Federal Reserve: Interest Rate Cut Possible in September

On August 22, according to comprehensive reports from CNBC/Bloomberg/WSJ, Federal Reserve Chairman Jerome Powell gave a mild hint about possible future rate cuts on Friday, noting that high uncertainty is making the work of monetary policymakers more difficult.

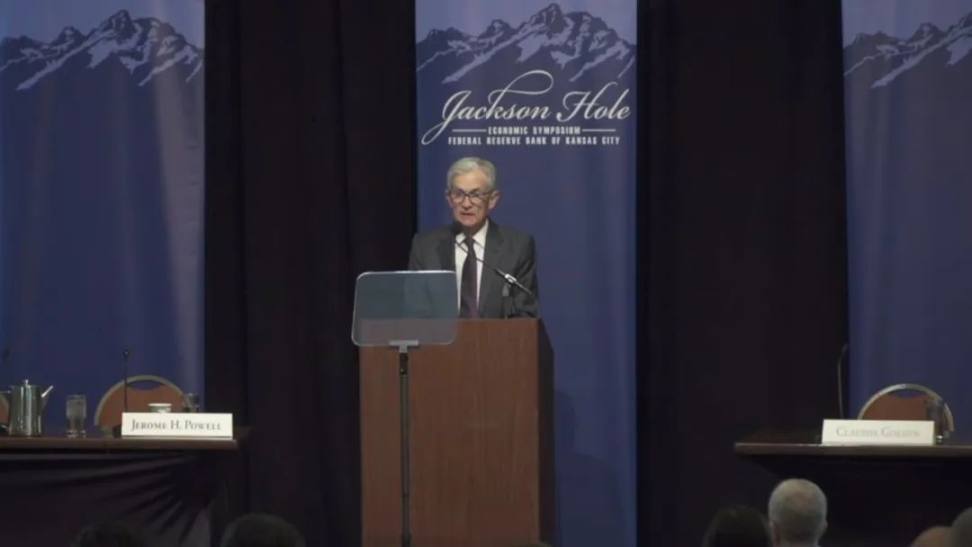

At the Federal Reserve's annual meeting in Jackson Hole, Wyoming, the central bank chief delivered his much-anticipated speech, in which he mentioned "comprehensive changes" in tax, trade, and immigration policies in his prepared remarks. As a result, the "risk balance between the Fed's dual goals of full employment and price stability appears to be shifting."

Although he pointed out that the labor market remains strong and the economy has shown "resilience," he stated that downside risks are rising. Meanwhile, he said that tariffs are creating renewed risks of rising inflation—a scenario the Fed needs to avoid, namely stagflation.

Powell stated that since the Fed's benchmark interest rate is a full percentage point lower than when he delivered his keynote speech a year ago and the unemployment rate remains very low, "we can afford to carefully consider changing our policy stance."

He added, "Nevertheless, because policy is in restrictive territory, the baseline outlook and the evolving risk balance may require us to adjust our policy stance."

This was the only time in his speech that he came close to supporting a rate cut, and Wall Street generally believes that the Federal Open Market Committee will hold its next meeting from September 16 to 17, when a rate cut is expected.

However, these remarks were enough to push the stock market higher and send U.S. Treasury yields tumbling. After Powell's speech was made public, the Dow Jones Industrial Average rose by more than 600 points, while the policy-sensitive two-year U.S. Treasury yield fell by 0.08 percentage points to around 3.71%.

Beyond market expectations, U.S. President Donald Trump also publicly criticized Powell and his colleagues, demanding that the Fed cut rates sharply.

Since last December, the Fed has kept its benchmark lending rate in the range of 4.25%-4.5%. Policymakers continue to exercise caution, citing the uncertain impact of tariffs on inflation, and believe that the current economic conditions and slightly tighter policy stance provide time for further decision-making.

The Importance of Fed Independence

Although Powell did not specifically respond to the White House's call for lower interest rates, he did point out the importance of the Fed's independence.

"Members of the Federal Open Market Committee will make these decisions solely based on their assessment of the data and its impact on the economic outlook and risk balance. We will never deviate from this principle," he said.

This speech comes at a time when the White House is engaged in ongoing negotiations with its global trade partners, with the situation often changing rapidly and final outcomes difficult to predict. Recent indicators show that consumer prices are gradually rising, but wholesale costs are increasing even faster.

