Gold Weekly Forecast: Easing Geopolitical Tensions, Mixed US Data Limit Volatility

Gold (XAU/USD) failed to stage a meaningful rebound following a bearish start to the week as markets reacted to easing geopolitical tensions and mixed macroeconomic data releases from the United States (US). Activity-related data from the US and comments from the Federal Reserve (Fed) officials could drive XAU/USD’s action in the near term. Gold Declines Sharply … <a href="https://beincrypto.com/gold-forecast-easing-tensions-mixed-data/">Continued</a>

Gold (XAU/USD) failed to stage a meaningful rebound following a bearish start to the week as markets reacted to easing geopolitical tensions and mixed macroeconomic data releases from the United States (US).

Activity-related data from the US and comments from the Federal Reserve (Fed) officials could drive XAU/USD’s action in the near term.

Gold Declines Sharply After Testing $3,400

Gold came under heavy selling pressure on Monday and lost more than 1.5% on a daily basis as easing geopolitical tensions undermined the safe-haven demand. Growing optimism about a resolution to the Russia-Ukraine conflict on the announcement of a meeting between US President Donald Trump and Russian President Vladimir Putin allowed markets to start the week in an upbeat mood.

In the second half of the day on Monday, US President Trump announced that tariffs aimed at Chinese imports will be delayed by 90 days. In response, China’s Commerce Ministry said early Tuesday that the country will suspend adding some US firms to the unreliable entity list for 90 days and will suspend additional tariffs on US goods for 90 more days.

Following Monday’s sharp decline, Gold found support near $3,350 on Tuesday as the July inflation data from the US fed into expectations of three Federal Reserve (Fed) rate cuts in the remainder of the year and caused US Treasury bond yields to push lower.

The Bureau of Labor Statistics (BLS) announced that annual inflation, as measured by the change in the Consumer Price Index (CPI), held steady at 2.7% in July. On a monthly basis, the CPI and the core CPI rose by 0.2% and 0.3%, respectively, matching analysts’ estimates.

On a yearly basis, the core CPI increased by 3.1%, at a faster pace than the 2.9% rise recorded in June. According to the CME FedWatch Tool, the probability of the Fed lowering the policy rate by a total of 75 bps this year climbed above 55% from about 40% before the release of the inflation report.

In the absence of high-impact data releases, Gold fluctuated in a tight range on Wednesday to close the day virtually unchanged. On Thursday, the monthly data published by the BLS showed that the Producer Price Index (PPI) rose by 3.3% in July, up sharply from the 2.4% increase recorded in June.

On a monthly basis, the PPI and the core PPI increased by 0.9%. Hot producer inflation data caused markets to reassess the Fed policy outlook, opening the door for a rebound in US Treasury bond yields and causing Gold to extend its weekly decline.

Mixed data releases from the US failed to trigger a noticeable market reaction, and Gold remained in the lower half of its weekly range. Retail Sales in the US increased by 0.5% on a monthly basis in July, while Industrial Production contracted by 0.1%. Finally, the University of Michigan’s preliminary Consumer Confidence Index for August declined to 58.6 from 61.7 in July.

Gold Investors Await PMI Data, Powell’s Speech at Jackson Hole

Geopolitics could drive Gold’s valuation at the beginning of the week. If there is no de-escalation in the Russia-Ukraine conflict following the Trump-Putin meeting, Gold could benefit from safe-haven flows.

