CFTC Crypto Sprint phase 2 is a public consultation process where the CFTC seeks input to implement the President’s Digital Assets Working Group recommendations, including a unified spot-and-futures license and guidance on asset classification. Public comments close October 20 and will shape targeted rulemaking and investor protections.

-

CFTC requests public comments on implementing the President’s Digital Assets Working Group recommendations.

-

Phase 2 focuses on a unified spot-and-derivatives framework, asset classification, and retail protection measures.

-

Public comment period runs through October 20; first-phase feedback closed August 18.

Meta description: CFTC Crypto Sprint phase 2: CFTC opens public comments to implement the President’s Digital Assets plan. Submit feedback by Oct 20 to influence rules.

What is the CFTC Crypto Sprint phase 2?

CFTC Crypto Sprint phase 2 is the Commodity Futures Trading Commission’s follow-up engagement to collect public input on implementing the President’s Digital Assets Working Group recommendations. The process seeks views on a unified spot-and-futures licensing approach, asset classification, and safeguards for leveraged or margined retail trading.

How will public comments shape the final rules?

Public comments will inform targeted guidance and potential rulemaking by the CFTC and the SEC under the CLARITY Act framework. The agency intends to weigh technical submissions and stakeholder concerns to draft clear operational guidance for a unified license and to define whether specific tokens are commodities or securities.

Key Takeaways

CFTC has launched its second phase of ‘Crypto Sprint’ to advance the implementation of the President’s Digital Assets Working Group recommendations.

The U.S. Commodity Futures Trading Commission (CFTC) has announced the second phase of its ‘Crypto Sprint’ initiative.

It has opened public comments related to the implementation of the recommendations of the President’s Working Group on Digital Asset Markets.

In a statement, the acting CFTC chair, Caroline Pham, noted that public input would help achieve the President’s crypto vision.

“The public feedback will assist the CFTC in carefully considering relevant issues for leveraged, margined, or financed retail trading on a CFTC-registered exchange as we implement the President’s directive.”

Why is the unified license important?

A unified spot-and-futures license aims to reduce regulatory fragmentation and create a single compliance pathway for platforms offering both cash and derivatives trading. By aligning market structure, regulators hope to increase transparency and investor protections while simplifying oversight for exchanges and custodians.

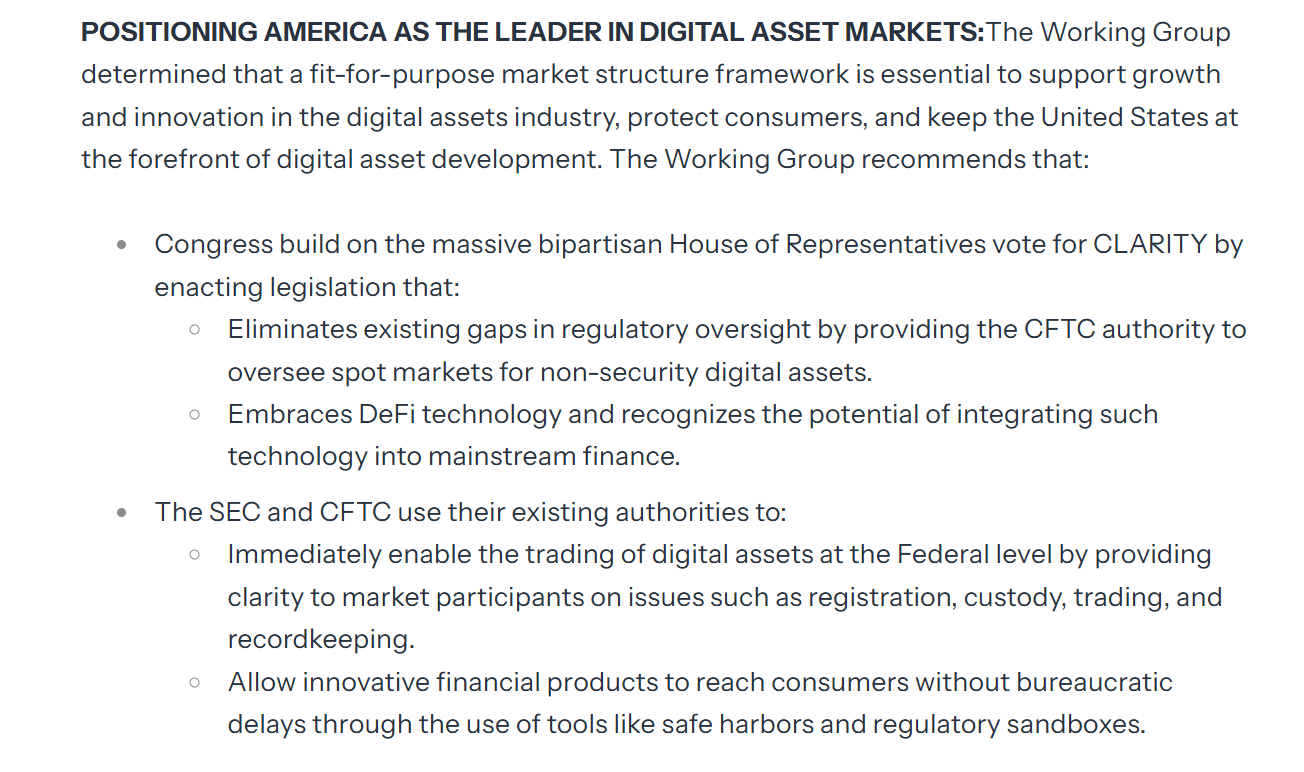

Trump’s crypto agenda — what did the report recommend?

