Attracting Over 2 Million Users in One Year: Reviewing Element Market’s NFT Expansion Path

In the past year, Element, which claims to be the largest L2 marketplace, has attracted over 2 million new users—a rare feat in the NFT market sector. This article explores what Element has done right to gain the favor of so many users.

Recently, the market has been almost flooded by Meme topics, and NFTs seem to have been forgotten in a corner.

In comparison, the gambling-like surge in Meme hotspots makes it easier to create liquidity and market opportunities, while for NFTs, almost all blue-chip assets have been halved or even nearly wiped out, surviving precariously in the asset allocations of a small number of active players.

Against this backdrop, most NFT marketplaces have faced significant challenges in user growth.

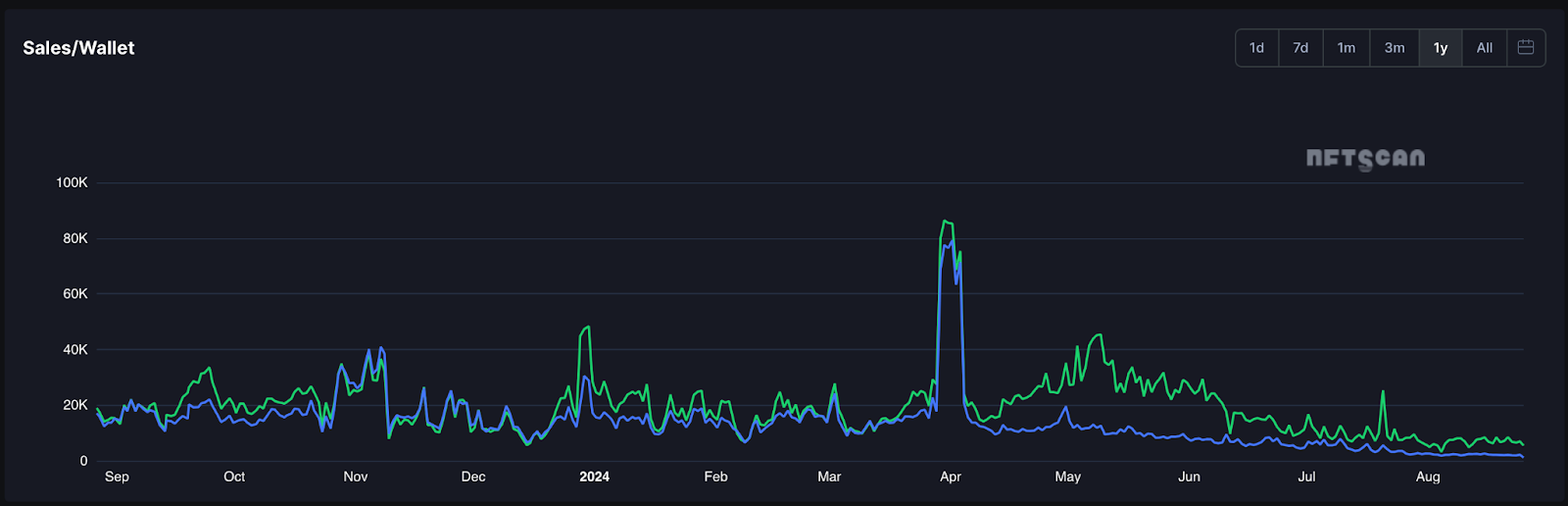

However, according to data from NFTScan, over the past year, Element has achieved an average of over 20,000 trading wallets per day among the 13 public chains tracked by NFTScan, with the total number of trading wallets reaching 2 million.The actual number may be much higher, as Element currently supports 22 public chains. So what exactly has enabled Element to buck the trend and attract over 2 million new users in just one year?

Data source:

The Rise of Ethereum Layer 2: The Key Driver of Element's Growth

The emergence of Ethereum Layer 2 (L2) solutions has driven significant growth for Element. As gas fees on the Ethereum mainnet have soared, L2 networks such as Arbitrum, Optimism, and zkSync have provided users with a more cost-effective way to interact with decentralized applications (dApps). Element quickly integrated these L2 networks, offering lower transaction fees and faster trading experiences, attracting a large number of new users.