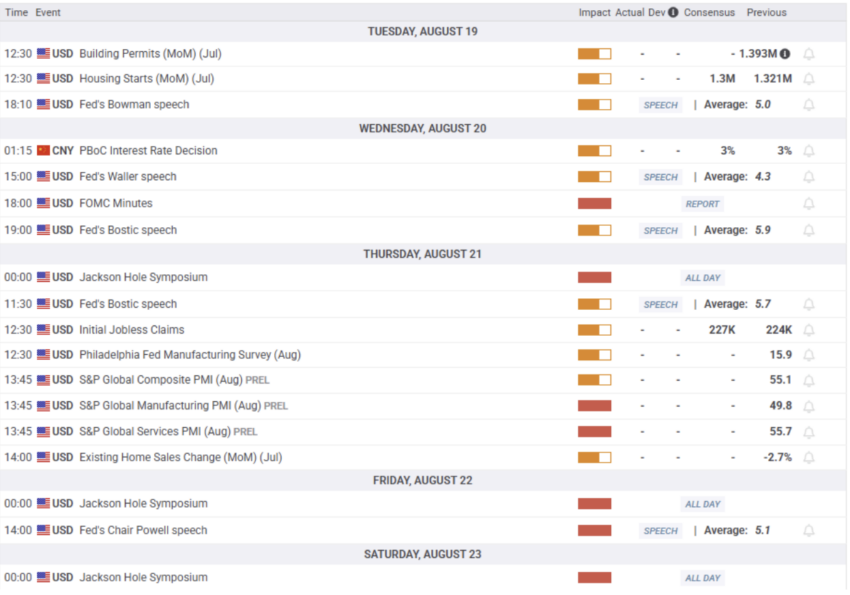

On Wednesday, the Fed will release the minutes of the July policy meeting. Because this meeting took place before the latest employment and inflation data were released, the content of this publication is likely to be outdated, with regard to providing fresh clues into the policy outlook.

On Thursday, S&P Global will release the preliminary Manufacturing and Services Purchasing Managers (PMI) data for August. A significant decline in the headline Services PMI, which stood at 55.7 in July, could hurt the USD with the immediate reaction. On the other hand, the USD could stay resilient against its peers and make it difficult for XAU/USD to gain traction if the Manufacturing PMI recovers above 50 and the Services PMI comes in near July’s print.

On Friday, Fed Chairman Jerome Powell will speak at the Jackson Hole Symposium. Powell’s remarks could trigger a big reaction in US T-bond yields and ramp up Gold’s volatility toward the end of the week.

Latest comments from Fed officials highlighted that there is a difference of opinion with regards to the policy outlook. While some policymakers advocate for multiple rate cuts this year, others argue that the uncertainty surrounding the inflation outlook warrants a more cautious approach to easing.

Fed Governor Michelle Bowman said recently that the latest weak labor market data underscores her concerns about labor market fragility and strengthens her confidence in her own forecast that three interest rate cuts will likely be appropriate this year. On the other hand, Kansas City Fed President Jeffrey Schmid argued that the tariffs’ limited effect on inflation is a reason to keep policy on hold, not to cut rates.

In case Powell downplays the disappointing employment data and hints that they will need time to assess inflation dynamics following the first rate cut of the year, investors could refrain from pricing in three rate cuts this year. This scenario would help US T-bond yields push higher and drag Gold lower. Conversely, investors could remain hopeful about a 75 bps reduction in 2025 if Powell voices growing concerns over the worsening conditions in the labor market.

Economic Calendar. Source:

Economic Calendar. Source:

Gold technical analysis

Gold’s near-term technical outlook points to a neutral stance. The Relative Strength Index (RSI) indicator on the daily chart moves sideways at around 50, and Gold fluctuates near the 20-day and the 50-day Simple Moving Averages (SMAs).

A pivot level seems to have formed at $3,355-$3,360 (20-day SMA, 50-day SMA). In case Gold fails to reclaim this level, technical sellers could remain interested. In this scenario, $3,305-$3,285 (100-day SMA, Fibonacci 23.6% retracement of the January-June uptrend) could be seen as the next support area before $3,200 (static level, round level).

Gold Price Analysis. Source:

Gold Price Analysis. Source:

In case Gold stabilizes above $3,355-$3,360 and flips that area into support, the next resistance level could be spotted at $3,400 (static level, round level) ahead of $3,430 (static level).

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Staking Weekly Report December 1, 2025

🌟🌟Core Data on ETH Staking🌟🌟 1️⃣ Ebunker ETH staking yield: 3.27% 2️⃣ stETH...

The Blood and Tears Files of Crypto Veterans: Collapses, Hacks, and Insider Schemes—No One Can Escape

The article describes the loss experiences of several cryptocurrency investors, including exchange exits, failed insider information, hacker attacks, contract liquidations, and scams by acquaintances. It shares their lessons learned and investment strategies. Summary generated by Mars AI This summary was produced by the Mars AI model, and the accuracy and completeness of its generated content are still in the process of iterative improvement.

Mars Morning News | Federal Reserve officials to advance stablecoin regulatory framework; US SEC Chairman to deliver a speech at the New York Stock Exchange tonight

Federal Reserve officials plan to advance the formulation of stablecoin regulatory rules. The SEC Chair will deliver a speech on the future vision of capital markets. Grayscale will launch the first Chainlink spot ETF. A Coinbase executive has been sued by shareholders for alleged insider trading. The cryptocurrency market fear index has dropped to 23. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.

OECD's latest forecast: The global interest rate cut cycle will end in 2026!

According to the latest forecast from the OECD, major central banks such as the Federal Reserve and the European Central Bank may have few "bullets" left under the dual pressures of high debt and inflation.