Solana News Today: Ether Surpasses All-Time High as Institutional Demand Reshapes Crypto Landscape

- Ether (ETH) hits $4,945.60, surpassing its 2021 all-time high, driven by institutional adoption and bullish sentiment. - Solana (SOL) surges past $200 amid whale accumulation, ETF filings, and growing institutional interest in staking tokens. - Ethereum's supply constraints and Solana's on-chain activity position both as key players in crypto's institutionalization. - Technical indicators suggest Solana could target $250, while Ethereum's 6.7% gain highlights altcoin diversification trends.

Ether, the native token of the Ethereum blockchain, has surpassed its previous all-time high, reaching $4,945.60 on August 24, 2025, according to CoinGecko data. This marks a significant milestone for the second-largest cryptocurrency by market capitalization, as it outperforms its November 2021 record of $4,878. Institutional adoption and increased bullish sentiment have played a pivotal role in this recent surge, with digital asset treasury companies and exchange-traded funds (ETFs) contributing to heightened demand. Ether’s price trajectory has also been influenced by corporate activity, as several firms have followed the lead of Michael Saylor’s company, which has aggressively accumulated Bitcoin since 2020. Companies such as SharpLink Gaming , BitMine Immersion Technologies, and EthZilla have shown particular interest in ether , signaling a shift in institutional investment strategy toward Ethereum-based assets.

The growing institutional interest in ether is supported by Ethereum’s unique economic model, which tends to generate neutral or even negative net issuance of new coins. This dynamic helps constrain supply while demand remains robust, creating a favorable environment for long-term price appreciation. James Butterfill, head of research at CoinShares, emphasized that Ethereum has emerged as a preferred platform for large stablecoin transactions, a role that could expand following the proposed GENIUS Act. Ethereum, launched in 2015 by Vitalik Buterin and collaborators, was designed as a fully programmable blockchain with smart contract functionality. These self-executing contracts enable a wide range of decentralized applications, from financial services to gaming, positioning Ethereum as a foundational infrastructure for the digital economy.

While Ether’s performance has drawn considerable attention, Solana (SOL) has also captured the spotlight with its rapid price recovery and strong institutional backing. In recent weeks, Solana’s price has climbed past $200, with intraday highs approaching $208, supported by a market capitalization of $112.5 billion. This surge has been fueled by whale accumulation, with large investors entering the $190–$200 price range and setting a firm demand floor. On-chain activity also shows a significant increase in protocol buybacks, with Solana-based projects contributing 40% of all crypto buybacks, up from 11% in June. This shift reflects growing confidence in the network’s fundamentals and its potential for broader adoption.

Technical indicators further support the optimism around Solana. The $210 level has emerged as a key resistance point, forming a triple-top pattern that typically signals market exhaustion. However, the presence of an ascending trendline and strong momentum metrics, such as a relative strength index (RSI) of 67 and a bullish MACD, indicate that the upward trend could continue. Traders are closely watching for a breakout above $210, which could open the door to $218 and eventually $250. A failure to maintain above $200, however, could expose the token to a pullback toward $176, highlighting the volatility inherent in this market. Futures open interest has also increased, signaling that leveraged positions are becoming more prevalent among traders.

Institutional developments are further bolstering Solana’s outlook. VanEck’s filing for a U.S. ETF backed by JitoSOL staking tokens represents a significant step toward regulated exposure for institutional investors. This, combined with growing interest from global financial institutions—including the European Central Bank’s exploration of Solana for a digital euro—positions the network as a serious contender in the blockchain space. Unlike speculative altcoins, Solana’s growth is underpinned by tangible on-chain activity, including protocol revenue, cross-chain integrations, and real-world use cases in finance and infrastructure. With a circulating supply of 540 million tokens, the market remains sensitive to large capital inflows, providing both liquidity and volatility.

The broader cryptocurrency landscape remains dynamic, with Solana outperforming both Ethereum and Bitcoin in recent weeks. While Ethereum has gained 6.7% and Bitcoin has seen a 4.2% decline, Solana has surged 8.1%. This divergence underscores the increasing diversification within the altcoin space and highlights Solana’s role as a key player in the next phase of blockchain adoption. Analysts remain cautiously optimistic about the long-term potential of both Ethereum and Solana, with some projecting that Solana could reach $250 or even $1,000 under favorable macroeconomic conditions. However, these forecasts depend on continued institutional support and the ability of the network to maintain stability in the face of past technical challenges.

Source:

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Faces Intensifying Sell-Off as ETF Outflows and Leverage Unwinds Pressure Markets

Solana ETF Hit 18-Day Inflow Streak

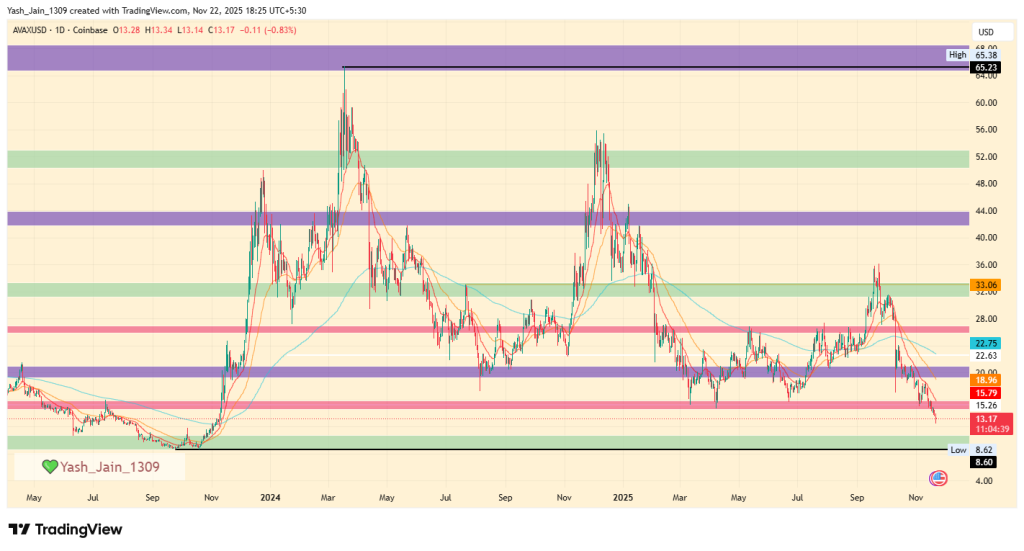

Avalanche Price Prediction 2025, 2026 – 2030: Will AVAX Price Hit $100?

PEPE Price Prediction 2025, 2026 – 2030: Can Pepe Memecoin Reach 1 Cent?