Bitcoin Volatility Hits Five-Year Low With Market Adoption

Bitcoin volatility has dropped to levels we haven’t seen in five years, and it’s changing how people think about the market. The 30-day realized volatility recently fell below 40%. It’s remarkable because Nvidia, despite being a market darling, currently shows significantly higher volatility, with some periods seeing 30-day implied volatility exceeding 80%. Bitcoin isn’t just a speculative asset anymore. Spot ETFs, retirement plan allocations, and institutional interest are steadily smoothing out price swings.

Spot ETFs Driving Market Stability

Since the SEC approved 11 Spot ETFs, more than $150 billion has flowed into these funds. Big names like BlackRock’s IBIT have consistently absorbed liquidity during corrections, acting as a stabilizer when retail sentiment wavers. Academic analysis confirms that ETF inflows materially reduced Bitcoin volatility, supporting the idea that regulated investment vehicles are turning Bitcoin into a more predictable asset.

Retirement Plans Encourage Bitcoin Volatility

401(k)s and IRAs now allow Bitcoin exposure, which encourages buy-and-hold behavior. These low-turnover allocations act as a buffer against sudden sell-offs. Endowments, Pension funds, and insurance companies are slowly adding Bitcoin. These are secured through regulated channels, bringing long-term capital into the market. That’s not the kind of money that jumps in and out in a day.

Laws like the GENIUS Act for stablecoins and the CLARITY Act for market structure are giving corporates and governments the certainty they need to integrate crypto into treasuries. Analysts from Deutsche Bank expect volatility to stay compressed as Bitcoin increasingly substitutes or complements traditional portfolio hedges.

Bitcoin Correlates More with Traditional Markets

In Europe, multi-asset funds are allocating 1-3% of portfolios to Bitcoin for diversification, while Asia-Pacific sovereign funds experiment with small digital reserve mandates. Middle Eastern family offices in the UAE are allocating up to 5% of wealth portfolios through regulated exchange-traded notes.

Lower Bitcoin volatility changes how investors view it. It’s less risky, so previously cautious institutions can now allocate capital. Portfolio allocation models are starting to treat Bitcoin alongside commodities, REITs, and high-yield bonds rather than as a purely speculative play. And the more stable prices get, the more feasible it becomes for Bitcoin to act as a medium of exchange or settlement tool.

Institutional accumulation is reshaping supply dynamics. Over 770,000 BTC are now held in accounts with more than 10,000 BTC, mostly by institutions. ETFs alone control nearly 6.5% of total Bitcoin supply, while corporate treasuries add persistent demand, independent of retail sentiment. Exchange reserves are shrinking, further reducing speculative pressure.

Structural Shift in Bitcoin Market Volatility

Daily volatility is far lower than in previous cycles, and correlations with tech stocks and high-yield bonds are rising. Traditional four-year halving cycles no longer dictate price patterns; institutional flows now drive market dynamics. Even so, macro conditions still matter. Bitcoin late August 2025 saw $1.17 billion in ETF outflows, the second-largest weekly withdrawal on record.

For investors, this changes portfolio strategies. Bitcoin can be part of retirement plans and long-term allocations without the wild swings of the past. It’s being treated as a strategic asset, not a fringe bet. With spot ETFs, corporate adoption, and regulatory clarity all reinforcing stability, Bitcoin volatility may stay low for the foreseeable future. The combination of market behavior, global adoption, and regulatory frameworks suggests this isn’t temporary. It can be a fundamental shift in how Bitcoin functions within the financial system

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

One In Three Young Investors Moves To Crypto-Friendly Advisors

Open Campus and Animoca Brands Partner with Rich Sparkle Holdings to Drive EduFi Adoption

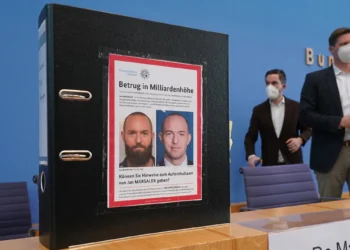

Russian Spy Ring Funds Espionage Through Crypto Laundromat, UK Police Reveal

Cardano Price Prediction 2025, 2026 – 2030: Will ADA Price Hit $2?