AMTD Launches $240M Crypto Strategy to Diversify Reserves

- AMTD allocates $240 million to crypto assets, following Tesla and Strategy’s lead.

- BTC, ETH, and USDT are key assets in AMTD’s strategy to hedge risks and boost liquidity.

- TGE is driving AMTD’s growth by focusing on tokenized assets and expanding new revenue streams.

AMTD Group has made a significant move in corporate finance by allocating $240 million to digital assets. By adding Bitcoin (BTC), Ethereum (ETH), and Tether (USDT) to its reserves, AMTD aligns itself with companies like Tesla and Strategy. This signals a growing trend of institutional adoption of cryptocurrencies, especially in Asia, as companies explore new financial strategies.

AMTD’s decision is a calculated response to inflation and currency risk. Bitcoin and Ethereum serve as hedges against economic instability. Tether, a stablecoin, provides liquidity in the digital market. This move isn’t speculative but part of a broader strategy to diversify AMTD’s financial assets.

AMTD Strengthens Portfolio with Crypto

AMTD has positioned crypto as a core part of its treasury strategy, treating it alongside traditional assets like equities and bonds. This approach diversifies its portfolio, enhances return potential, and prepares the company for the future of finance.

A key part of AMTD’s crypto strategy is its subsidiary, The Generation Essentials Group (TGE). TGE focuses on tokenized assets, including applications in media, entertainment, and hospitality. By integrating blockchain technology, AMTD creates new revenue streams. This positions the company as a leader in bringing crypto into everyday business operations.

The ability of TGE to tokenize real-world assets, including luxury goods and real estate, opens up potential opportunities to allow fractional ownership. This makes it available as an investment option to both retail and institutional investors. It is in line with international regulatory developments, especially the EU MiCAR, to facilitate the expansion of tokenized assets.

AMTD Enhances Credibility with Compliant Crypto Conversion Program

The fact that AMTD is willing to comply with the regulation adds to its credibility. The crypto conversion program that the company is offering allows investors to convert Bitcoin, Ethereum, and other major coins into shares in their NYSE-listed subsidiaries. This project aligns with U.S. and European regulations, ensuring transparency and security, making the platform appealing to institutional investors.

Nonetheless, there are still threats with regard to the strategy of AMTD. The crypto conversion program’s success would depend on its ability to obtain the necessary regulatory approvals. It would also depend on market demand, which would determine its success. There is a fear of existing shareholders being diluted due to the issuance of new shares. Investors must carefully consider the combination of these factors because they affect the overall risk and reward.

AMTD’s strategy reflects a broader corporate shift in Asia toward digital assets. Other firms are also moving in this direction. For instance, Hong Kong-based construction company Ming Shing Group Holdings Limited (NASDAQ: MSW) recently announced plans to purchase 4,250 Bitcoin at an estimated cost of $482.96 million, averaging $113,638 per BTC. The deal is expected to close by the end of 2025.

Related: Hong Kong Construction Firm Ming Shing Invests $483M in Bitcoin

Both AMTD’s compliant conversion program and Ming Shing’s large-scale Bitcoin purchase highlight a new era of corporate Bitcoin adoption in Asia. As more firms follow this path, the line between traditional finance and crypto could blur further, reshaping corporate treasury models on a global scale.

The post AMTD Launches $240M Crypto Strategy to Diversify Reserves appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Atlantic: How Will Cryptocurrency Trigger the Next Financial Crisis?

