has never missed out on market speculation surrounding the BTC ecosystem, but previous hype was more like "castles in the air" without a solid foundation. After the Nakamoto upgrade, Stacks will provide the market with higher expectations through improved performance and sBTC.

Do Kwon Wants Lighter Sentence After Admitting Guilt

Bitwise Expert Sees Best Risk-Reward Since COVID

Stellar (XLM) Price Prediction: Can Bulls Push Toward $0.30 in December?