Bankless co-founder Ryan's letter to his son: Don't put your money in banks, put it into crypto

Turn money into assets and put them into cryptocurrency.

Turn your money into assets and put them into cryptocurrency.

Written by: Ryan Adams, Bankless Co-founder

Translated by: Luffy, Foresight News

Editor's Note: This article is a letter from Bankless co-founder Ryan Adams to his son. In the letter, Ryan offers some wealth management advice, with the core idea being "Don't keep your money in the bank." He argues that banks are actually a triple "scam." Ryan's final alternative is to keep some dollars for daily expenses, and then put your wealth into a portfolio of assets that can store value over time, such as bitcoin, gold, and stocks. The full translation is as follows:

Dear Son,

Don't keep your money in the bank. Banks may seem safe, but in reality, they're a triple "scam."

Scam #1: They Steal Your Yield

At any time, the US dollar actually has a risk-free yield, which is Treasury bonds. To put it simply, Treasury bonds are "dollars dressed up as short-term government bonds," and they can give you a fixed yield of 4.2%.

No extra risk—it's basically free money, tailor-made for you.

But banks never give you this money in your savings account; they pocket it themselves. They don't tell you about this yield, nor do they help you convert your dollars into Treasury bonds. They even actively lobby the US government to prevent depositors from getting this yield.