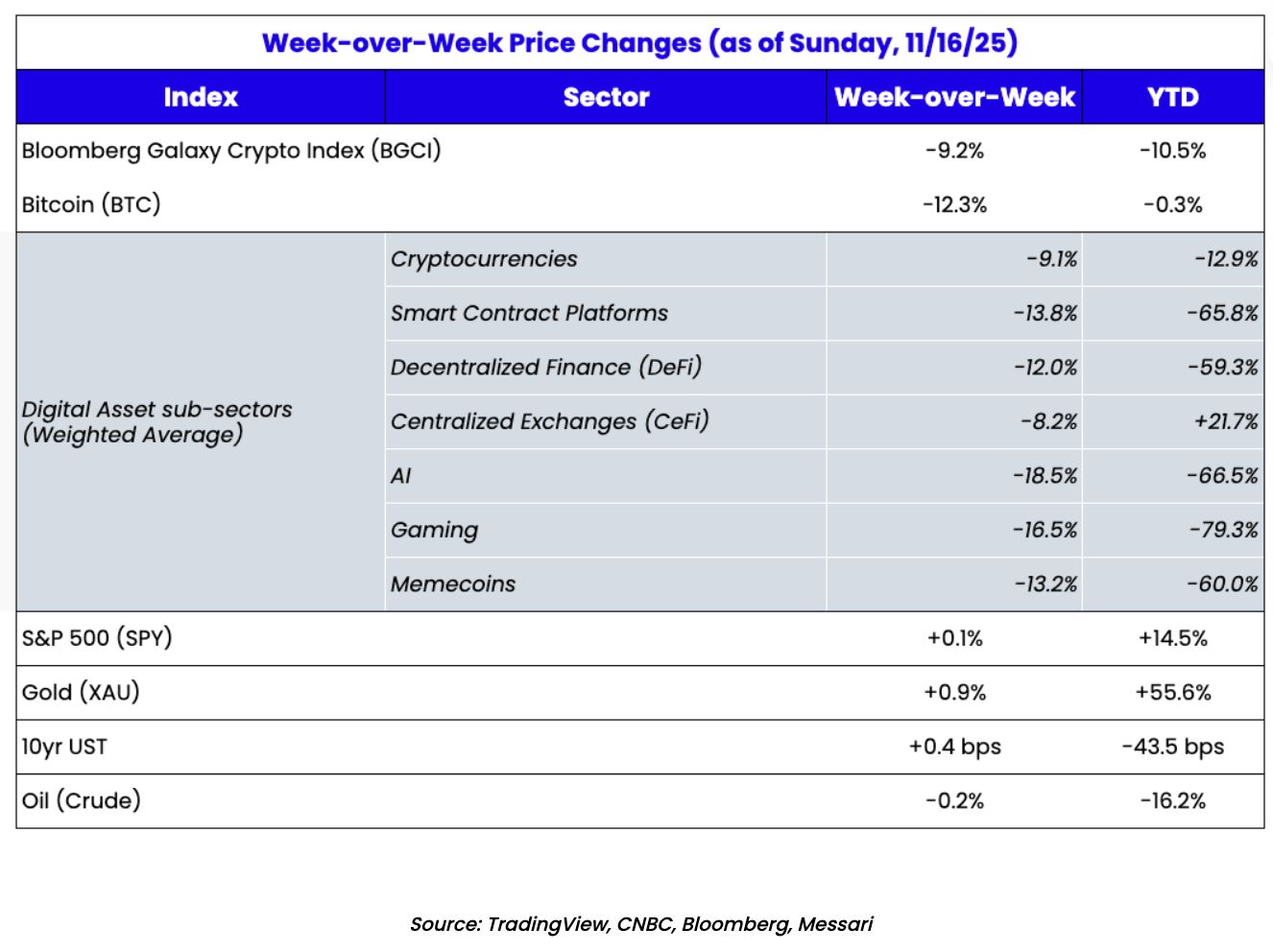

Bitcoin fell below $90,000, and the cryptocurrency market lost $1.2 trillions in six weeks. Stablecoins, criticized for disguising risks as safety, have been identified as potential triggers for a financial crisis, and the GENIUS Act could increase these risks. Summary generated by Mars AI. This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Bitcoin Surrenders Early as Market Awaits Nvidia’s Earnings Report Tomorrow

Global risk assets have experienced a significant decline recently, with both the US stock market and the cryptocurrency market plunging simultaneously. This is mainly due to investor fears of an AI bubble and uncertainty surrounding the Federal Reserve's monetary policy. Concerns over the AI sector intensified ahead of Nvidia's earnings report, while uncertainty in macroeconomic data further increased market volatility. The correlation between Bitcoin and tech stocks has strengthened, leading to split market sentiment, with some investors choosing to wait and see or buy the dip. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model are still being iteratively improved.

Recent Market Analysis: Bitcoin Falls Below Key Support Level, Market on High Alert, Preparing for a No Rate Cut Scenario

Due to the uncertainty surrounding the Federal Reserve’s decision in December, it may be wiser to act cautiously and control positions rather than attempting to predict a short-term bottom.

If HYPE and PUMP were stocks, they would both be undervalued.

If these were stocks, their trading prices would be at least 10 times higher, if not more.