Stellar XLM Poised for Final Dip Before Targeting $1 Breakout

- XLM could slide to $0.36–$0.33 before igniting a breakout rally that may drive it toward $1.

- Negative funding and a sharp fall in OI show buyers losing ground as sellers gain strength.

- Liquidation risks tilt against longs, signaling higher chances of decline before a rebound.

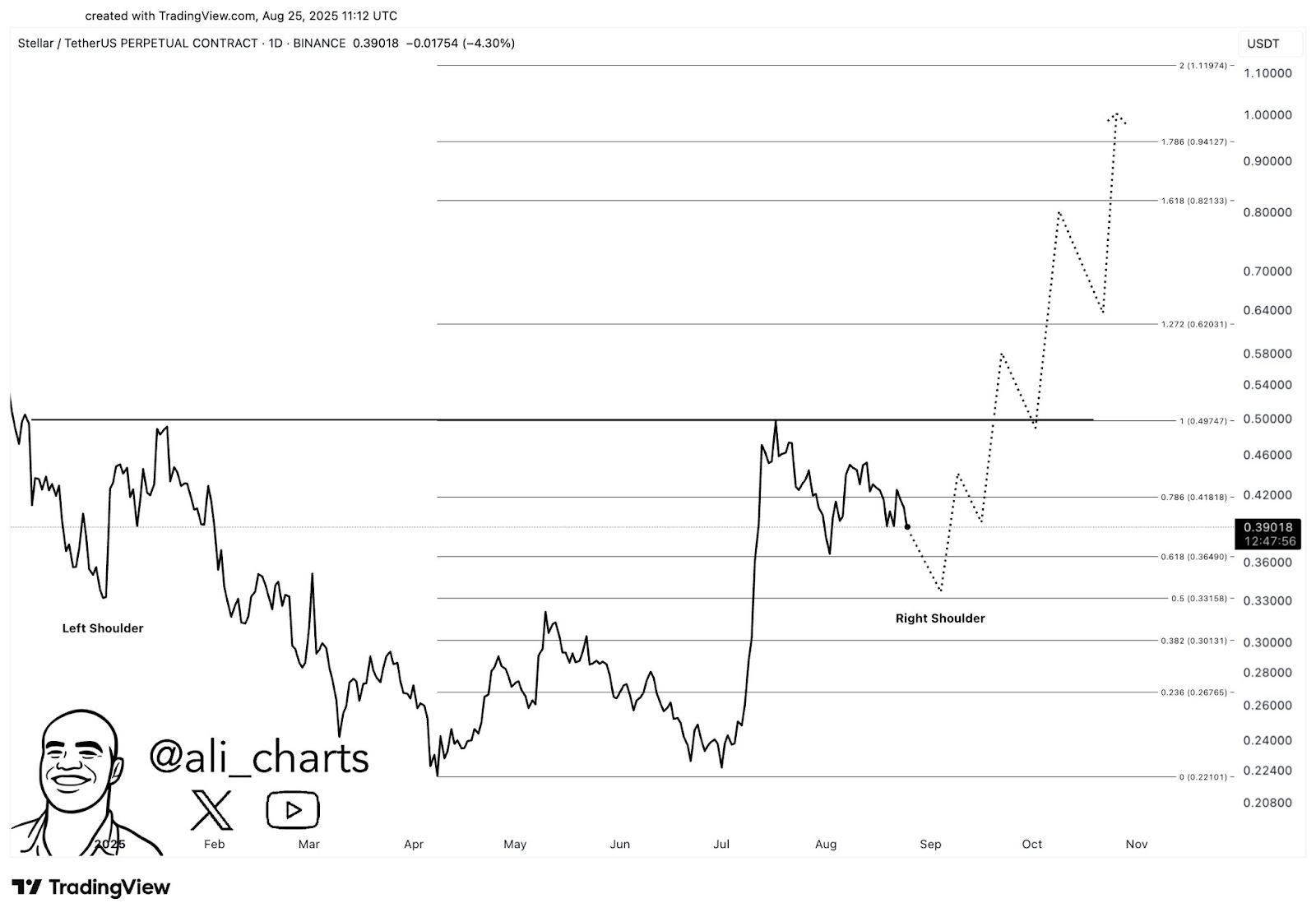

Stellar’s token XLM may have to take one more step back before leaping forward. Crypto market analyst Ali_charts shared a chart showing that the token, now trading near $0.39, could first slide to the $0.36–$0.33 range before igniting a powerful rally.