The report released in late July recommended two main actions. First, accelerating a comprehensive market structure bill through Congress. Second, enhancing agency collaboration to fold DeFi and crypto into mainstream financial market oversight.

Source: White House

During the first Crypto Sprint, the CFTC sought input on a unified license covering spot and futures trading; that comment period closed on August 18. Phase 2 extends engagement and asks for targeted feedback on implementation specifics.

Phase 2 will close on October 20. Comments are expected to address asset definitions, compliance obligations for exchanges, custody standards, and retail leverage limits.

Who has commented so far and what are they proposing?

Industry stakeholders and consulting firms have proposed several measures. 221A Consulting recommended a leverage limit to better protect retail investors and clearer statutory definitions separating commodities from securities. Market participants also suggested operational guidance for unified licensing and clearer custody rules.

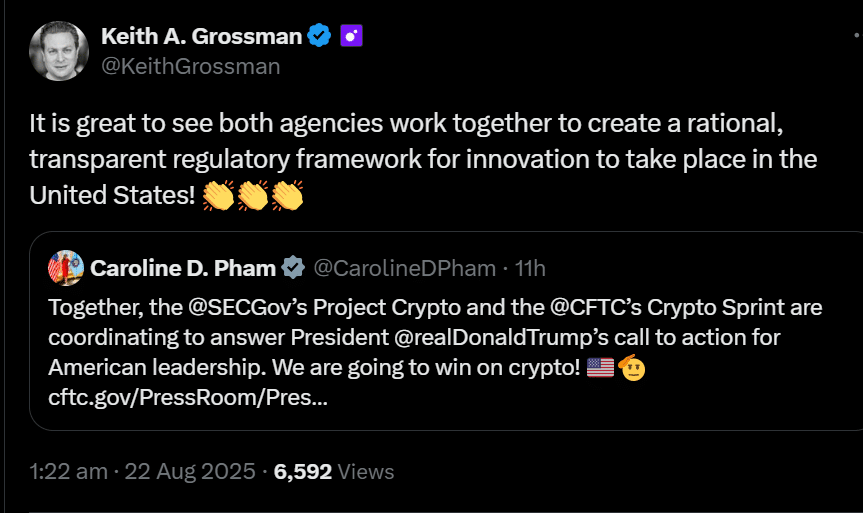

Source: X

When will the CFTC issue guidance or rules?

The CFTC plans to review phase 2 comments and publish targeted guidance aligned with the input received and the ongoing Senate market structure bill process. Exact rule timings depend on comment analysis and interagency coordination with the SEC under the CLARITY Act.

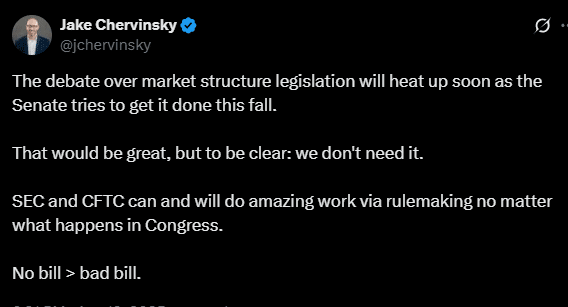

Several legal experts favor targeted guidance over wholesale market-structure legislation, arguing that agency rulemaking can provide faster, practical clarity for market participants.

Source: X

Frequently Asked Questions

How can stakeholders submit comments to the CFTC during Crypto Sprint phase 2?

Stakeholders should prepare concise, data-driven comments addressing the unified license, asset classification, custody, and retail protections, and submit them following the CFTC’s public comment procedures. The comment window for phase 2 closes October 20.

Will the CFTC coordinate with the SEC on final rules?

Yes. The CFTC is coordinating with the SEC through Project Crypto and within the CLARITY Act framework to align oversight and avoid regulatory gaps between commodities and securities rules.

Summary table — key dates and actions

| Phase 1 comment window closed | August 18, 2025 |

| Phase 2 comment window closes | October 20, 2025 |

| Expected guidance / rule drafting | Pending review of comments and interagency coordination |

Key Takeaways

- CFTC Crypto Sprint phase 2: Solicits public comment to implement Digital Assets Working Group recommendations.

- Unified license focus: Aims to align spot and derivatives regulation for platforms offering both products.

- Stakeholder action: Submit focused, evidence-based comments by October 20 to influence guidance and rulemaking.

Conclusion

The CFTC Crypto Sprint phase 2 advances implementation of the President’s Digital Assets Working Group recommendations by soliciting targeted public input on a unified license, asset classification, and retail protections. COINOTAG will monitor filings and agency guidance; market participants should prepare evidence-backed comments to shape practical regulatory outcomes.