Ethereum’s Early August Surge Meets Reality Check as Bears Eye Dip Below $4,000

After Ethereum's early August surge to $4,793, sell-offs and profit-taking have created significant pressure, leaving ETH vulnerable to a dip below $4,000. With weak sentiment among derivatives traders, bears are eyeing a drop to $3,491.

Ethereum’s rally in early August drove the largest altcoin to a cycle peak of $4,793 by August 14, marking one of its strongest performances of the year.

However, the sharp rise also triggered a wave of profit-taking, which has since put significant pressure on the asset and caused it to lose much of its recent gains. With selloffs intensifying in the derivatives market, ETH now faces the risk of a breakdown below the $4,000 price mark.

ETH Faces Heavy Sell Pressure

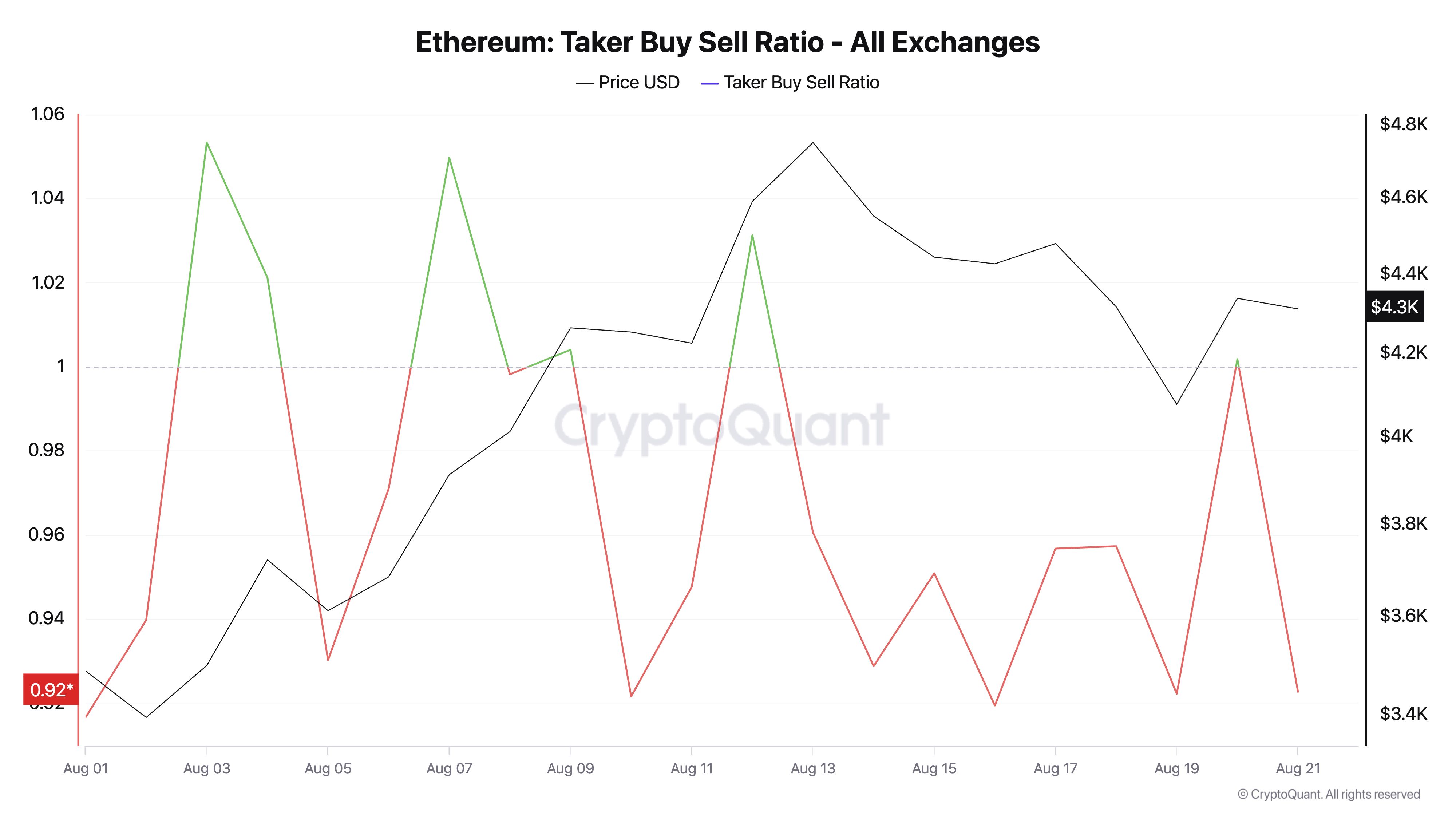

ETH’s price has been weighed down by the bearish tilt in sentiment among its derivatives traders. This is reflected by its taker-buy/sell ratio, which has mostly remained under one since the beginning of August.

At press time, this stands at 0.92 per CryptoQuant, indicating that sell orders dominate buy orders across the ETH futures market.

ETH Taker Buy Sell Ratio. Source:

CryptoQuant

ETH Taker Buy Sell Ratio. Source:

CryptoQuant

The taker buy-sell ratio measures the balance between buy and sell orders in an asset’s futures market. A ratio above one indicates stronger buying pressure, showing traders are actively chasing price gains. On the other hand, a value below one reflects dominant selling pressure, often linked to profit-taking or bearish sentiment.

Since August began, ETH’s taker buy/sell ratio has stayed mostly below one, confirming persistent sell-offs among futures traders.

For context, the coin’s performance had been largely muted for much of the year, so when an uptrend finally began in July and extended into early August, many traders seized the opportunity to lock in profits.

This mounting sell-side pressure confirms the weakening bullish sentiment and could worsen ETH’s price fall if it continues.