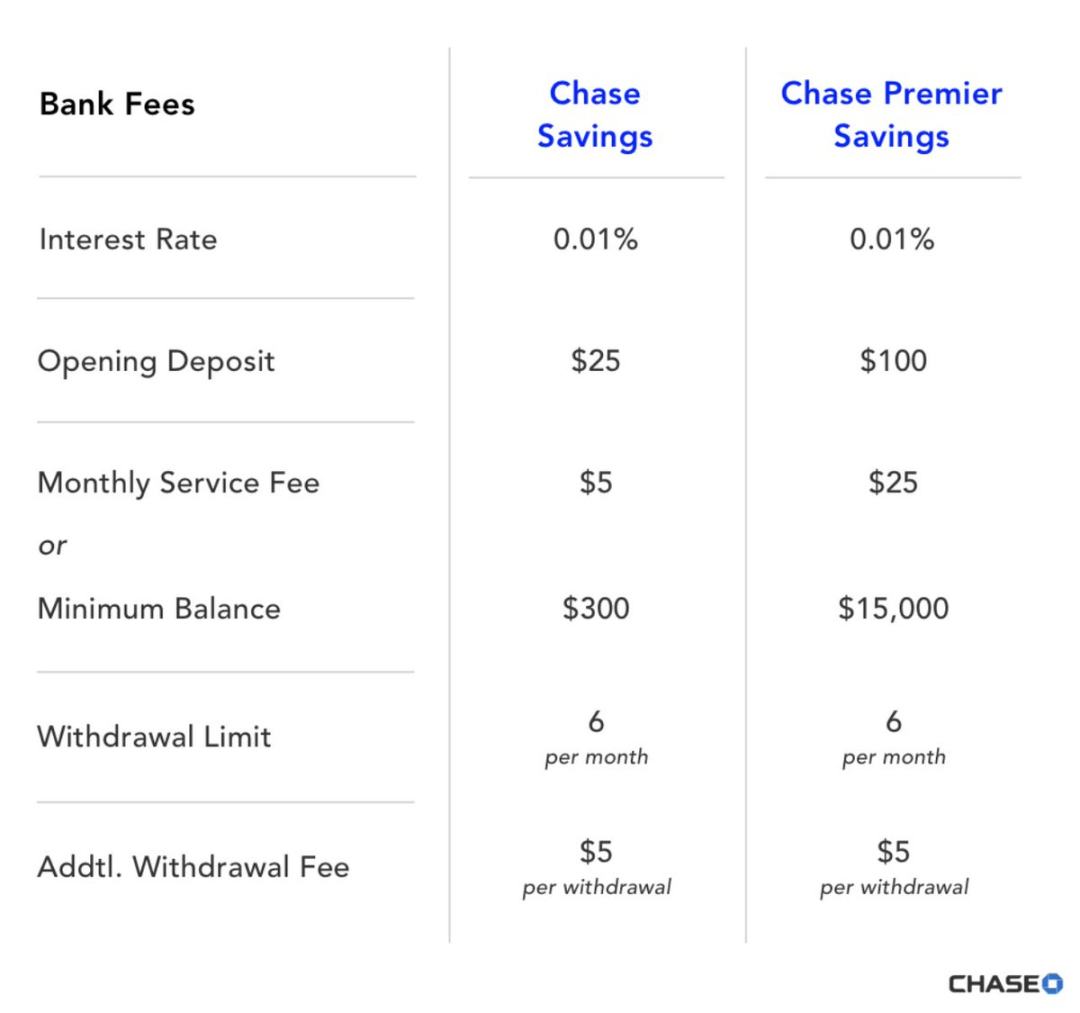

Banks take a 4.19% yield and only give you 0.01%

Wealthy people never put their money in banks; they put their cash into Treasury bonds, not savings accounts. But the middle class and those lacking financial knowledge have their yield stolen every day by the "friendly" bank next door, without even realizing it.

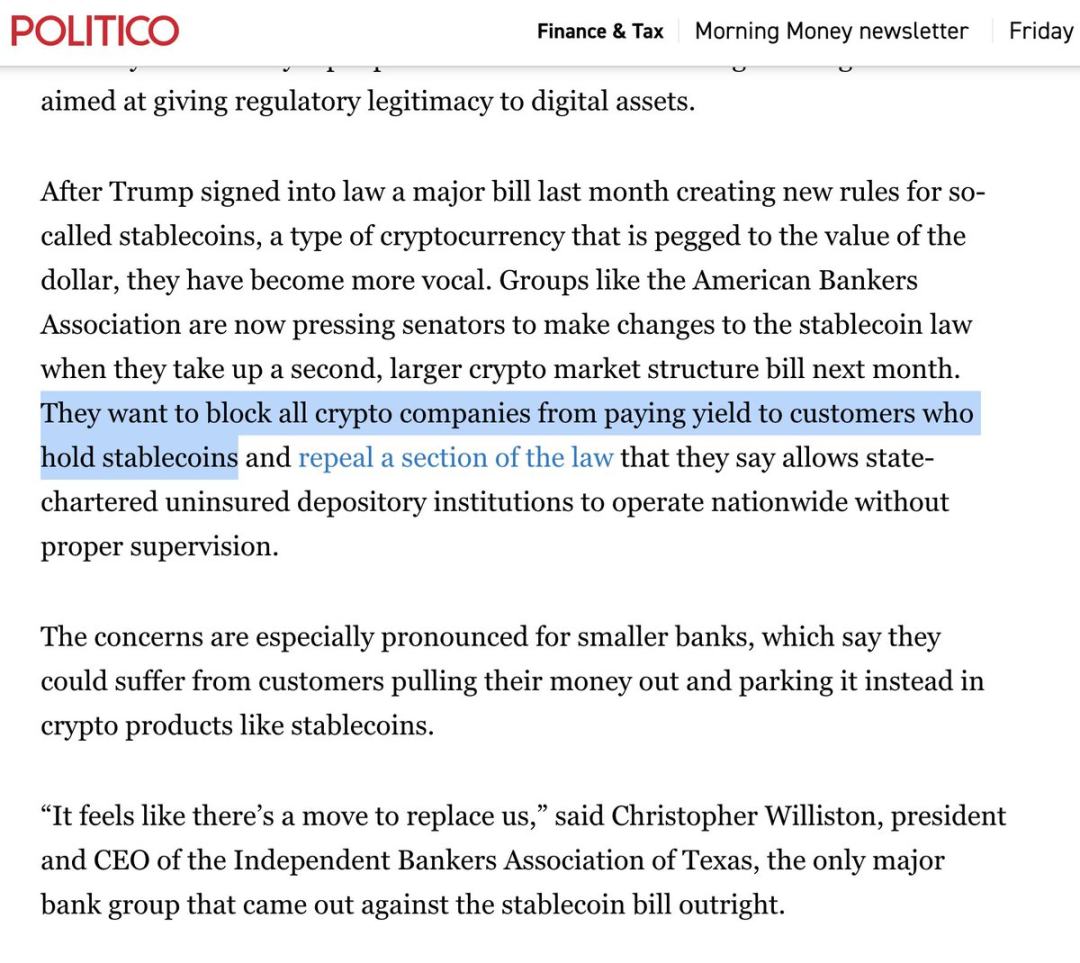

Bank lobbying groups even target the small yields from crypto stablecoins, not letting you touch them. They spread panic, claiming that if the "vampire" business of savings accounts disappears, the entire financial market will collapse!

