XRP Price Reversal Looms Owing To $600 Million Long-Term Holder Buy

XRP shows signs of recovery as long-term holders accumulate $600 million worth, hinting at a price reversal if resistance breaks.

XRP has struggled to recover recent losses, with its price lacking upward momentum in recent sessions. Despite limited progress on the charts, the altcoin is showing early signs of support.

Long-term holders are beginning to step in with significant accumulation, suggesting potential resilience against ongoing weakness in the broader crypto market.

XRP Key Holders Are Turning Around

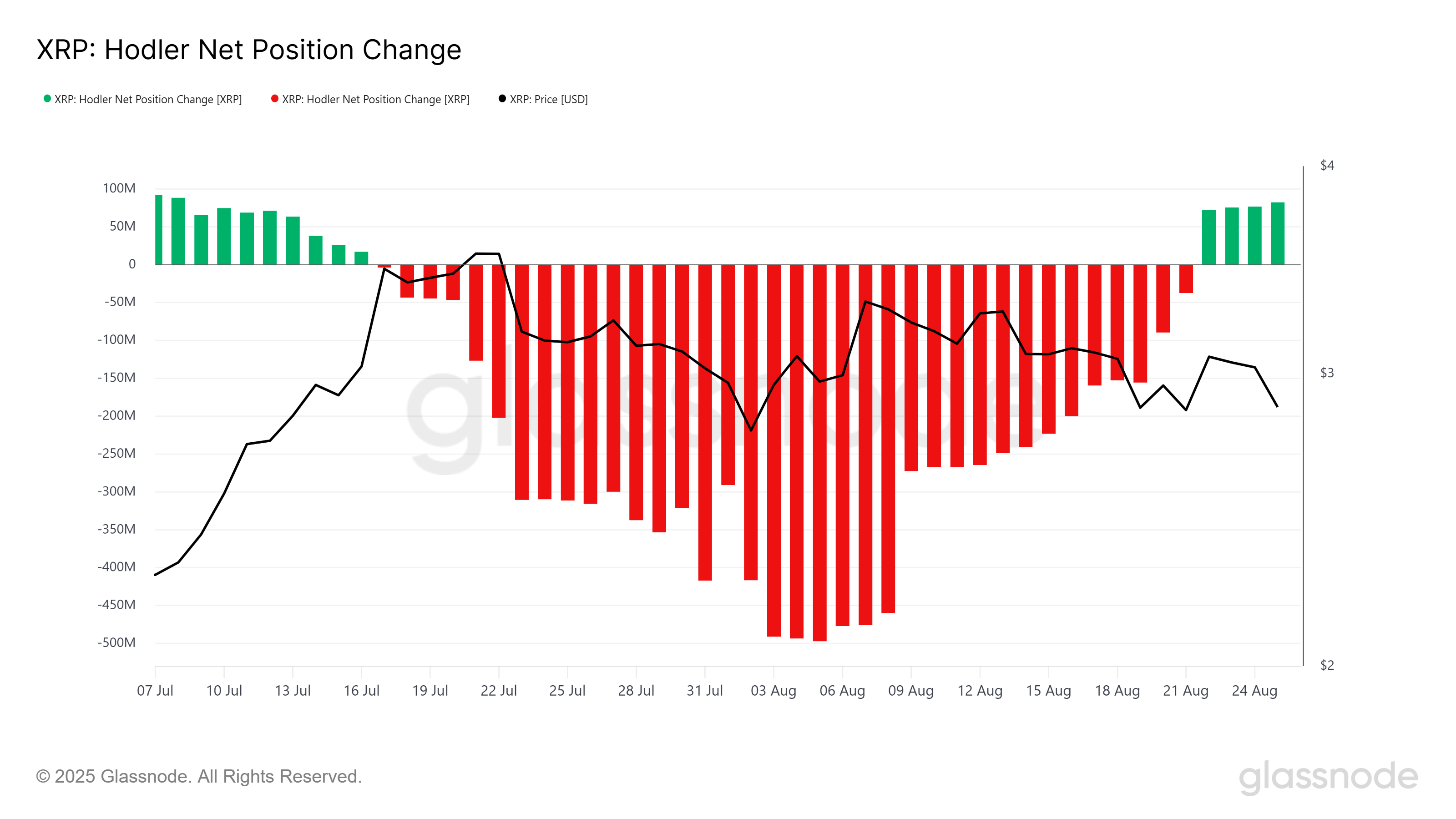

On-chain data highlights a shift in XRP’s long-term holder activity. The HODLer net position change shows that after nearly a month of steady selling, investors with larger positions are returning to accumulation. This turnaround signals renewed conviction in XRP’s future price potential, particularly at current discounted levels.

