Bitget Daily Digest (August 27)|Donald Trump Jr. Invests in Prediction Market Polymarket; Trump Media & Technology Group Buys $105M Worth of $CRO

远山洞见2025/08/27 03:23

By:远山洞见

Today’s Outlook

1、The U.S. EIA Crude Oil Inventory (week ending Aug. 22, 10,000 barrels) will be released today. Previous value: -6.014 million.

2、Solana initiates Alpenglow voting; if passed, Solana's finality time will drop to about 100–150 milliseconds, putting it on par with centralized systems like Visa.

3、Gryphon shareholders will vote on the merger with American Bitcoin, a mining company backed by the Trump family.

Macro & Hot Topics

1、U.S. Commerce Secretary: Plans to Publish GDP Data on Blockchain U.S. Commerce Secretary Howard Lutnick announced Tuesday that the department will start publishing economic data “on the blockchain.” The plan aims to use blockchain for GDP data distribution and will soon be expanded government-wide, according to Lutnick.

2、Google Cloud Launches L1 Blockchain GCUL, Now in Private Testnet GCUL, a new L1 blockchain by Google Cloud, is in private testnet phase. It uses Python-based smart contracts and strives to become a neutral, finance-focused infrastructure for on-chain commercial bank money, round-the-clock capital market infrastructure, payments, and agency settlement. The plan is to open it up to Google’s massive network in the future. Earlier this year, they also partnered with CME for a tokenized asset pilot program. More technical details are expected in coming months.

3、Donald Trump Jr.'s VC Fund Invests in Prediction Market Polymarket Prediction market platform Polymarket has secured multi-million dollar investment from 1789 Capital—a VC founded by Donald Trump Jr., who joined the firm last year. Polymarket was recently valued at over $1 billion by Founders Fund. Trump Jr. will also join Polymarket’s advisory board.

4、Trump Media Signs $155M Strategic Deal with Crypto.com Trump Media and Technology Group (TMTG) announced a strategic partnership and purchase deal with Crypto.com. TMTG will integrate Crypto.com’s wallet system for an upgraded in-app rewards program: users can exchange “gems” for Cronos ($CRO) tokens, use CRO to pay for subscriptions, or enjoy free/discounted Truth+ access by opening a Crypto.com account. Trump Media subscribed to $105M worth of CRO (about 685 million tokens), to be held and staked via Crypto.com. In return, Crypto.com invested $50M for TMTG common stock. Both positions are subject to lock-up periods.

Market Performance

1、

BTC and ETH rebounded in the short term. In the past 24 hours, $283M was liquidated in both long and short positions.

2、All three major U.S. stock indices turned green mid-session; Nvidia surged over 1% ahead of earnings; the China Concept Stock Index hit a five-month high; offshore RMB strengthened past 7.15, a one-month high; France’s stock index tumbled nearly 2% amid political turmoil.

