Date: Tue, Aug 26, 2025 | 06:20 AM GMT

The cryptocurrency market is facing a sharp decline as Bitcoin (BTC) retraced to $110K from its recent high of $117K, while Ethereum (ETH) slipped 5% today to $4,400. This downside pressure has hit major memecoins hard, and Fartcoin (FARTCOIN) took the heaviest hit, dropping 14% in the last 24 hours.

But interestingly, the chart of FARTCOIN is now flashing a potentially bullish signal — the emergence of a “Power of 3” setup that could open doors for a strong bounceback.

Source: Coinmarketcap

Source: Coinmarketcap

Power of 3 Pattern in Play?

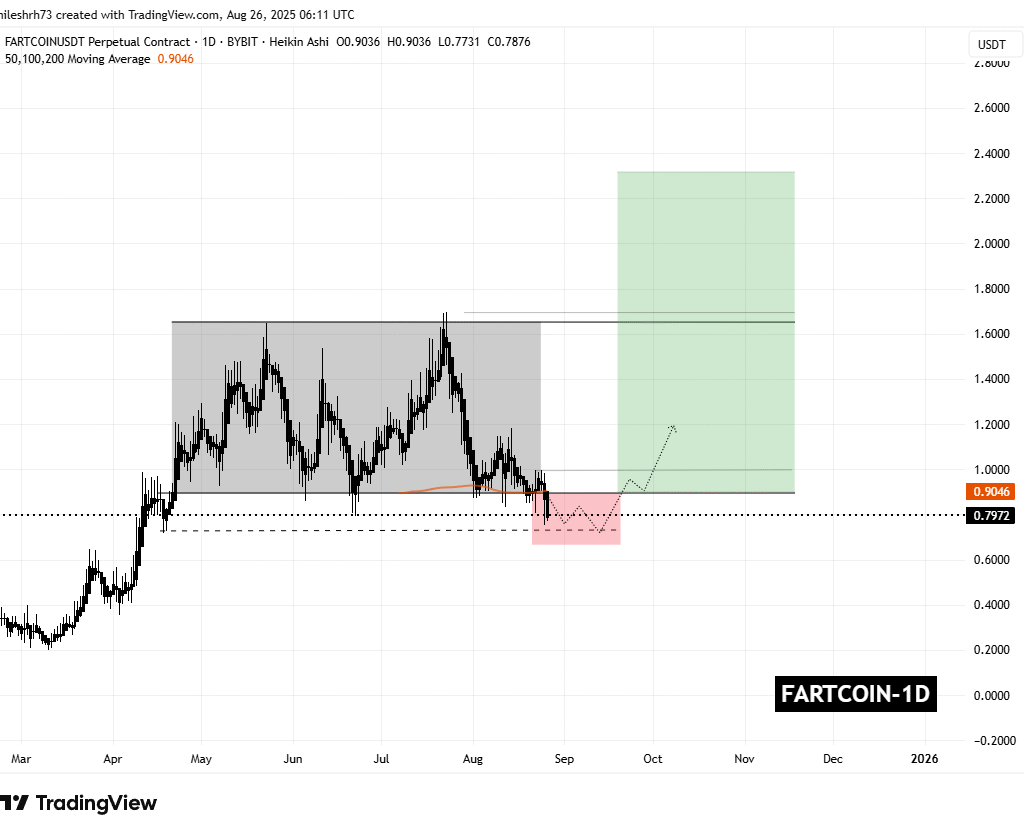

On the daily chart, FARTCOIN seems to be shaping into a textbook Power of 3 setup, which typically unfolds in three phases:

Accumulation Phase

FARTCOIN consolidated for weeks in a tight zone between $1.65 (resistance) and $0.89 (support). This sideways action likely indicated quiet accumulation by larger investors, as volatility stayed muted.

Manipulation Phase

Earlier today, FARTCOIN dipped sharply below the $0.89 support, sliding to around $0.75. This sudden move appears to be a classic stop-hunt or fakeout, designed to shake out weak hands and trap short-sellers — a key hallmark of the manipulation phase.

FARTCOIN Daily Chart/Coinsprobe (Source: Tradingview)

FARTCOIN Daily Chart/Coinsprobe (Source: Tradingview)

What’s Next for FARTCOIN?

Currently, FARTCOIN is trying to stabilize near the $0.72 zone. If buyers manage to push the price back above $0.89, or reclaim the 200-day moving average (MA) at $0.90, it could kickstart the expansion phase — the most bullish leg of the Power of 3 structure.

A breakout above the $1.00 level would strengthen the bullish case and potentially fuel a rally toward $1.65, representing a 105% gain from current levels.

However, if $0.72 support breaks decisively, it may delay or even invalidate the bounceback scenario, leaving FARTCOIN vulnerable to further downside.

Disclaimer: This article is for informational purposes only and not financial advice. Always do your own research before investing in cryptocurrencies.