Non-USD Stablecoins Surge with Rising Markets and Local Adoption

Non-USD stablecoins are booming in 2025, particularly in Brazil, powering crypto adoption with Polygon leading the blockchain market in this developing sector.

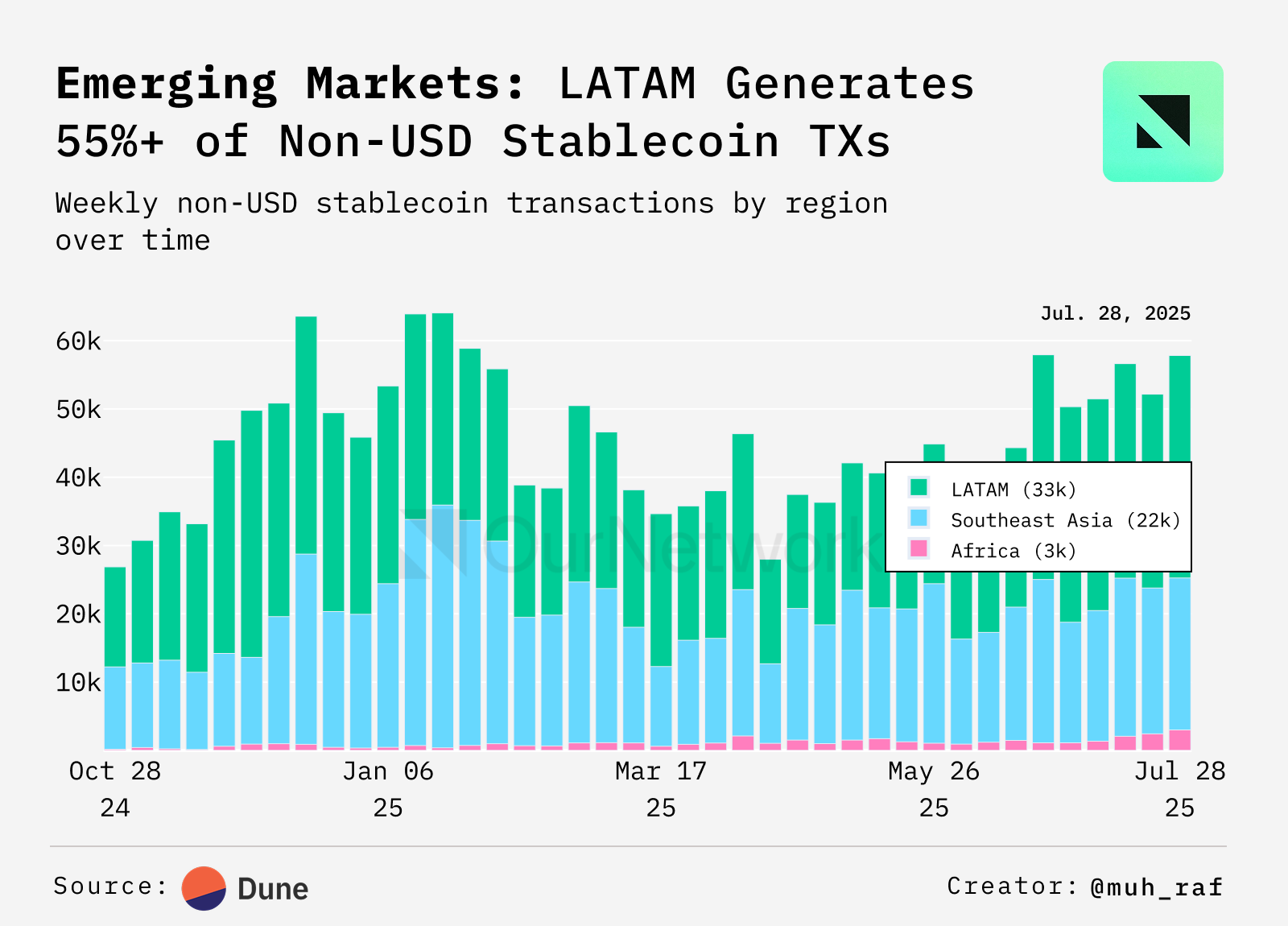

Non-USD stablecoins are a growing market in 2025, rebounding after a brief pause in March and April. These assets are powering genuine crypto adoption in several regions, which is often an elusive target.

