Iran crypto flows fell 11% to $3.7 billion from January–July 2025 as the Nobitex $90M hack, a mass Tether freeze of 42 wallets, and heightened Iran–Israel hostilities sharply reduced stablecoin usage and on‑ramp liquidity.

-

Flows fell 11% to $3.7B (Jan–Jul 2025)

-

June–July saw the steepest decline after a $90M breach at Nobitex and a 42‑wallet USDT freeze.

-

Outflows spiked 150% in the worst week, redirecting volume to high‑risk foreign exchanges and Polygon DAI.

Meta description: Iran crypto flows fell 11% to July 2025 after Nobitex hack and Tether freeze — read TRM Labs findings and expert implications. Read now.

What caused Iran crypto flows to drop 11% in 2025?

Iran crypto flows dropped 11% year‑on‑year to $3.7 billion between January and July 2025, according to TRM Labs, driven by the June Nobitex $90 million hack, Tether’s July freezing of 42 wallets, and escalated Iran–Israel conflict that disrupted on‑ramps and liquidity.

How did the Nobitex hack affect Iran’s crypto market?

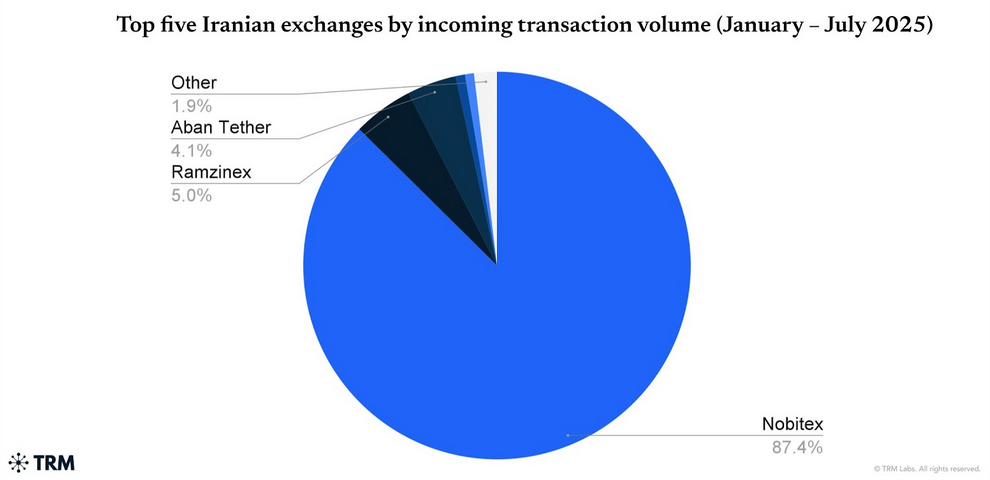

On June 18, pro‑Israel group Predatory Sparrow exploited Nobitex — the platform handling roughly 87% of Iran’s crypto volume — leading to a $90 million loss. The breach undermined trust in Iran‑based VASPs, slowed transaction processing and pushed users to riskier foreign exchanges with minimal KYC. TRM Labs reports liquidity fragmentation and delayed settlements after the incident.

Share of crypto transaction volume among Iranian VASPs between January and July. Source: TRM Labs

Why did Tether’s blacklist slow flows?

Tether carried out its largest freeze of Iranian‑linked USDT addresses on July 2, blacklisting 42 wallets. This prompted a coordinated move by exchanges and influencers to shift TRON‑USDT balances — Iran’s most used stablecoin — into DAI on Polygon, temporarily reducing liquidity on the TRON network and driving conversion and withdrawal bottlenecks.

How are sanctions and conflict changing crypto use in Iran?

Heightened Iran–Israel tensions and repeated power outages, attributed to both kinetic and cyber operations and state shutdowns, coincided with the flow decline. Iranians continue to use stablecoins to preserve value amid inflation and to facilitate sanctioned procurement of electronic components and other sensitive goods, per TRM Labs.

What volume moved to high‑risk exchanges and alternative stablecoins?

TRM Labs observed outflows surge more than 150% in the worst week, with a large portion routed to exchanges that perform limited Know‑Your‑Customer checks. Many users converted TRON‑USDT to Polygon DAI to avoid freezes, creating temporary spikes in DAI activity on Polygon networks.

Frequently Asked Questions

How large were Iran’s crypto flows between January and July 2025?

TRM Labs reports Iran’s cumulative crypto flows were approximately $3.7 billion from January through July 2025, an 11% decline from the same period in 2024.

Are illicit transactions a major portion of Iran’s crypto volume?

No. TRM Labs indicates illicit transactions remain under 1% of total Iranian crypto volume, while most activity reflects value preservation and sanctioned procurement channels.

Key Takeaways

- 11% decline: Iran crypto flows fell to $3.7B (Jan–Jul 2025), per TRM Labs.

- Primary drivers: Nobitex $90M hack, Tether freezing 42 wallets, and Iran–Israel conflict disruptions.

- Market response: Surge to high‑risk exchanges and a migration from TRON USDT to Polygon DAI reduced TRON liquidity.

Conclusion

Iran crypto flows have been materially affected by security breaches, compliance actions and geopolitical escalation. TRM Labs data shows an 11% contraction through July 2025, driven by the Nobitex hack and Tether blacklisting, with spillovers into liquidity, stablecoin preference and exposure to high‑risk venues. Market participants should prioritize custody diversification and on‑chain monitoring as the environment evolves. COINOTAG will continue tracking developments and official analytics updates.