Over the past several days, more than $600 million worth of XRP has been acquired by these long-term holders. Such accumulation reflects growing confidence that the cryptocurrency may find strength following this period of weakness.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

XRP HODLer Net Position Change. Source:

Glassnode

XRP HODLer Net Position Change. Source:

Glassnode

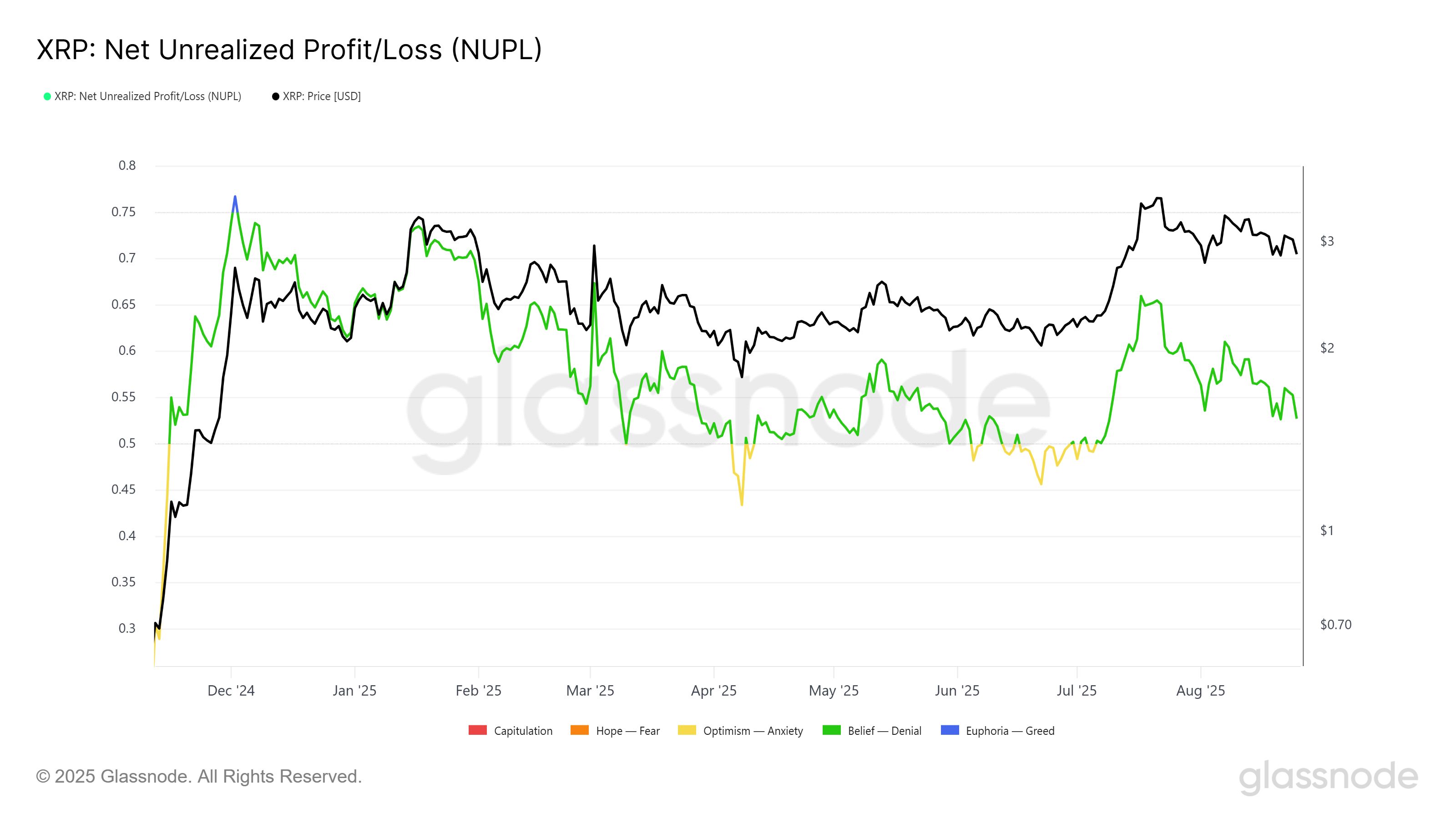

The broader macro momentum also supports a potential reversal for XRP. The net unrealized profit/loss (NUPL) indicator is nearing the optimism threshold, which has historically been a point where XRP price has reversed upward. Current conditions suggest that investors are holding reduced profits, creating a setup that has previously triggered rallies.

The decline in profits often acts as an incentive for new capital to enter, as lower valuations appeal to buyers. This dynamic has been visible in XRP’s recent activity, aligning with long-term holder accumulation.

XRP NUPL. Source:

Glassnode

XRP NUPL. Source:

Glassnode

XRP Price Needs A Boost

XRP trades at $2.91 at the time of writing, struggling beneath the $2.95 resistance. The asset recently failed to break through the $3.07 resistance, which led to the price falling back toward current levels. This rejection has left XRP consolidating without strong short-term upward momentum.

Investor support, however, suggests conditions may soon shift. If XRP breaches the $3.07 resistance, flipping $3.12 into support could spark fresh momentum. Such a move may enable a climb to $3.27, positioning XRP for renewed strength after weeks of stalled price action across the cryptocurrency market.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

If market bearishness deepens, XRP could retrace toward $2.74 or consolidate below $2.95. This outcome would maintain pressure on the altcoin while preventing a breakout. Such price action would temporarily invalidate the bullish outlook, keeping XRP constrained.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Long English Thread] The Evolution of Aave: From Dual Market Structure to Liquidity Hub

[English Long Tweet] Vitalik Devconnect Argentina Speech Breakdown: From EIP-7732 to zkVMs to Lean Ethereum

Exclusive Interview with Bitget CMO Ignacio: Good Code Eliminates Friction, Good Branding Eliminates Doubt

A software engineer’s philosophy of branding.

App delays and launch sniping: Base co-founder’s token issuance sparks community dissatisfaction

While most major altcoins are showing weakness, Jesse has chosen to issue a token at this time, and the market may not respond positively.