Massive Crypto Moves: $7.9B in Options Expire, $2B USDT Minted in 24 Hours

Record Inflows Options Expiry Shake the Market

In the past 24 hours, the crypto market has seen activity levels not witnessed in years. According to analysts, $5.9 billion in Bitcoin and Ethereum options are set to expire today. Options expiry events of this size often result in heightened volatility as traders close, roll over, or hedge positions.

Meanwhile, others reported the minting of $1 billion USDT today alone, contributing to a massive $2 billion minted in the past 24 hours. Stablecoin inflows of this scale typically signal fresh buying power entering the market, and whales appear to be loading up.

Whale Activity Market Sentiment

Other analysts described the current whale accumulation as “buying like never seen before in history.” Large investors are often early movers in market cycles, and such aggressive stablecoin deployment suggests confidence in a near-term price surge.

Bitcoin Ethereum Price Predictions

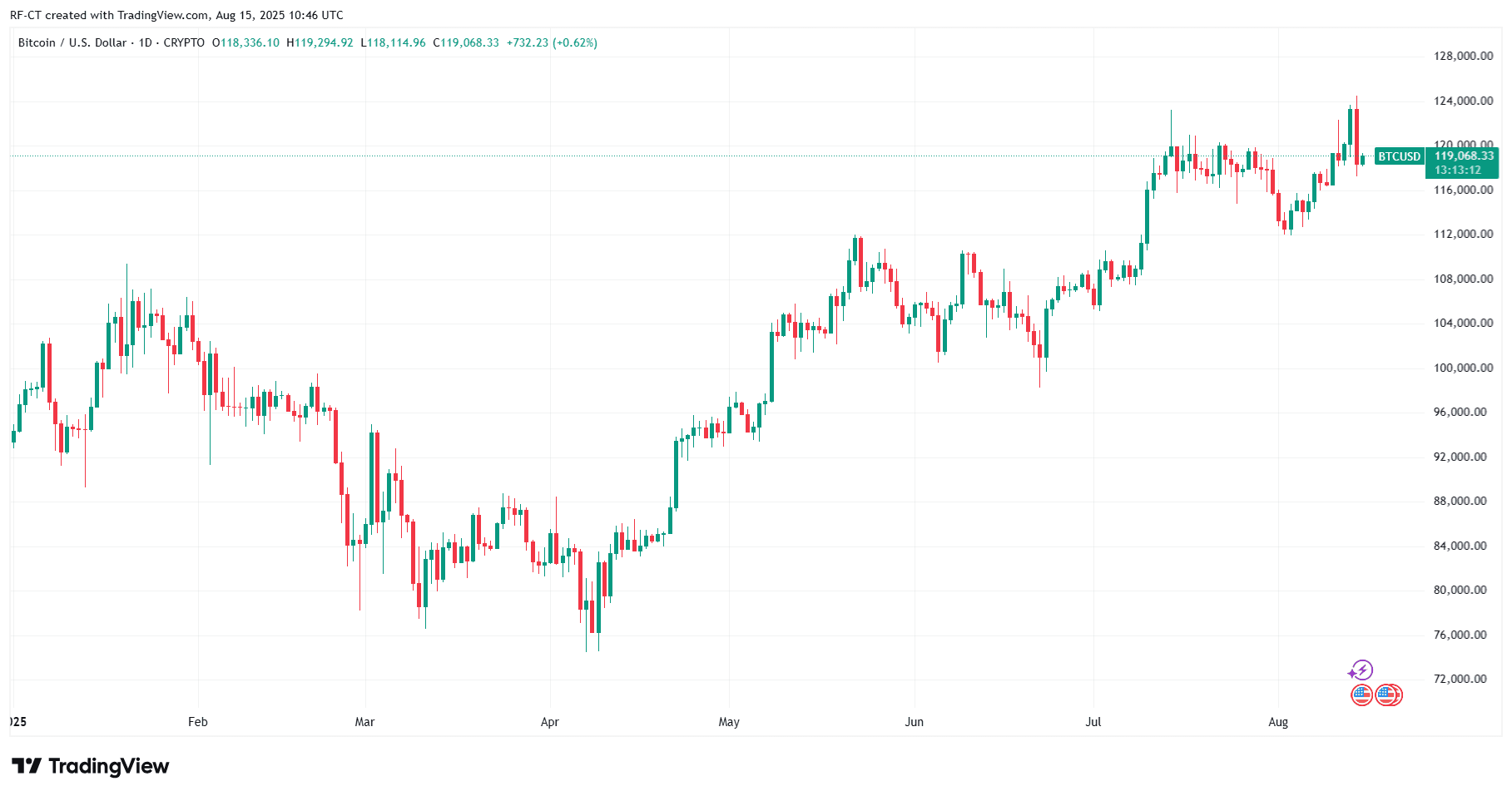

Bitcoin (BTC):

- Bullish scenario: If fresh liquidity fuels a post-expiry breakout, BTC could reclaim $118K quickly, with a push toward $122K–$125K possible in the coming week.

- Bearish scenario: Failure to hold $115K support after expiry could see a correction toward $111K–$109K before buyers step in again.