The projection outlines a textbook inverse head-and-shoulders formation, with the “right shoulder” still in play. According to Ali, the breakout moment will come once XLM clears the $0.50 neckline. That move could set the stage for a run toward $0.62 and $0.82, eventually aiming for $0.94.

Source:

X

Source:

X

The bigger picture points to a bold target: a push close to $1.10. Achieving this would translate into an increase of over 150% over current prices. Fibonacci retracement levels support the setup, defining the short-term support areas as well as critical resistance levels on the road. Although a dip might challenge investors’ patience, the analysis implies that it is a pause before the momentum builds.

XLM Price Slides With More Correction on the Horizon

XLM is currently underperforming, with price action on the monthly, weekly, and daily charts all indicating further downside. The token’s price has been in a gradual decline, with each attempt to squeeze into higher price bands resulting in price rejection.

According to CoinMarketCap, XLM has lost 12.7% in value over the last month, with additional declines of 4.32% on the weekly chart and 2.35% on the daily chart. The declining price supports Ali’s analysis that the token will undergo an additional fall in price.

Source:

TradingView

Source:

TradingView

The 4-hour chart underscores this bearish tilt. XLM is tracking a descending channel, a formation that often signals further downside. The token currently hovers near the 23.60% Fibonacci level at $0.38, serving as immediate support. Should this floor give way, the next critical zone rests between $0.37 and $0.36, marking a possible 4–6% decline.

Related: XLM Price Prediction: Can Stellar Hit $1 in This Bull Cycle?

On-Chain Metrics Signal Fragile Market Setup for XLM

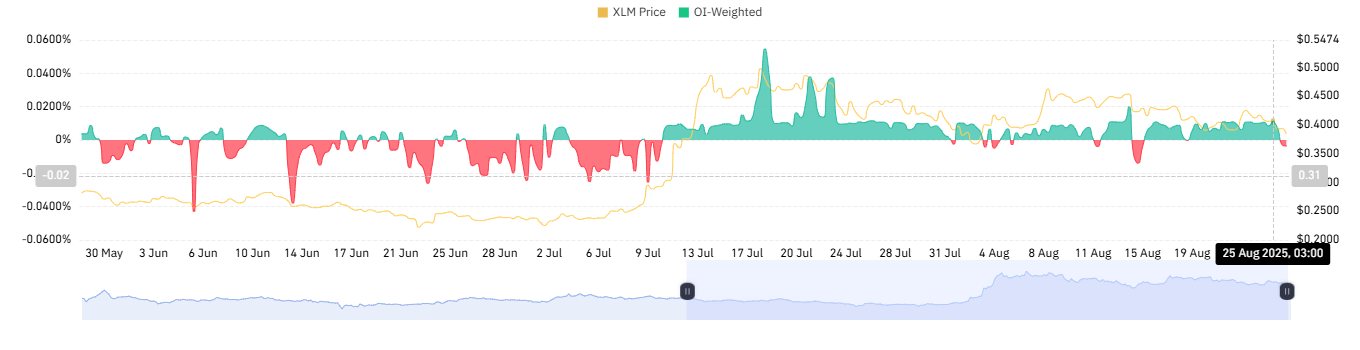

XLM faces mounting pressure as fresh data reveals a sharp turn in market sentiment. The token’s OI-weighted funding rate has flipped negative to -0.0036 percent, a signal that short sellers are now paying long traders to hold positions. Such a shift often reflects a market leaning firmly toward the downside, with sellers gaining the upper hand.

