Google Cloud Unveils GCUL, L1 Blockchain for Institutional Finance

- Google Cloud launches GCUL, a permissioned blockchain for institutional finance.

- GCUL supports Python smart contracts and promises stable monthly transaction fees.

- The system aims to transform settlement, payments, and tokenization by 2026.

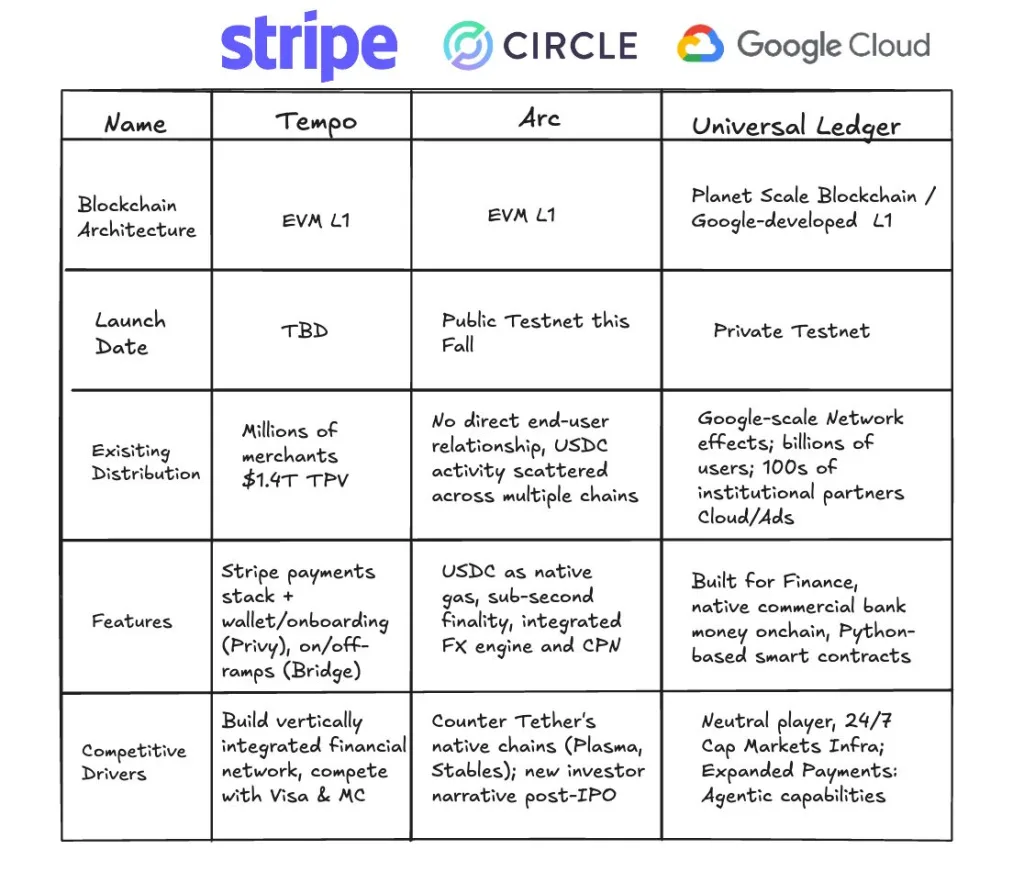

Global tech giants are moving beyond cloud dominance to reshape the foundations of finance. Google Cloud is now developing the Google Cloud Universal Ledger (GCUL), a new Layer 1 blockchain network currently in its private testnet phase. The system is not built for retail speculation. Instead, it is designed for banks, exchanges, and large institutions that want speed, compliance, and reliability in financial transactions.

A Closed-Loop Blockchain for Enterprise Finance

Google Cloud first revealed GCUL in March alongside CME Group. The project aims to handle tokenization and wholesale payments. Early testing has already begun, with new market services targeted for launch in 2026. CME described the first phase as a step toward cheaper, 24/7 settlement for collateral, margin, and fees.

Unlike Ethereum or Solana, GCUL is not open to public use. It is a permissioned network. The system is structured to fit within regulatory frameworks. It features built-in compliance tools like KYC-verified accounts and predictable monthly invoicing for transaction fees.

Google designed GCUL to run Python-based smart contracts. This makes it easier for enterprises already using Python in existing systems. By avoiding Solidity, the platform reduces barriers for banks and traditional finance developers.

The service also offers simplicity. Institutions access the network through one API. This removes the need to build and maintain blockchain infrastructure. It also promises stable and transparent costs, unlike unpredictable crypto gas fees.

Scalability is another focus. GCUL is built to support high-volume financial use cases. From payments to digital asset issuance, the platform is intended to process transactions across global institutions.

Source:

Rich Widmann

Source:

Rich Widmann

Implications for Open Blockchains

Stablecoins already show that demand exists for digital, always-on financial systems. But their growth has also revealed problems. Fragmentation, regulatory uncertainty, and volatile fees remain major issues. GCUL presents itself as a direct solution to these weaknesses.

By offering settlement with traditional assets and commercial bank money, GCUL avoids the volatility of crypto markets. Institutions could complete atomic transactions with multiple currencies at any time of day. Cross-border payments become faster, cheaper, and less dependent on the existing banking rails.

For banks and trading platforms, this model offers reduced reconciliation costs, fewer errors, and simplified compliance. It also cuts fraud risk. That means firms can focus resources on innovation while still maintaining control over client relationships.

However, the project also raises a key question. When big tech starts to come up with private financial ledgers, will open blockchains still reside at the center of world finance? Ethereum, Solana, and other chains are dependent on network effects from liquidity, decentralized governance, and public participation. But GCUL bypasses these features to deliver closed, regulator-approved rails.

Related: Google Becomes Largest TeraWulf Shareholder at 14%

Google’s move represents more than just a new blockchain. It is a bid to extend cloud dominance into core financial infrastructure. If successful, the GCUL would place Google in the same line with banks, exchanges, and governments as a new standard-setter of digital settlement.

The long-term effect may be a divide in Web3 adoption. Institutions could migrate to private, tech-led systems like GCUL. Meanwhile, retail users and decentralized projects will likely continue to make use of Ethereum and other public blockchains.

Google Cloud’s launch shows that institutional Web3 adoption may not follow the public blockchain path. Instead, closed-loop systems may take center stage. The outcome could redefine how banks, markets, and enterprises connect to distributed ledgers in the coming years.

The post Google Cloud Unveils GCUL, L1 Blockchain for Institutional Finance appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025

QNT Price Breaks Falling Wedge: Can the Bullish Structure Push Toward $150?

Digital dollar hoards gold, Tether's vault is astonishing!

The Crypto Bloodbath Stalls: Is a Bottom In?