Yields fluctuate, so you need to keep an eye on the statements from the Fed Chair. But as long as the yield is positive, put your dollars into short-term Treasuries and money markets, not bank accounts.

Scam #2: The So-Called Yield Isn't Real Yield

Now you should know the next secret: the yield is fake.

You think the 4.2% yield you get now can make up for your loss in purchasing power? Actually, that's just the "nominal yield." Because the purchasing power of the dollar shrinks every year—this is called inflation. Even in good times, inflation is expected; in bad times, it's even worse.

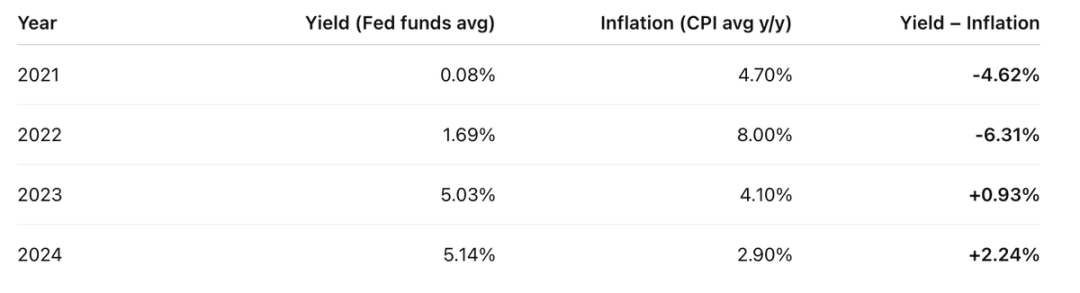

In the past four years, your actual yield looked like this:

Account yield minus annual CPI—the result is not great

So in the past four years, there were two years when you lost much more than you earned.

But the reality is even worse: the "fake yield" you get is still taxed as income.

Suppose your income tax rate is 20%. You have to pay 20% tax on that "fake yield" first. So your actual yield looks like this:

Before the inflation "tax," you already paid income tax—dollars are effectively double-taxed

Real yield = nominal yield - inflation.

They want you to think inflation is a natural force like gravity or a law of physics. It's not. It's a deliberate design of modern governments and central banking systems.

Inflation is just another tax, no different from any other tax, except it's hidden.

I know you don't mind paying your fair share of taxes. Public services are important, and you agree with the common good. But what about this hidden tax? It specifically targets middle-class savers trying to save for the future. Is that fair?

Learn from the wealthy: they avoid the "savings tax" by holding large amounts of assets instead of dollars. This brings us to the third and most insidious layer of the nested "scam."

Scam #3: Money Itself Isn't "Real"

Okay, maybe that's a bit exaggerated. The dollar does exist, but it's just a "temporary thing." It's suitable for short-term payments, not for storing wealth across time, and not for leaving to the future. It's a medium of exchange, not a store of value.