Source:

Coinglass

Source:

Coinglass

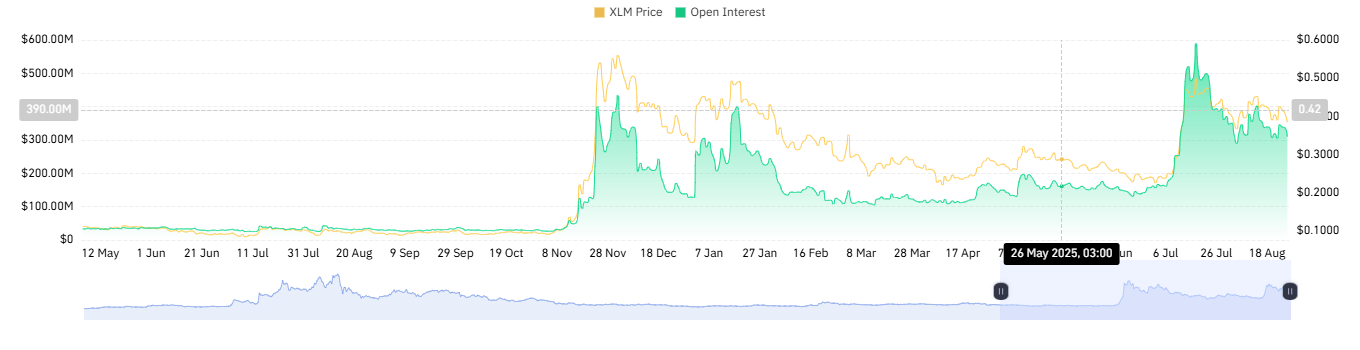

More alarming is the steep reduction in open interest, which fell from $588.3 million to $309.79 million. This steep reduction shows traders unwinding positions, closing contracts, and stepping away from leveraged bets. The retreat highlights disinterest from the buyers and a market increasingly driven by defensive positioning.

Source:

Coinglass

Source:

Coinglass

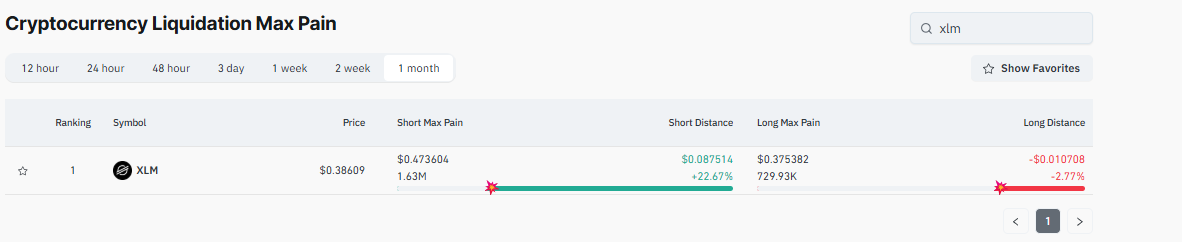

Liquidation data depicts the same picture. Currently trading at $0.386, XLM has a 2.77% downside to its long max pain point of $0.3753, with the short pain point over 22% higher, at $0.4736. The asymmetry puts longs at risk of a minor price decline, although shorts are safe until longs can initiate a significant price rebound.

Source:

Coinglass

Source:

Coinglass

Taken together, the signals suggest the setup is fragile. The negative funding, the shrinking open interest, and the skewed liquidation risk all point to the market being against the longs. As a result, the near-term XLM chart will likely trend further down in the absence of buyers with deep pockets, and the market will likely anticipate more long liquidations before any recovery can take shape.

The post Stellar XLM Poised for Final Dip Before Targeting $1 Breakout appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto: Fundraising Explodes by +150% in One Year

Bitcoin Drops $8B In Open Interest : Capitulation Phase ?

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025