Philippines Lawmaker Proposes 10,000 BTC Strategic Reserve

The Philippines introduced a bill to acquire 10,000 BTC over five years, locking holdings for two decades. Supporters highlight diversification benefits, while critics warn of risks as global governments accelerate sovereign Bitcoin accumulation.

The Philippines has advanced toward adopting Bitcoin as a strategic reserve asset. 36-year-old Congressman Miguel Luis Villafuerte introduced the Strategic Bitcoin Reserve Act, calling for acquiring 10,000 BTC over five years.

If enacted, the measure would position Bitcoin alongside gold and foreign-exchange reserves, making the Philippines one of the world’s largest state-level cryptocurrency holders.

Bill Details: 10,000 BTC Target, 20-Year Lock-In

House Bill No. 421, filed on August 22, 2025, directs the Bangko Sentral ng Pilipinas (BSP) to purchase 2,000 BTC annually over five years.

The law mandates a 20-year minimum holding period, after which it would allow only limited sales. The reserve could liquidate no more than 10% within two years, and only for retiring sovereign debt.

Representative Villafuerte described Bitcoin as ‘a modern strategic asset, comparable to digital gold,’ arguing that the Philippines should not let other countries leave it behind while accumulating reserves.

— Dicki Devesa (@57twl57) August 22, 2025

A Strategic Bitcoin Reserve Bill has been filed by Rep. Miguel Villafuerte in the House of Representatives. The Bill seeks to purchase 10,000 BTC over a 5-year period. pic.twitter.com/0coTMQrVvh

As of November 2024, the Philippines carried ₱16.09 trillion ($285 billion) in debt, with nearly 68% owed domestically. Supporters argue that diversifying reserves beyond the US dollar and gold is essential for stability, particularly in light of global financial uncertainty.

“The country must stockpile strategic assets such as Bitcoin to safeguard our national interest,” the bill’s explanatory note states

Philippines Tightens Oversight of Bitcoin Reserves

The reserve would be stored in cold storage facilities distributed nationwide, with limited access. The BSP governor would oversee the reserve, supported by the Department of Finance, Department of Defense, and Securities and Exchange Commission.

The bill requires quarterly proof-of-reserve audits by independent third parties to build trust. These reports must be published online for complete public transparency.

The legislation also affirms that private citizens and businesses are free to hold and trade Bitcoin without government interference.

Global Race Heats Up as Governments Stockpile Bitcoin

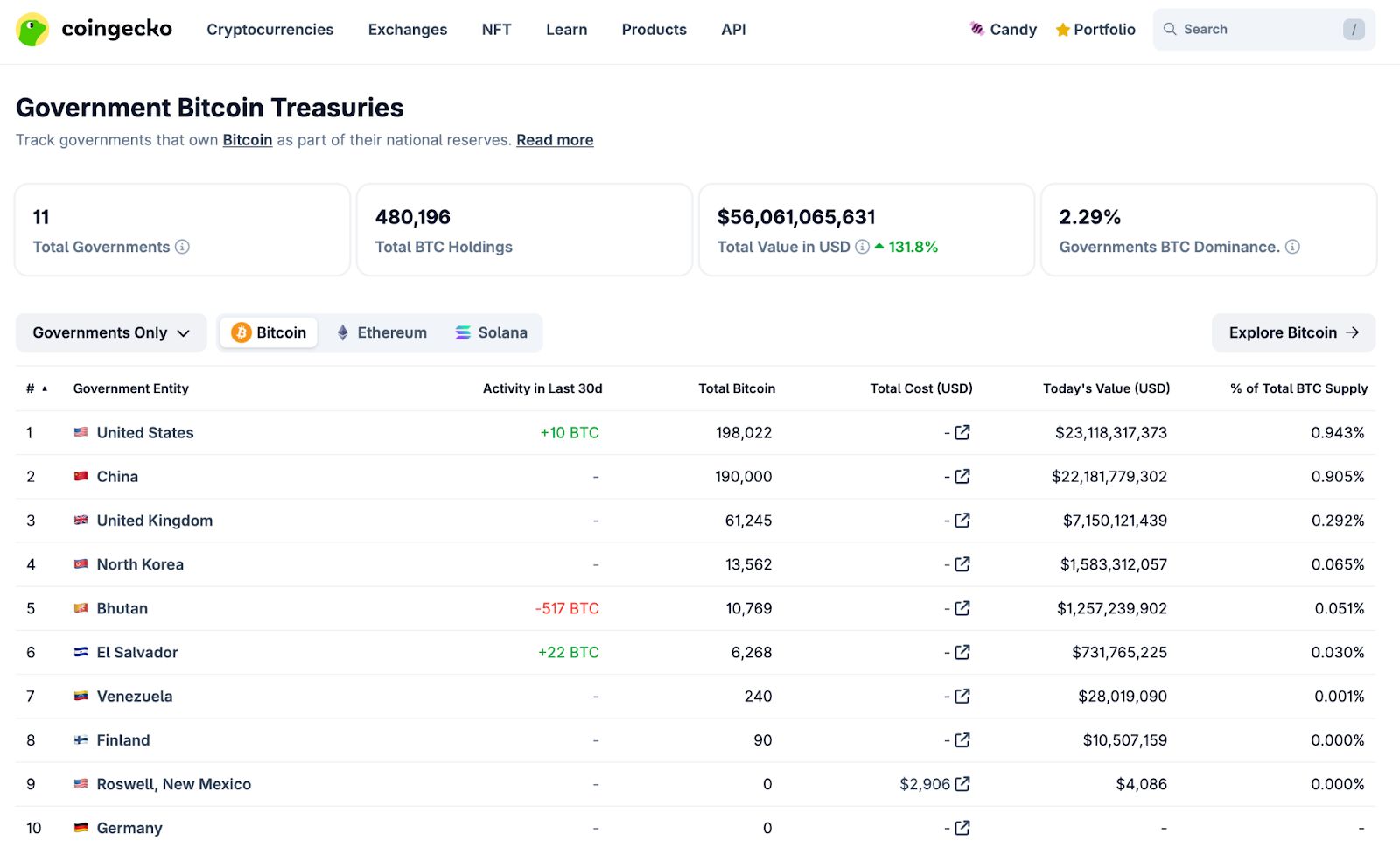

Governments worldwide are increasingly turning to Bitcoin. According to CoinGecko data this month, eleven governments collectively hold 480,196 BTC, worth about $56 billion—roughly 2.29% of Bitcoin’s supply. The list includes North Korea (13,562 BTC), Bhutan (10,769 BTC), and El Salvador (6,268 BTC).

El Salvador remains the highest-profile adopter after making Bitcoin legal tender in 2021. Despite declining retail usage, it has recently accumulated, adding 22 BTC, lifting its sovereign holdings above $725 million.

The Philippines plans a 10,000 BTC reserve exceeding $1.1 billion at the current $116,850 per coin level. That commitment could place the country alongside Bhutan and ahead of El Salvador in sovereign holdings.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump vs. Federal Reserve: The Battle Over Central Bank Independence Escalates

"I'm panicking, what happened?" Cloudflare outage causes global internet chaos

The incident once again highlights the global internet's heavy reliance on a few key infrastructure providers.