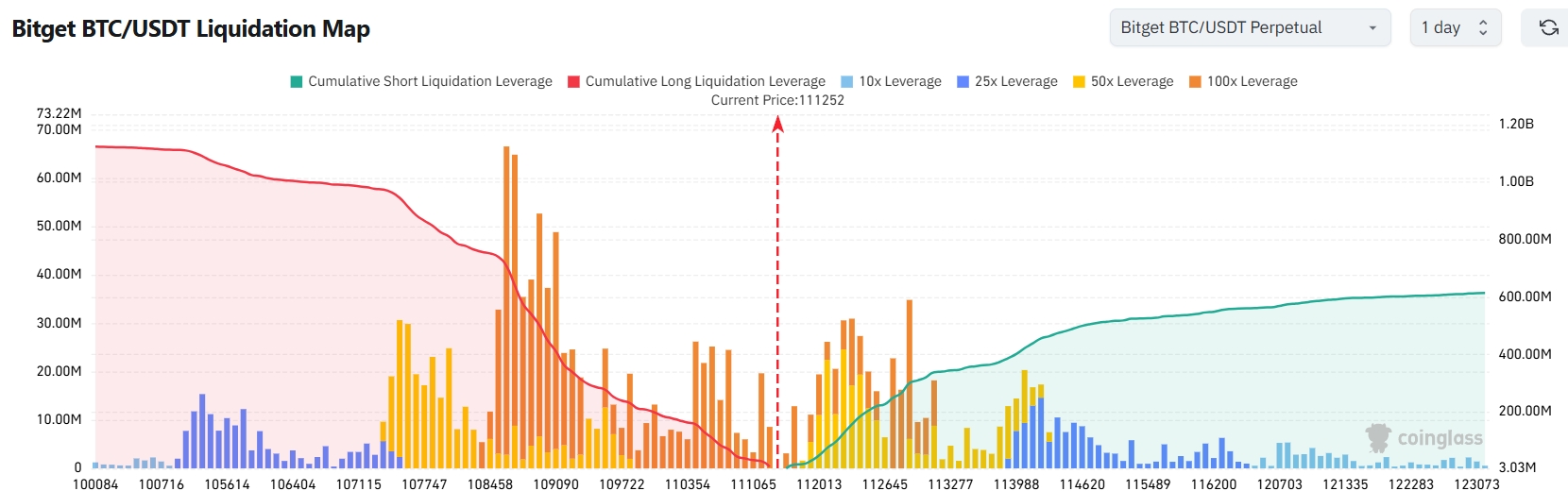

3、On Bitget’s BTC/USDT liquidation map, with BTC at $111,275 USDT:

-

If it drops 2,000 points to around $109,275, total long liquidations will exceed $339M.

-

If it rises 2,000 points to around $113,275, total short liquidations will surpass $345M. With short liquidation amounts much higher than longs, it’s advisable to manage leverage prudently to avoid mass liquidations during volatility.

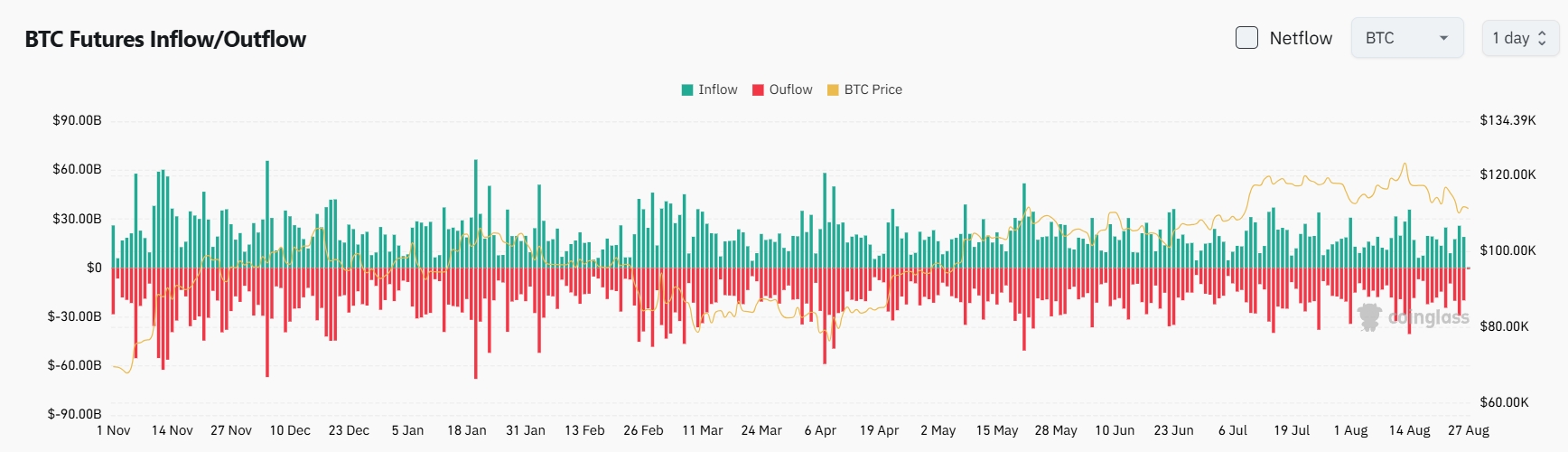

4、In the past 24 hours, BTC spot inflows were $2.5B and outflows $2.2B—net inflow of $300M.