Traders Ditch High-Risk Bets Amid Price Pressure

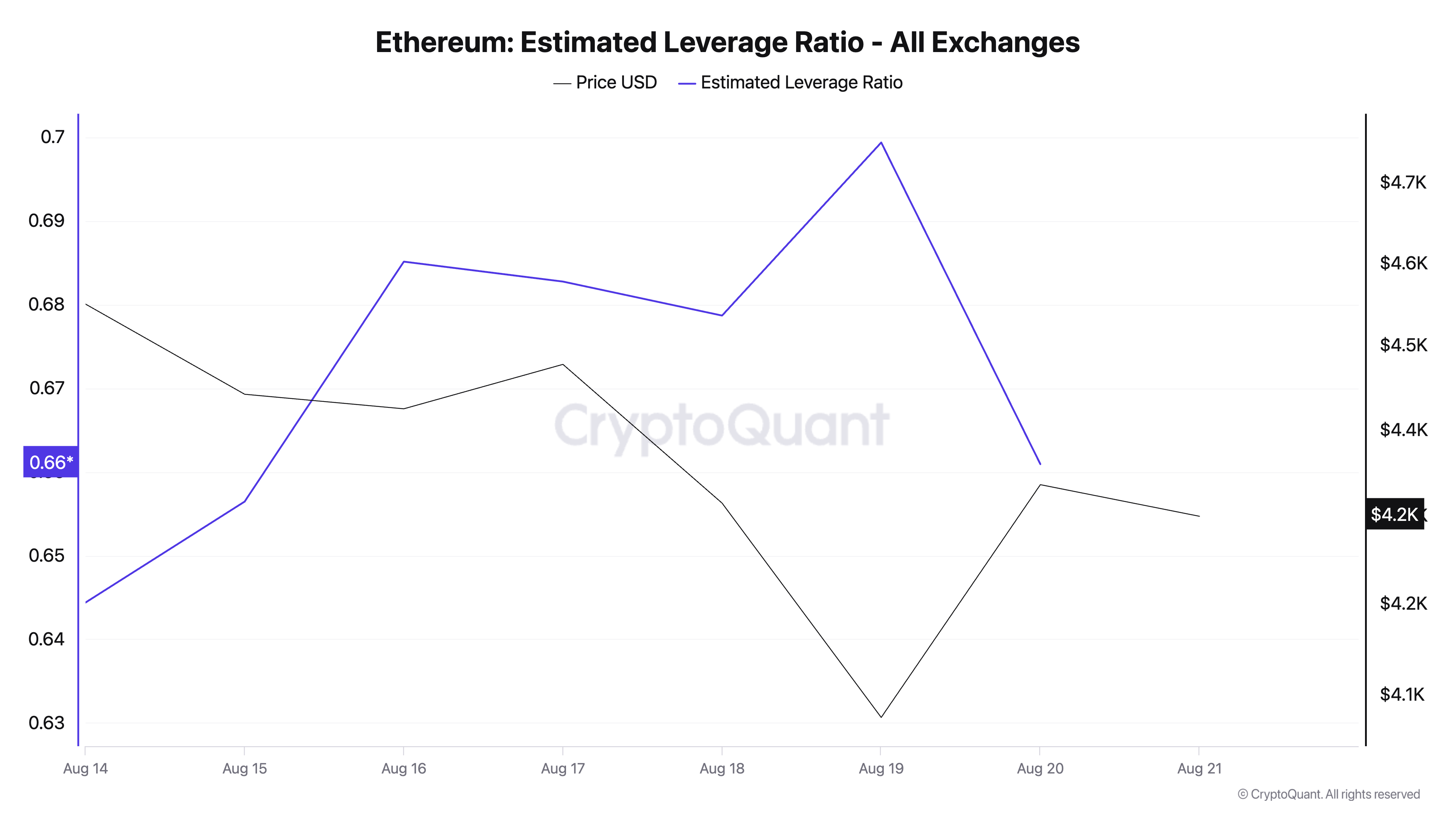

The recent decline in ETH’s Estimated Leverage Ratio (ELR) also confirms the low confidence among coin holders. According to CryptoQuant, ETH’s ELR currently sits at 0.66 — its lowest value in the past five days.

ETH Estimated Leverage. Source:

CryptoQuant

ETH Estimated Leverage. Source:

CryptoQuant

An asset’s ELR measures the average leverage its traders use to execute trades on a cryptocurrency exchange. It is calculated by dividing the asset’s open interest by the exchange’s reserve for that currency.

When an asset’s ELR falls, it indicates a reduced risk appetite among traders. This trend signals that ETH investors have grown increasingly cautious this week and are now avoiding high-leverage positions that could worsen potential losses.

Which Comes First: $3,491 or $4,793?

As of this writing, ETH trades at $4,295. If sell-side pressure strengthens, the altcoin could retest the support floor at $4,063. Should this key price mark give way, ETH could plunge to $3,491.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

Conversely, ETH could see a rebound and rally to $4,793 if new demand enters the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cobie: Long-term trading

Crypto Twitter doesn't want to hear "get rich in ten years" stories. But that might actually be the only truly viable way.

The central bank sets a major tone on stablecoins for the first time—where will the market go from here?

This statement will not directly affect the Hong Kong stablecoin market, but it will have an indirect impact, as mainland institutions will enter the Hong Kong stablecoin market more cautiously and low-key.

Charlie Munger's Final Years: Bold Investments at 99, Supporting Young Neighbors to Build a Real Estate Empire

A few days before his death, Munger asked his family to leave the hospital room so he could make one last call to Buffett. The two legendary partners then bid their final farewell.

Stacks Nakamoto Upgrade

STX has never missed out on market speculation surrounding the BTC ecosystem, but previous hype was more like "castles in the air" without a solid foundation. After the Nakamoto upgrade, Stacks will provide the market with higher expectations through improved performance and sBTC.