Japan’s FSA Pushes for Safer Crypto With Flat Tax and ETFs

- Japan to slash crypto taxes to flat 20%, matching stocks and bonds to spur growth.

- FSA to reclassify crypto, opening the door for regulated ETFs and stronger protections.

- Japan creates digital bureau to drive safe crypto adoption and financial integration.

Japan has initiated major changes to crypto regulation, aiming to boost digital asset use and align it with traditional finance. The Financial Services Agency (FSA) confirmed plans for a tax overhaul and market reform in its 2026 proposal. These efforts seek to reduce tax burdens and introduce regulated crypto exchange-traded funds (ETFs) in the country.

Flat Tax Reform Set to Reshape Crypto Landscape

The FSA intends to revise how the government taxes crypto profits to encourage broader market participation. Under current rules, authorities tax crypto gains as miscellaneous income, subject to progressive rates up to 55%. By contrast, the proposed model would apply a flat 20% tax, the same as equities and bonds.

This shift will ease financial pressure and provide a fairer system for those engaging in crypto markets. In addition, the reform will allow users to carry forward losses for up to three years. The changes signal a decisive move to normalize crypto and increase its appeal in domestic finance.

The agency’s decision aligns with broader goals of creating an “asset management nation.” As more people explore alternatives to traditional assets, crypto will receive more attention under this balanced tax framework. The simplified structure aims to enhance liquidity and strengthen long-term engagement.

Reclassification of Crypto Paves Way for ETFs

The FSA proposes a reclassification of crypto as a financial product under securities law. This adjustment would place it under the Financial Instruments and Exchange Act, applying stricter investor protection standards. Crypto will receive equal treatment alongside stocks and mutual funds.

This legal upgrade will open the door to regulated crypto ETFs, including those linked to Bitcoin. Currently, Japan does not allow spot crypto ETFs, placing it behind other global markets. The revision could reverse this by integrating crypto with mainstream investment tools.

Officials believe ETFs will entice retail and institutional traders to trade more systematically and openly. Reclassification will also extend oversight through measures like insider-trading rules and disclosure standards. These changes reinforce Japan’s push for safer, more transparent digital finance.

Digital Finance Bureau to Oversee New Crypto Framework

FSA intends to create a bureau of digital finance and insurance. The bureau will harmonize regulations, oversee market operations, and enforce dynamic crypto policies. The agency believes that crypto is now an essential part of most countries’ financial systems.

Japan’s history with crypto includes both high-profile collapses and regulatory successes. The government now prioritizes resilience and strategic growth. The upcoming structural reform represents the next phase of that evolution.

Related: Eric Trump’s Japan Crypto Push: Strengthening USD’s Global Grip?

Broader Economic and Policy Context

The reforms are part of Japan’s aim to boost its investment environment and give the new generations a helping hand by expanding Nippon Individual Savings Accounts (NISAs). The FSA has suggested reducing the entry age to 18 in NISAs and expanding the allowed products. These efforts are intended to revolutionize early-stage investing, including crypto.

In the past, weak regulation and incidents like the Mt. Gox collapse damaged confidence in Japan’s crypto sector. However, stronger oversight has since restored stability, allowing the country to position itself as both safe and innovative in global finance. Favorable tax policies and controlled ETF access are helping bridge the gap between traditional markets and digital assets. Together, these reforms place Japan at the forefront of responsible crypto integration worldwide.

The post Japan’s FSA Pushes for Safer Crypto With Flat Tax and ETFs appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Long English Thread] "Stablecoins" Are Not Stable at All: Why Do Stablecoins Always Die in the Same Way?

5 Charts to Understand the Current State of the Bitcoin Market

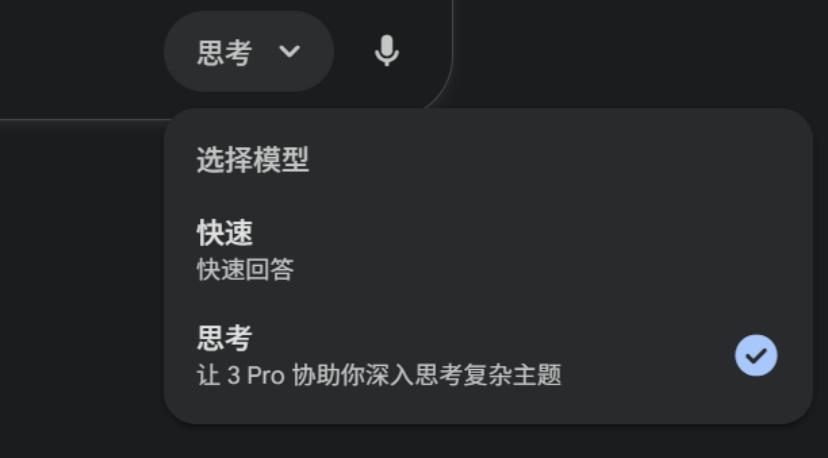

Even Altman gave it a thumbs up: What makes Google Gemini 3 Pro so powerful?

After 8 months of pretending to be asleep, Google suddenly dropped a bombshell with Gemini 3 Pro.

Research Report|In-Depth Analysis and Market Cap of GAIB AI (GAIB)