Ripple-SEC Case Closure Followed by Rush of Updated XRP ETF Filings

Seven major asset managers, including Grayscale and Franklin Templeton, updated their filings for spot XRP ETFs on August 22, shortly after the Ripple–SEC case concluded.

The long-running legal battle between Ripple Labs and the US Securities and Exchange Commission (SEC) has concluded, ending one of the most closely watched courtroom battles in crypto history.

On August 22, the Second Circuit Court dismissed all outstanding appeals, confirming that transactions involving XRP on public exchanges do not qualify as securities sales. The ruling ends a dispute that began in December 2020, when the SEC accused Ripple of raising $1.3 billion through unregistered XRP offerings.

Ripple Ends Five-Year Fight With $125 Million Fine

Ripple’s legal defense spanned nearly five years and cost more than $100 million, reflecting the uphill battle it faced under the hostile regulatory environment shaped by SEC Chair Gary Gensler and the Biden administration.

However, the trajectory of the case shifted in July 2023 when Judge Analisa Torres ruled that retail sales of XRP were lawful, while institutional sales violated securities laws.

#XRPCommunity #SECGov v. #Ripple #XRP The Second Circuit has approved the Joint Stipulation of Dismissal. pic.twitter.com/v796dAtfiZ

— James K. Filan

(@FilanLaw) August 22, 2025

Both Ripple and the SEC initially appealed that split ruling, prolonging the uncertainty.

However, the political climate shifted with the return of Donald Trump and the appointment of a more crypto-friendly SEC leadership. This development opened the door to settlement talks.

By March, Ripple Chief Executive Brad Garlinghouse confirmed a tentative deal involving a $50 million penalty and mutual withdrawal of appeals. Judge Torres initially rejected that agreement, keeping the case unresolved.

But in early August, both sides jointly requested dismissal, and the Second Circuit endorsed the proposal with a $125 million fine.

Crucially, Torres’ earlier opinion—emphasizing that “XRP itself is not a security”—remains intact.

Market observers believe this precedent will influence future product approvals and regulatory guidance.

XRP ETF Momentum Accelerates

The clarity from the ruling immediately sparked movement in the investment products sector.

On August 22, seven asset managers, including Grayscale, Franklin Templeton, Bitwise, CoinShares, WisdomTree, 21Shares, and Canary, updated their filings for an XRP-focused spot exchange-traded fund (ETF).

Nate Geraci, president of investment advisory firm NovaDius Wealth, described the flurry of activity as evidence that issuers are aligning proposals and positioning for an eventual regulatory acceptance.

Notably, the SEC has not approved a spot XRP ETF product in the US despite the presence of leverage funds.

Meanwhile, pro-crypto attorney John Deaton noted that October will be a critical month, as the SEC faces a series of ETF application deadlines—beginning with Grayscale on the 18th and ending with WisdomTree on the 25th.

Deaton pointed out that trading for these products could begin within days if the SEC approvals mirror the process for Bitcoin spot ETFs.

However, their launches could take several months if the SEC demands additional disclosures, as it did for Ethereum ETFs.

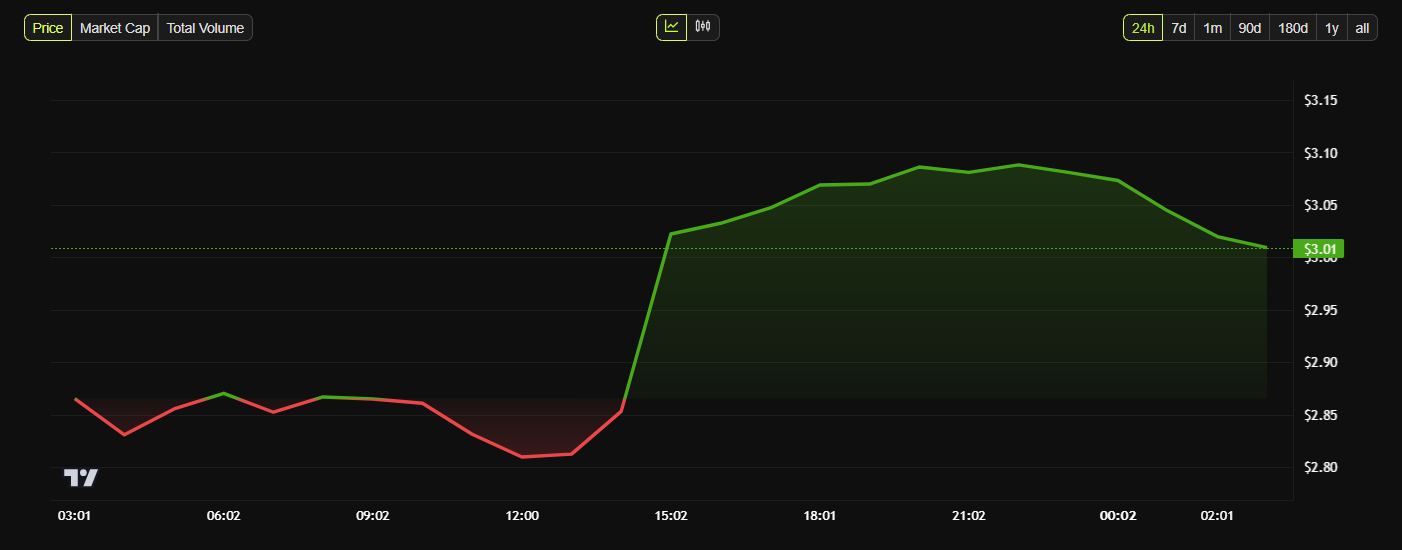

XRP Price Performance. Source:

BeInCrypto

XRP Price Performance. Source:

BeInCrypto

Meanwhile, these developments sparked optimism in the XRP market.

According to BeInCrypto data, the token gained 4% during the last 24 hours and traded at $3.01 as of press time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Starting this Thursday, the United States will fill in missing employment data and release a new batch of economic data

The United States will fill in missing employment data and release new economic data. The Coinbase CEO is looking forward to progress in crypto regulatory legislation. Market participants predict the market is nearing a bottom. Phantom has launched a professional trading platform. Trump hints that the candidate for Federal Reserve Chair has been decided. Summary generated by Mars AI This summary was generated by the Mars AI model, which is still being iteratively updated for accuracy and completeness.

Countdown to a comeback! The yen may become the best-performing currency next year, with gold and the US dollar close behind

A Bank of America survey shows that more than 30% of global fund managers are bullish on the yen's performance next year, with undervalued valuations and potential central bank intervention possibly paving the way for its rebound.

Gemini 3 arrives late at night: surpasses GPT 5.1, the era of Google large models has arrived

Google has defined it as an “important step towards AGI” and emphasized that it is currently the world’s most advanced agent in terms of multimodal understanding and depth of interaction.

Cloudflare Outage Sparks Global Disruptions Across Crypto Platforms and Major Web Services