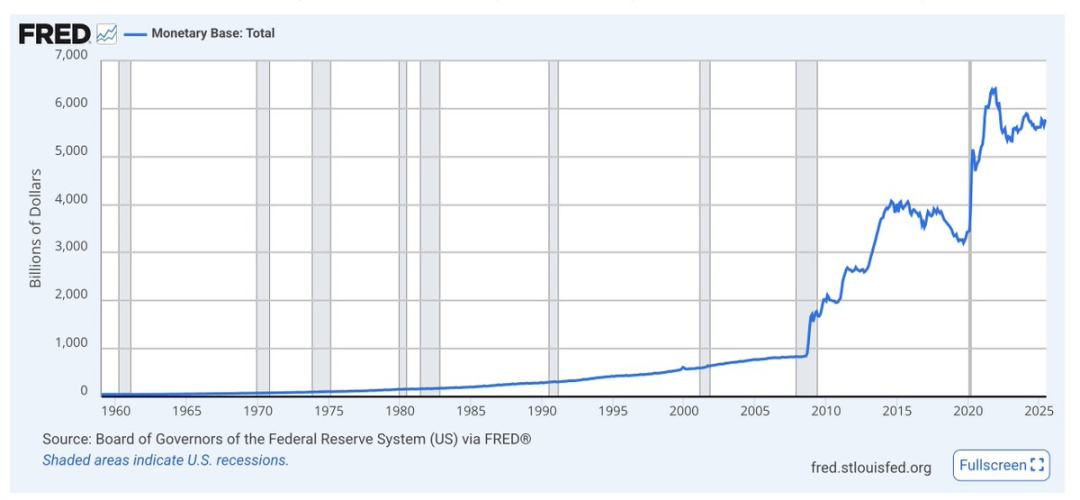

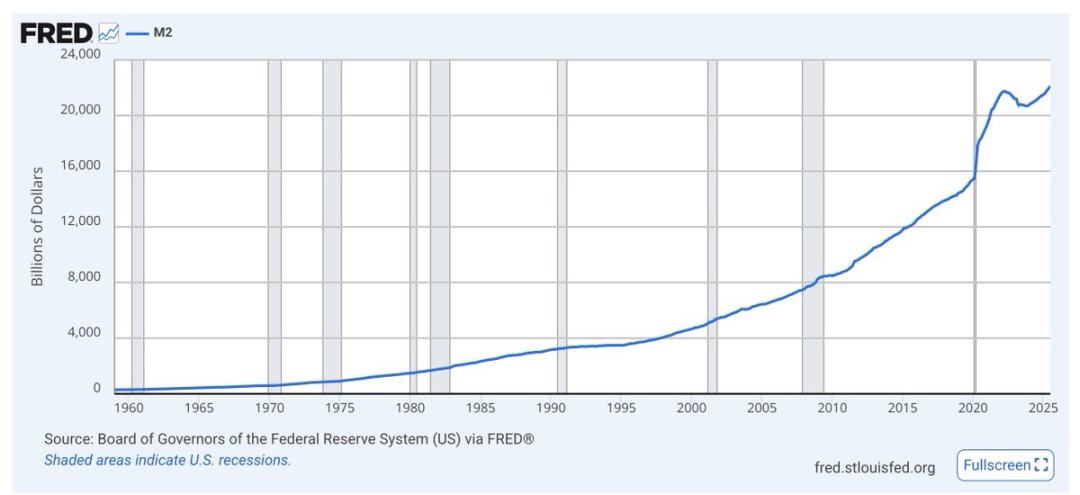

The base money supply, called M0, is cash and bank reserves. See how it spikes during crises—the overall trend is always upward

The dollar has no long-term scarcity constraint; its supply is always increasing. The proportion of dollars you hold in the total supply shrinks faster than your yield can make up for, because they keep printing money.

The issuance of dollars is almost never mentioned. Economists only focus on inflation and purchasing power, but in the long run, increasing the money supply devalues the dollar relative to assets. The more dollars they print, the less your money is worth.

M2 (M1 plus short-term savings) is the same—spikes during crises, with an overall skyrocketing trend

Don't get caught up in economists' debates—just look at the charts yourself. No matter who's in power, the government will use printing dollars as an economic and political "lubricant." That's what the dollar is for—it's not meant for saving.