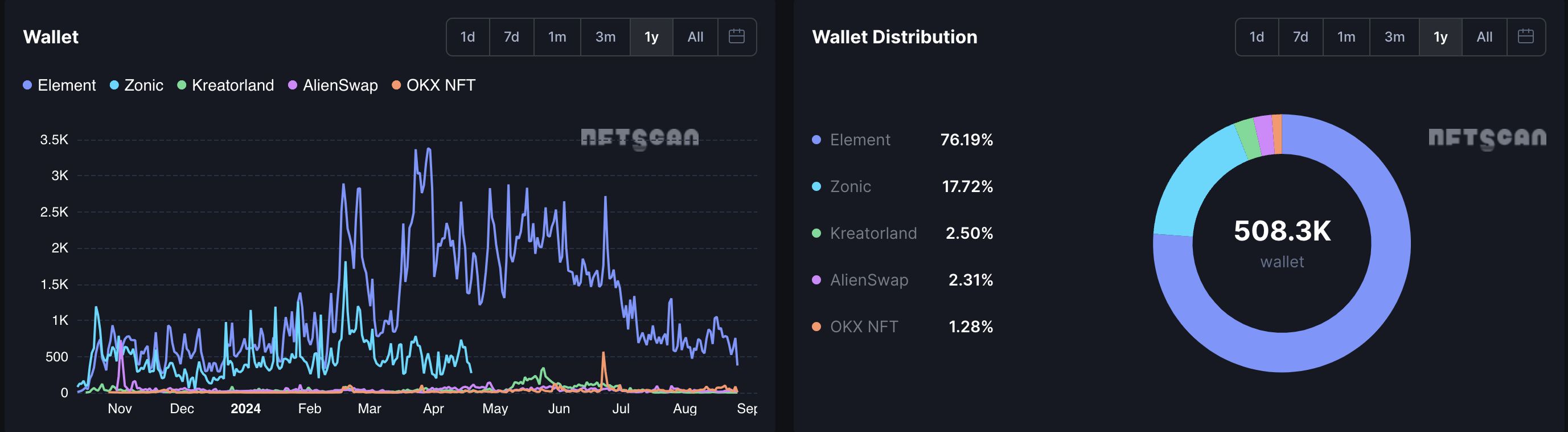

For example, Element is currently the largest NFT trading marketplace on L2 public chains such as Linea, Mantle, Scroll, opBNB, Starknet, and zkSync, with an average market share of over 50% on each chain.As shown in the figure below, taking the Scroll public chain as an example, Element occupies 76.19% of its total trading wallet address share, reaching 387,000 user addresses.

Data source:

Element's rapid support for L2 public chains has made it the preferred platform for users to trade NFTs across multiple networks, in line with the growing trend of multi-chain interoperability. At the same time, in the NFT sector, Element's multi-chain layout also provides users with more convenient trading options.

NFTs Are Becoming Core Assets for Most dApps

Another key factor driving Element's success is its refined support for various types of NFT assets, as NFTs are increasingly becoming mainstream assets for various dApps.

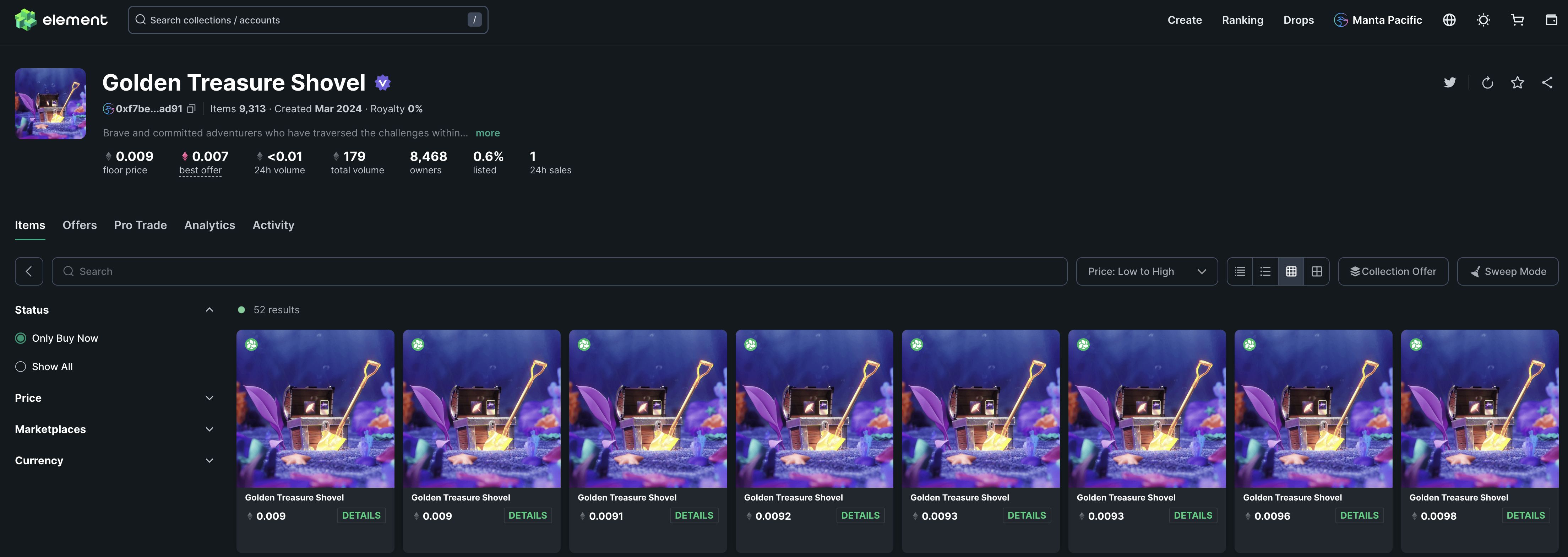

An obvious trend is that more and more dApps are choosing to issue NFTs as the foundational asset for community building, rather than traditional tokens. For example, L2 network Manta Chain, NFT cross-chain bridge Polyhedra, and blockchain game Matr1x have all launched NFTs as their first community asset. These NFTs are not only collectibles but also serve as cultural symbols and tools for airdrop interactions. By enhancing the trading smoothness and convenience for these large NFT collections, Element has attracted a large number of users, with its trading volume accounting for over 80% of the entire secondary market.