The Trump administration believes that tariffs will not lead to persistent inflation and therefore sees the need for rate cuts. Powell's stance in his speech was that a range of outcomes is possible, and a "reasonable baseline scenario" is that the impact of tariffs will be "temporary—a one-time change in the price level," which may not justify maintaining high interest rates. However, he stated that everything is still uncertain at this point.

Powell said, "It will take time for tariff increases to work their way through supply chains and distribution networks. In addition, the continued changes in tariff rates may prolong the adjustment process."

In addition to summarizing the current situation and potential outcomes, the speech also addressed the Fed's five-year review of its policy framework. Compared to the last review conducted by the Fed in 2020, there have been some significant changes.

At that time, during the COVID-19 pandemic, the Fed shifted to a "flexible average inflation targeting" regime, which essentially allowed inflation to run above the Fed's 2% target after being below it for a long period. As a result, if inflation rose slightly, signaling a more complete recovery in the labor market, policymakers could afford to be patient.

However, shortly after adopting this strategy, inflation began to climb, eventually reaching its highest level in 40 years, while policymakers mostly considered this rise to be "transitory" and did not see the need to raise rates. Powell pointed out the destructive impact of inflation and the lessons learned from it.

"It has proven that the idea of deliberately and moderately overshooting inflation is irrelevant. As I publicly acknowledged in 2021, the inflation that appeared a few months after we announced the 2020 consensus statement revision was neither intentional nor moderate," Powell said. "The past five years have painfully reminded us of the hardships caused by high inflation, especially for those least able to bear the higher cost of necessities."

Furthermore, in this review, the Fed reaffirmed its commitment to the 2% inflation target. This has drawn criticism from various parties, with some arguing that rates are too high and could lead to a depreciation of the dollar, while others believe the Fed needs to adopt more flexible policies.

Powell stated, "We believe that our commitment to this target is a key factor in helping keep long-term inflation expectations anchored."

Below is a summary of the key points from Fed Chairman Powell's speech at the Kansas City Fed Economic Symposium:

1. Powell left room for a rate cut at the Fed's September 16-17 meeting, stating: "The baseline outlook and the evolving risk balance may require us to adjust our policy stance."

2. The Fed Chairman also said, "The stability of the unemployment rate and other labor market indicators allows us to act cautiously when considering changes to our policy stance."

3. Regarding the labor market, Powell said that although it "appears balanced, this balance is peculiar, caused by a significant slowdown in both labor supply and demand. This anomaly suggests that downside risks to employment are rising."

4. Powell stated, "A reasonable baseline scenario" is that tariffs cause a "one-time" increase in the price level, but these effects will take time to be fully reflected in the economy.

5. Powell said, "In the short term, inflation risks are tilted to the upside, while employment risks are tilted to the downside—this is a challenging situation."

6. Powell stated that the Fed has adopted a new framework, removing the requirement for the central bank to pursue a long-term average 2% inflation rate and to make employment decisions based on the gap from its highest level.

Dear readers,please star "Carbon Chain Value", otherwise you may miss the latest updates. We hope that every piece of content we carefully create and curate can bring rational thinking and inspiration to our readers.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After 10 years of coming of age, Vitalik explores the value of Ethereum’s existence

In previous years, Vitalik focused on discussing technology, but this year he has shifted to exploring Ethereum’s “existential value,” reflecting that Ethereum is transitioning from an infrastructure-building phase to defining its influence on-chain.

Ethereum Consensus Layer Reconstruction Beam Chain: The Ultimate Path or a Technical Maze?

Is the 5-year implementation timeline for Beam Chain reasonable? What does the community think?

November 21 Key Market Information Gap, A Must-See! | Alpha Morning Report

1. Top News: Base Co-founder Jesse's jesse Token Released, Currently Valued at $14 Million 2. Token Unlock: $DMC, $ID

![[Bitpush Daily News Highlights] Goldman Sachs: Stock sell-off expected to reach $40 billion next week; Jefferies report: Tether's gold reserves reach 116 tons, making it one of the world's largest non-sovereign gold holders; TechCrunch: Prediction market Kalshi raises $1 billion, valuation reaches $11 billion](https://img.bgstatic.com/multiLang/image/social/266a4eb2f52d42906f0b432a905d6ba81763665562274.png)