By TradingView - BTCUSD_2025-08-15 (YTD)

By TradingView - BTCUSD_2025-08-15 (YTD)

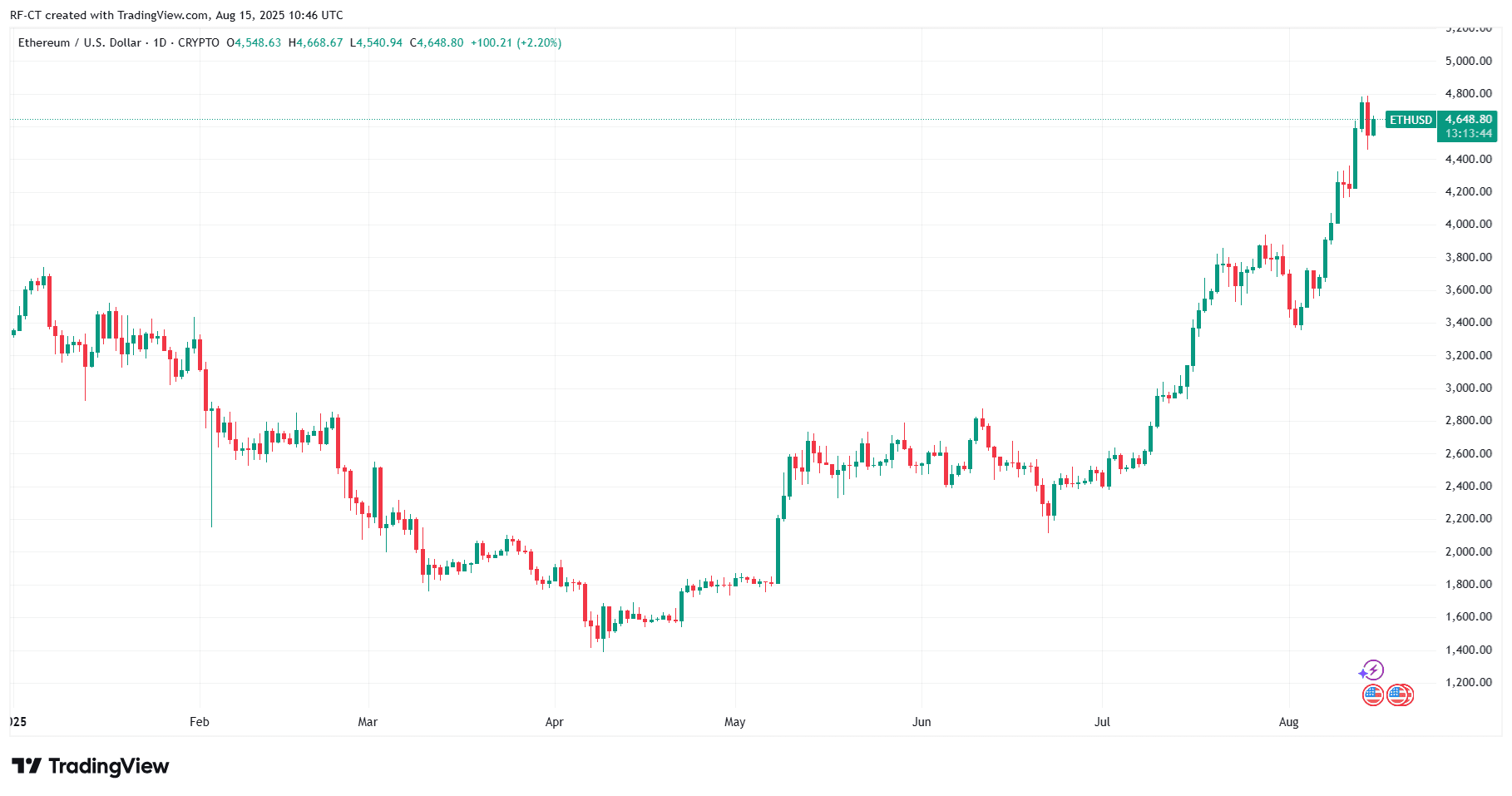

Ethereum (ETH):

- Bullish scenario: ETH could retest $4,350, with a breakout eyeing $4,500–$4,650 if momentum sustains.

- Bearish scenario: A drop below $4,100 could trigger a pullback to the $3,950–$3,900 range.

By TradingView - ETHUSD_2025-08-15 (YTD)

By TradingView - ETHUSD_2025-08-15 (YTD)

Scenario Analysis: What to Expect Next

- High Volatility Window: With options expiry and $2B in new USDT liquidity, sharp price swings are likely within the next 48 hours.

- Liquidity-Driven Breakouts: If whales maintain buying pressure, BTC and ETH could enter a short-term rally phase, breaking key resistance levels.

- Fakeout Risk: Rapid gains could be followed by profit-taking, so traders should monitor volume and open interest for confirmation.

💡 Trading Tip: Large stablecoin mints often precede rallies, but pairing them with technical confirmation, such as breakout closes on high volume, is essential for avoiding bull traps.

$BTC, $ETH, $USDT

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ETFs are being launched in clusters, but coin prices are falling. Can ETF approval still be considered good news?

On one hand, Vanguard has opened Bitcoin ETF trading, while on the other hand, CoinShares has withdrawn its applications for XRP, Solana Staking, and Litecoin ETFs, highlighting a significant divergence in institutional attitudes toward ETFs for different cryptocurrencies.

ADP employment data "unexpectedly weak", is a Federal Reserve rate cut imminent?

Glassnode Report: Current Structure Strikingly Similar to Pre-Crash 2022, Beware of a Key Range!

Coinglass report interprets Bitcoin's "life-or-death line": 96K becomes the battleground between bulls and bears—Is the ETF capital withdrawal an opportunity or a trap?

Bitcoin's price remains stable above the real market mean, but the market structure is similar to Q1 2022, with 25% of supply currently at a loss. The key support range is between $96.1K and $106K; breaking below this range will increase downside risk. ETF capital flows are negative, demand in both spot and derivatives markets is weakening, and volatility in the options market is underestimated. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.