Data source:

As early as 2022, Element demonstrated its deep understanding and active participation in functional NFTs through its collaboration with the BNB chain domain name collection "Space ID." By supporting personalized attribute configurations, Element made it easier for users to access and trade these functional NFTs. This emphasis on diverse NFTs is also a key step for Element to maintain its footing. Especially for users who want to participate in emerging blockchain ecosystems through NFTs, Element provides an indispensable platform.

Continuous On-Chain Activities

NFTs are playing an increasingly important role in the blockchain ecosystem. They are not only digital collectibles but also symbols of cultural identity, Meme value, and community interaction. Traders' attention to popular on-chain NFT collections continues to increase, viewing them as windows for exploring new trends and opportunities.

Over the past year, Element has collaborated with more than a dozen dApps, organizing multiple on-chain NFT interactive events and attracting participation from over one million users.These activities have not only fueled enthusiasm for on-chain NFT interactions but have also gradually transformed Element from an NFT trading marketplace into an on-chain interactive community. Taking the "Hi, Starks" Starknet on-chain event as an example, it was jointly planned and launched by "Element, LayerSwap, Briq, and Starknet ID," with a total participation of over 600,000 people.

Source:

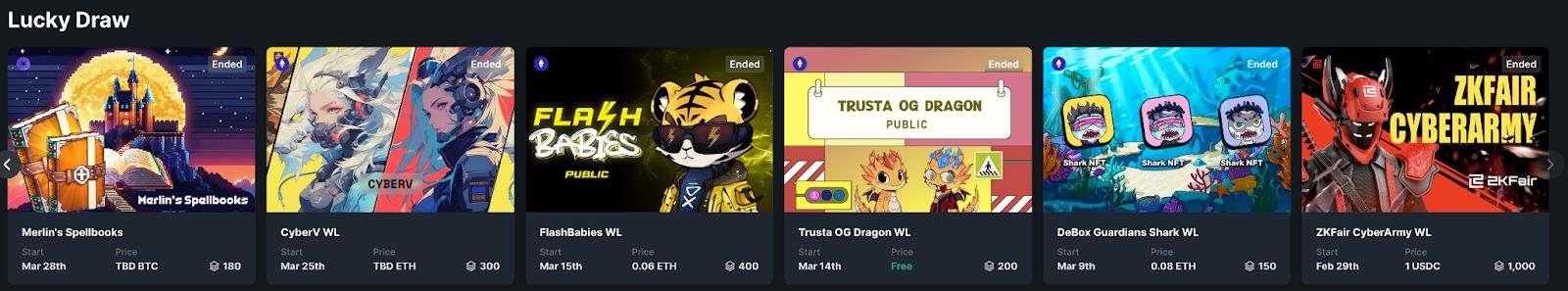

In addition, Element has recently launched a lucky draw section, offering more than 20 whitelist, NFT, and token lottery events, with the highest return rate reaching 179 times.

In summary,Element's rapid growth over the past year stems from its quick response to L2 public chains, deep understanding of user needs, and comprehensive service for diverse NFT asset types. This is particularly valuable and wise in the harsh NFT market landscape.

Can Element's Continued Growth Be Sustained?

In the context of widespread challenges in the NFT market, Element has demonstrated remarkable growth potential by quickly adapting to market conditions and actively embracing user needs.

It is worth noting that Element has recently launched two important features: "NFT Drops" and "NFT as a Service," providing creators with one-click collection issuance and tool-based services for quickly establishing NFT marketplaces. These features reduce the development burden for creators, allowing them to focus more on creation.

With the emergence of these features, it is evident that Element is transitioning from a "C-end application-oriented marketplace" to a "C-end + B-end infrastructure service provider."However, whether Element can continue this growth momentum by extending its product functionality remains to be seen. Let's wait and see.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What major moves have mainstream Perp DEXs been making recently?

Perp DEXs are all unveiling major new features.

After a 1460% surge, re-examining the value foundation of ZEC

History has repeatedly shown that extremely short payback periods (super high ROI) are often precursors to mining disasters and sharp declines in coin prices.

Tom Lee reveals: The crash was caused by the 1011 liquidity crunch, with market makers selling off to fill a "financial black hole"

Lee stated directly: Market makers are essentially like the central banks of crypto. When their balance sheets are damaged, liquidity tightens and the market becomes fragile.

Boxing champion Andrew Tate's "Going to Zero": How did he lose $720,000 on Hyperliquid?

Andrew Tate hardly engages in risk management and tends to re-enter losing trades with higher leverage.