Latin America, especially Brazil, is powering this trend, representing 55% of the total volume. Additionally, Polygon is by far the most popular blockchain, giving it a potential opportunity.

Non-USD Stablecoins on the Rise

Dollar-based stablecoins are highly prominent for obvious reasons; they represent the largest token platforms. President Trump even wants to include them in US fiscal policy, prompting new integrations.

Still, non-USD stablecoins have also been growing, and some new analysis illustrates this:

Non-USD stablecoins aren’t just a side story anymore.From Q4 2024 to August 2025, 23 different non-USD stablecoins across Southeast Asia, LATAM, and Africa pushed 20k+ weekly transactions, with peaks above 60k in early 2025.> The biggest drivers: SGD- and BRL-pegged… pic.twitter.com/cxMgHmP8u1

— Shann³ (@shannholmberg) August 25, 2025

Stablecoins based on the Euro have drawn a lot of attention and partnerships, especially due to MiCA regulations. Asia, too, has been growing as a region, and China is even considering a new stablecoin despite its anti-crypto policies.

Latin America, however, is currently the biggest adopter of non-USD stablecoins, thanks to Brazil leading the way.

On-chain data shows that non-USD stablecoins grew consistently in H1 2025; 23 such assets enjoy more than 20,000 weekly transactions. Latin America represents 55% of this entire market, representing more activity than Southeast Asia and Africa combined.

Non-USD Stablecoins in Developing Markets. Source:

ournetwork.xyz

Non-USD Stablecoins in Developing Markets. Source:

ournetwork.xyz

Multiple New Potential Opportunities

Additionally, Polygon is the preferred blockchain for these non-USD stablecoins, representing a whopping 70% of this market. For most of the last year, it has hosted more than 4,000 active addresses every week, blowing competitors like Base, BNB, and Ethereum out of the water.

If the market keeps growing, this niche could significantly boost Polygon.

There are some key reasons why this bullish scenario might play out. Over the years, the crypto community has put a lot of hope on practical use cases like cross-border remittance payments. Major cryptocurrencies like Bitcoin and Ethereum have transformed into store-of-value assets, rather than payment methods.

Although outreach programs repeatedly try to encourage local BTC adoption, regular usage remains low even in the most pro-crypto jurisdictions. Non-USD stablecoins, however, may have an advantage here.

These assets can’t have speculative value, and conducting everyday payments in local currency may be more practical than converting to USD.

Additionally, they take better advantage of crypto’s decentralized capabilities, bucking the overwhelming centralization trend in today’s market.

Still, compared to the gargantuan size of platforms like Tether and Circle, 20,000 weekly transactions seem very small. Non-USD stablecoins have a long way to go if they’re going to impact the broader markets.

However, this niche use case is powering practical adoption, which may give it a distinct advantage in the long run.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Federal Reserve Hawks Speak Out, Asset Price Crash Risk May Become New Obstacle to Rate Cuts

JPMorgan warns that if Strategy is removed from MSCI, it could trigger billions of dollars in outflows. The adjustment in the crypto market is mainly driven by retail investors selling ETFs. Federal Reserve officials remain cautious about rate cuts. The President of Argentina has been accused of being involved in a cryptocurrency scam. U.S. stocks and the cryptocurrency market have both declined simultaneously. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Citibank and SWIFT complete pilot program for fiat-to-crypto PvP settlement.

Pantera Partner: In the Era of Privacy Revival, These Technologies Are Changing the Game

A new reality is taking shape: privacy protection is the key to driving blockchain toward mainstream adoption, and the demand for privacy is accelerating at cultural, institutional, and technological levels.

Exclusive Interview with Bitget CMO Ignacio: Good Code Eliminates Friction, Good Branding Eliminates Doubt

A software engineer's brand philosophy.