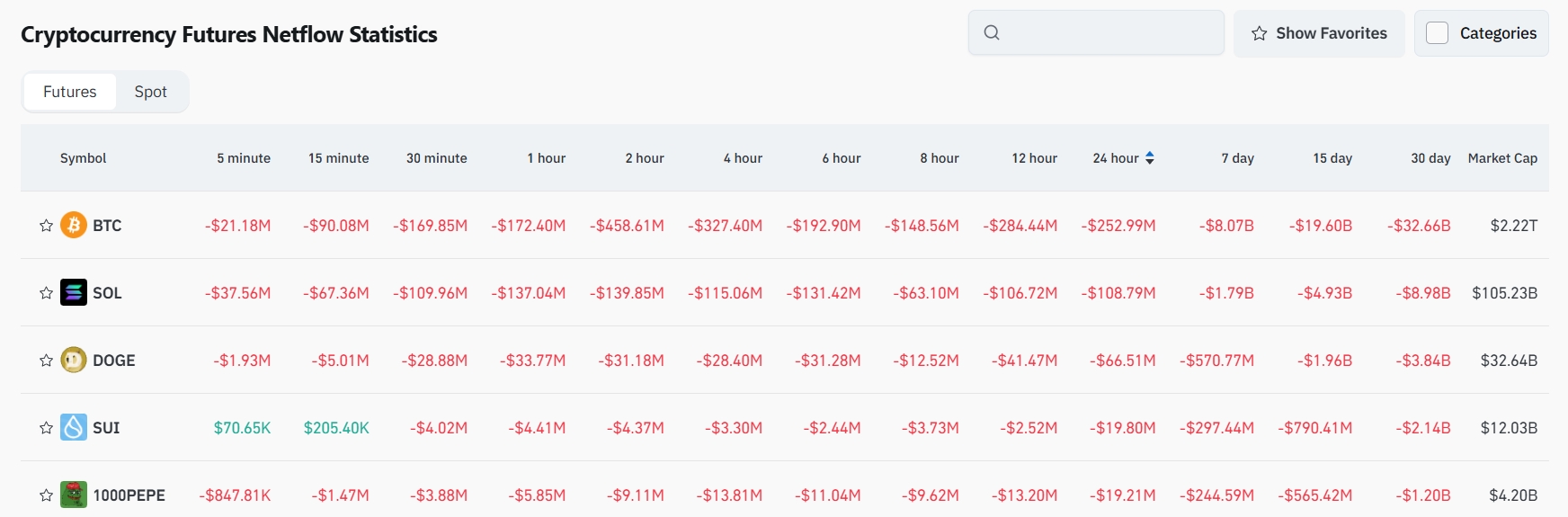

5、In the past 24 hours, contracts of $BTC, $SOL, $DOGE, $SUI, $PEPE, etc. saw leading net outflows, possibly signaling trading opportunities.

Institutional Insights

Standard Chartered: Current ETH and Treasury Company Valuations Are Undervalued; End-of-Year Target Price Remains $7,500 Original:

https://www.coindesk.com/markets/2025/08/26/ether-and-eth-treasury-companies-look-undervalued-after-plunge-standard-chartered

Matrixport: Bitcoin ETFs May See Five Straight Months of Net Outflows Due to Seasonal Headwinds Original:

https://x.com/Matrixport_CN/status/1960231234480828442

News Highlights

1、CFTC Commissioner Kristin Johnson announces resignation, leaving the commission with only one member.

2、A former Kuaishou executive was caught laundering $140M in Bitcoin—setting a new record in big tech corruption.

3、UAE holds about 6,300 Bitcoin, ranking fourth globally among national Bitcoin holders.

4、Trump threatens steep tariffs on countries imposing digital taxes.

Project Updates

1、Rex Shares has applied to launch an ETF backed by staked BNB.

2、Play Solana handheld gaming console PS-G1 will start shipping on October 6, featuring a built-in Solana wallet.

3、dYdX releases updated roadmap: new Telegram trading features and improved token utility.

