LINK Jumps 18% Weekly: What’s Driving Chainlink to a 6-Month Peak?

TL;DR

- Chainlink breaks multi-month resistance with volume, pushing the price above $25 and nearing the key $29 level.

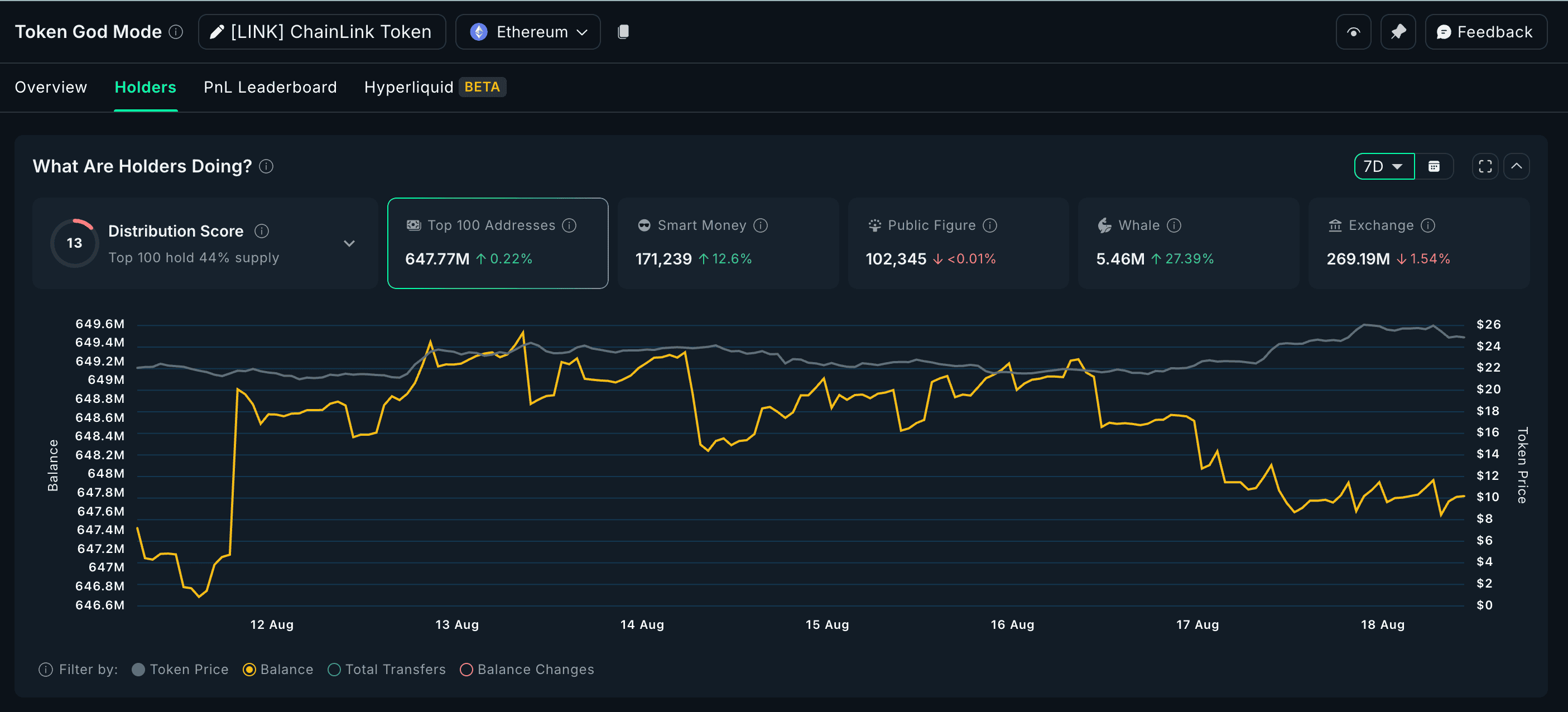

- Whale wallets added 1.1 million LINK this week, showing strong confidence despite minor pullbacks.

- Chainlink leads RWA development with new ETF data feeds, boosting its institutional adoption narrative.

Breakout Clears Long-Term Resistance

Chainlink (LINK) has gained over 18% in the past week and is currently trading around $25. The move followed a breakout above a key resistance area between $20 and $21. This zone had previously rejected the price multiple times since early 2025.

Notably, the breakout came with strong volume, pushing the asset well above the 200-day moving average. The green zone on the chart marked a supply region, which is now acting as support. The current structure shows price consolidating after the breakout, holding above support for now.

Targets and Scenarios

Analysts expect a move to $29 if the broader market holds steady. Crypto analyst Emperor said,

“If BTC holds $115,000 and LINK consolidates, I expect this to move toward $29.”

The chart shows that $29 marks a weekly resistance level. A pullback scenario is also possible if market sentiment weakens.

“A retest of $20 could happen if there’s a slow bleed in altcoins,” the same trader added.

However, due to the speed of the recent move, a sharp drop appears less likely unless broader conditions shift.

Whale Accumulation on the Rise

On-chain data shows a rise in large holder activity. Whale wallets have added over 1.1 million LINK in the last seven days—valued at around $27 million. Smart money addresses also increased holdings by over 12% during the same period.

This activity has been backed by renewed accumulation from the top 100 LINK wallets. These shifts suggest that large buyers are stepping in while the token gains momentum.

Chainlink Expands Role in RWA Sector

Development around real-world asset (RWA) tools is drawing attention. Chainlink has launched data feeds for U.S. equities and ETFs. One analyst posted,

“Chainlink is delivering what institutions need for tokenized markets.” He added, “The LINK era is here. This is just the beginning.”

The project is now ranked first in RWA development activity, according to Santiment.

Chainlink’s price remains near short-term highs, with $29 in focus as the next possible resistance zone. Traders are watching price action closely as the broader altcoin market looks for direction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A decade-long tug-of-war ends: "Crypto Market Structure Bill" sprints to the Senate

At the Blockchain Association Policy Summit, U.S. Senators Gillibrand and Lummis stated that the "Crypto Market Structure Bill" is expected to have its draft released by the end of this week, with revisions and hearings scheduled for next week. The bill aims to establish clear boundaries for digital assets by adopting a classification-based regulatory framework, clearly distinguishing between digital commodities and digital securities, and providing a pathway for exemptions for mature blockchains to ensure that regulation does not stifle technological progress. The bill also requires digital commodity trading platforms to register with the CFTC and establishes a joint advisory committee to prevent regulatory gaps or overlapping oversight. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, is still being iteratively updated.

Gold surpasses the $4,310 mark—Is the "bull frenzy" returning?

Boosted by expectations of further easing from the Federal Reserve, gold has risen for four consecutive days. Technical indicators show strong bullish signals, but there remains one more hurdle before reaching a new all-time high.

Trend Research: Why Are We Still Bullish on ETH?

Against the backdrop of relatively accommodative expectations in both China and the US, which suppress asset downside volatility, and with extreme fear and capital sentiment not yet fully recovered, ETH remains in a favorable "buy zone."