What If Ethereum Unstaking Surge: Does It Lead to Sell Bomb?

Ethereum prices slipped after hitting a near record last week, with analysts warning that a surge of unstaked coins could weigh on the market later this month. The cryptocurrency rose from $3,698 at the start of August to $4,788 last Thursday, its highest level in four years. But as of 9 am UTC on Monday, … <a href="https://beincrypto.com/what-if-ethereum-unstaking-surge-does-it-lead-to-sell-bomb/">Continued</a>

Ethereum prices slipped after hitting a near record last week, with analysts warning that a surge of unstaked coins could weigh on the market later this month.

The cryptocurrency rose from $3,698 at the start of August to $4,788 last Thursday, its highest level in four years. But as of 9 am UTC on Monday, it had dropped to $4,260 — a 10% pullback after an almost 30% two-week rally.

ETH Unstaking Wait Time Jumps from 25 to 40 Days

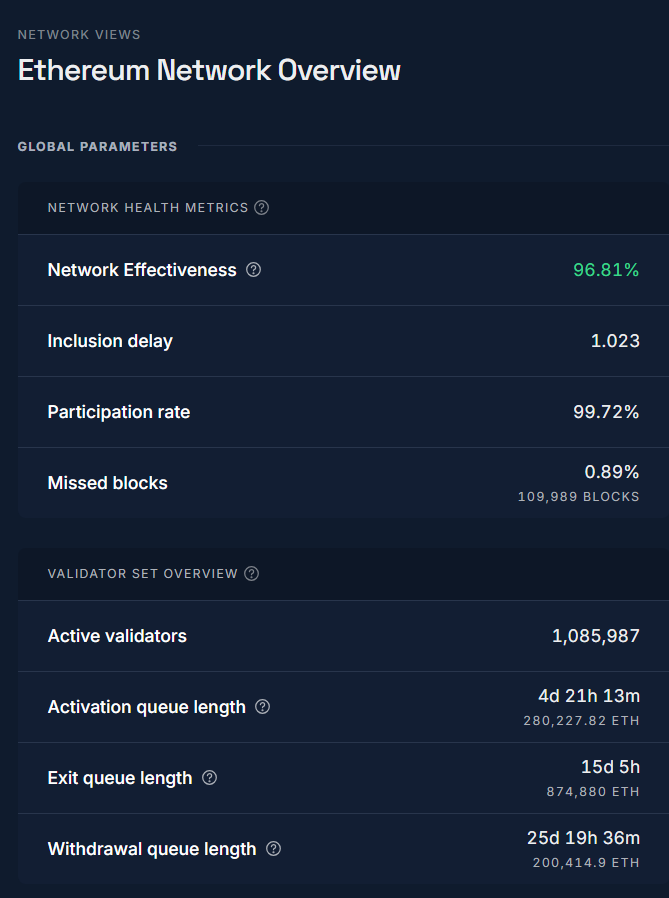

The sharp gains triggered heavy unstaking activity. On-chain data provider said that on Aug 9 alone, the Ethereum exit queue was so congested that processing times extended to about 25 days.

The unstaking process involves two main steps: the Exit Queue and the Withdrawal Queue. The Exit Queue is when a validator requests to exit their role on the network. The Withdrawal Queue is the subsequent step where the unstaked ETH is transferred back to the user’s wallet. Usually, unstaking takes just two to three days.

The queue has continued to grow. This backlog reflects the growing number of validators looking to offload their ETH at a higher price.

X Influencer noted that the ETH validator exit queue doubled to $3.7 billion in four days. As of Aug 18, Rated’s data showed more than 1.075 million ETH waiting to exit, stretching processing times to 40 days. By contrast, staking new ETH takes less than five days.

Ethereum Network Overview. Source:

Rated

Ethereum Network Overview. Source:

Rated

Unstaking requests began accelerating around Aug 6, meaning some coins could hit user wallets by Aug 25. Analysts caution that prices could fall further if buyers fail to absorb the new supply.

Still, some market watchers see a balance between inflows and outflows. X Influencer said that while about 600,000 ETH net outflows remain significant, the market has weathered similar conditions before. On July 26, a comparable backlog preceded a 20% rally over the following two weeks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Staking Weekly Report December 1, 2025

🌟🌟Core Data on ETH Staking🌟🌟 1️⃣ Ebunker ETH staking yield: 3.27% 2️⃣ stETH...

The Blood and Tears Files of Crypto Veterans: Collapses, Hacks, and Insider Schemes—No One Can Escape

The article describes the loss experiences of several cryptocurrency investors, including exchange exits, failed insider information, hacker attacks, contract liquidations, and scams by acquaintances. It shares their lessons learned and investment strategies. Summary generated by Mars AI This summary was produced by the Mars AI model, and the accuracy and completeness of its generated content are still in the process of iterative improvement.

Mars Morning News | Federal Reserve officials to advance stablecoin regulatory framework; US SEC Chairman to deliver a speech at the New York Stock Exchange tonight

Federal Reserve officials plan to advance the formulation of stablecoin regulatory rules. The SEC Chair will deliver a speech on the future vision of capital markets. Grayscale will launch the first Chainlink spot ETF. A Coinbase executive has been sued by shareholders for alleged insider trading. The cryptocurrency market fear index has dropped to 23. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.

OECD's latest forecast: The global interest rate cut cycle will end in 2026!

According to the latest forecast from the OECD, major central banks such as the Federal Reserve and the European Central Bank may have few "bullets" left under the dual pressures of high debt and inflation.