4、MetaMask introduces social login, simplifying wallet creation and recovery.

5、Canary has filed an application (S-1) with the SEC for a TRUMP ETF.

6、Trump Media platform to integrate Crypto.com digital wallet and CRO token.

7、Orderly proposal: Up to 60% of net trading fees may be used for ORDER token buybacks.

8、Binance launches a keyless secure wallet browser extension.

9、Sky Protocol spent 1.4 million USDS last week to buy back 20.06 million SKY tokens.

10、U.S. SEC confirms receipt of Canary’s application for an INJ staking ETF.

X Trends

1、Honest Michael: The WLFΙ Game—Beyond Stablecoins, the Blueprint for Token-Equity Synergy

WLFΙ’s scope goes far beyond just a stablecoin. The short-term goal is to substitute FDUSD, leveraging the regulatory advantages from the U.S. Genius Act—making USD1 almost certain to gain compliance access, while USDT still faces risk. WLFΙ’s $20B valuation in the Alts acquisition was backed by deep-pocketed funds, so near-term liquidity pressure is minimal.

The key question: at a $24B valuation, the current price has likely priced in most expectations. For further upside, WLFΙ needs U.S. equity market liquidity—that’s the logic behind token-equity synergy. If airdrop sell pressure on September 1 can push the market cap down towards $10B–$15B (price range: $0.1–$0.15), that may offer a better long-term entry.

Potential: WLFΙ could scale up as a strategic national currency and benchmark against USDC—crucially depending on ongoing buybacks, market share, and integrating ecosystem projects. Both an opportunity and a risk.

2、Crypto_Painter: Long Liquidations Hit Record Highs; Spot Premium Becomes Short-Term Support Key

Before the U.S. market opens, BTC spot premium index pulled back slightly but remains positive, indicating ongoing spot dip-buying demand. Price didn’t hit the 108k target directly, but approached the zone. Of note: this drawdown’s long liquidation scale is the second highest of 2024, underscoring both the magnitude and rationality of the pullback.

Futures markets have “burned through” much of their fuel. If spot buying persists, stabilization is probable in the short-term, but the big picture still hinges on ongoing spot flows.

3、Phyrex: Fed Independence & BTC Support Test

U.S. stocks saw a modest rebound; market worries about a September rate cut eased temporarily. Yet, Trump’s firing of Cook is really aimed at putting pressure on the Fed, ensuring voting control for the FOMC meeting. BTC turnover rose as some short-term investors sold off, yet overall support remains strong—$110k now shows consensus for a bottom, with $108k as a key line of defense. Core logic remains: the market is driven by Trump-Fed dynamics.

4、AB Kuai.Dong: WebX Tokyo—Japan Flips the Script

Main message from this WebX Tokyo conference: Japan is making a dramatic policy shift toward crypto. The 55% miscellaneous high tax was confirmed to be cut to a unified 20% financial tax; corporate tax can be as low as 15%—basically, “so long as you pay taxes, you’re set.” Capital is flowing back, North American VCs, Tokyo Stock Exchange, CZ, and Arthur all showed up; more projects are landing in Japan. Attendance reached 12,000 (up almost 50% YoY), with over 90 side events—now, project teams are seeing Tokyo as a new launchpad. Even those who left due to regulation seven years ago are being welcomed back. Japan is going all out to become East Asia’s financial hub.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Crypto: Fundraising Explodes by +150% in One Year

Cointribune•2025/11/30 11:03

Bitcoin Drops $8B In Open Interest : Capitulation Phase ?

Cointribune•2025/11/30 11:03

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025

Coinpedia•2025/11/30 03:39

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$91,290.52

+0.77%

Ethereum

ETH

$3,010.16

+0.48%

Tether USDt

USDT

$1

-0.00%

XRP

XRP

$2.19

-0.67%

BNB

BNB

$880.87

+0.43%

Solana

SOL

$137.02

+0.03%

USDC

USDC

$1.0000

-0.02%

TRON

TRX

$0.2812

+0.03%

Dogecoin

DOGE

$0.1494

+0.07%

Cardano

ADA

$0.4191

+0.34%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now