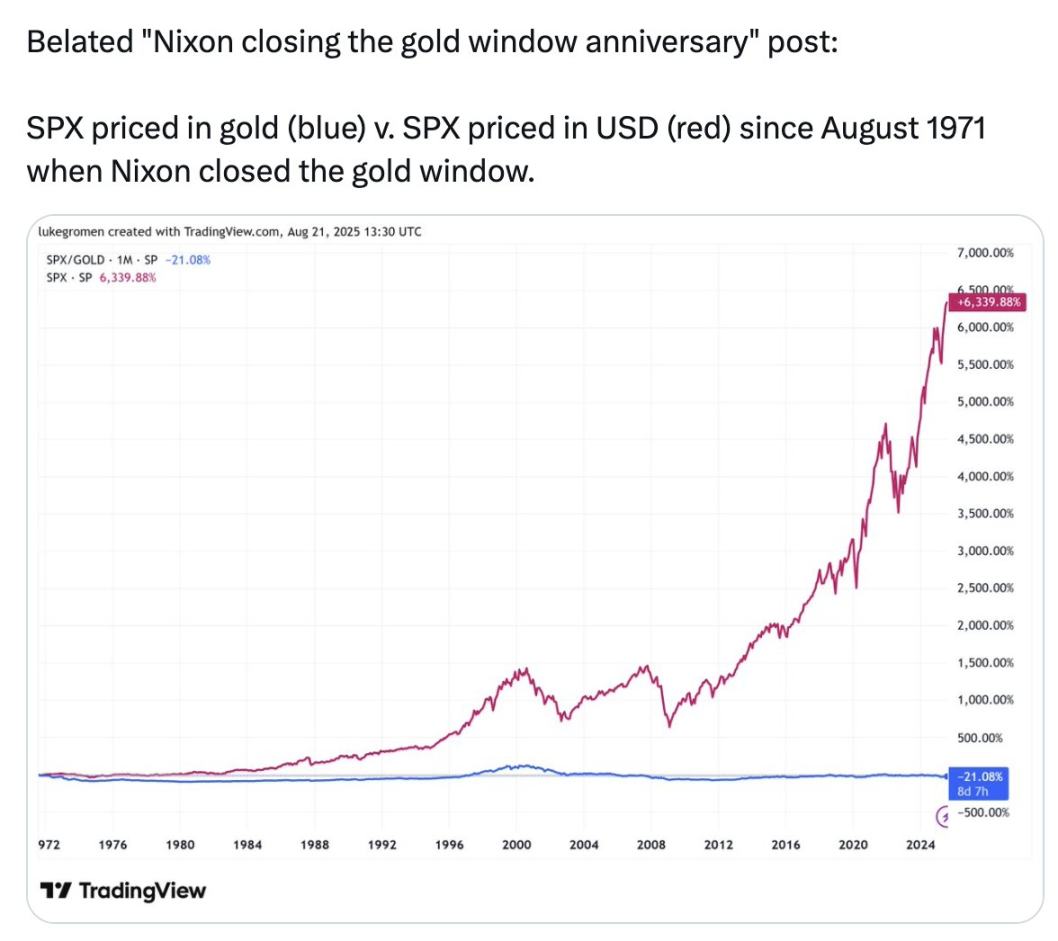

Look at the blue line in this chart:

The S&P 500, measured in dollars, has risen 6339% since 1971; but measured in gold, the S&P 500 has actually fallen 21%

In the past 54 years, storing wealth in gold has outperformed storing it in the 500 largest and best-performing US companies.

This chart isn't telling you to buy gold—it's to show you that what they call "money," the thing we use to measure everything, the dollars in your bank account, aren't really "money." They can't store value—they never could, and never will.

The "money" they talk about isn't a store of value. So this is the triple-layered "scam":

- Scam #1: Stealing your yield;

- Scam #2: The so-called yield isn't real yield;

- Scam #3: Money itself isn't "real."

So what should you do?

Keep some dollars for short-term needs, like daily expenses, taxes, and emergency funds. Earn yield in the form of Treasury bonds.

Put all your long-term wealth into a portfolio of assets that can store value across time: stocks and real estate are fine, but bitcoin, ethereum, and gold are also good. The latter three have scarce supply and won't be diluted by inflation. These assets seem risky because they're volatile, but volatility does not equal risk.

You can also put some medium-term wealth into Treasury bonds, and when long-term store-of-value assets drop in price, invest your cash into them. That's the trick to investing. As Buffett says, be greedy when others are fearful, and fearful when others are greedy. Don't rush—wait for big drops, and think in terms of years, even decades.

Try to use crypto tools and exchanges to manage these. Don't touch the bleeding-edge risks—this way, you can stay at the forefront while avoiding the pitfalls as crypto disrupts traditional finance.

School won't teach you this. But you have to learn, keep digging deeper, and protect your own future.

Don't keep your money in the bank. Turn your money into assets and put them into cryptocurrency.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A 6200-fold profit: Who is the biggest winner of Moore Threads?

On December 5, Moore Threads officially debuted on the STAR Market, opening at 650 yuan, a surge of 468.78% compared to its issue price of 114.28 yuan.

Bitcoin Faces Struggles as Market Volatility Intensifies

In Brief Bitcoin struggles under $90,000, affecting market dynamics. Altcoin market sees significant downturn and investor panic. Regulatory news in the U.S. impacts cryptocurrency trends.

Crypto: The PEPE memecoin site redirects to a malicious link

21Shares Launches First Leveraged Sui ETF in the U.S. as Network Activity Surges