Institutional Flows Test XLM's $0.38 Floor: Will Bulls Hold?

- Stellar (XLM) tested $0.38 support with 115% above-average volume, confirming key floor before rebounding to $0.389. - Institutional flows drove 4% intraday volatility as ETF interest boosted XLM's 24-hour turnover to $402M amid crypto regulatory optimism. - Analysts highlight $0.33 as critical support for bullish case, while bearish indicators like CMF (-0.10) suggest mixed short-term outlook. - Long-term prospects tied to Stellar Anchors expansion and cross-border transaction initiatives amid sustained

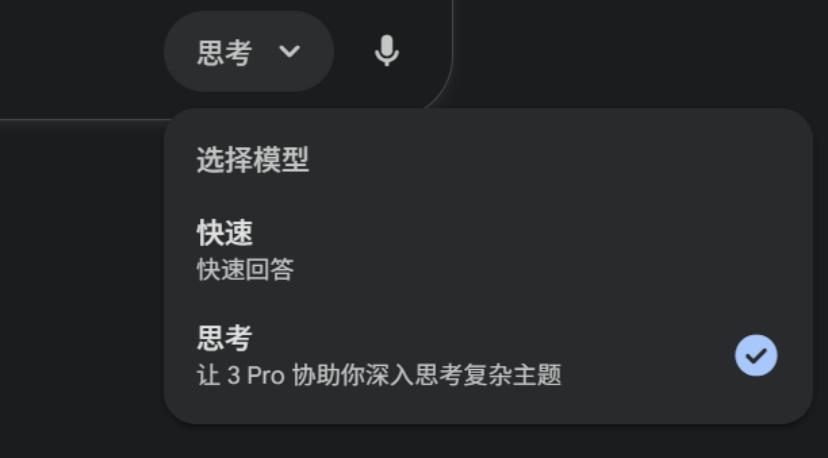

Stellar's (XLM) native token faced heightened volatility in recent trading sessions as it tested key support and resistance levels. On August 25, XLM dropped from $0.398 to $0.380 in just over an hour, with 95.27 million tokens traded at the support level—115% above the average daily volume. This confirmed $0.380 as a critical floor for bulls, who witnessed a modest rebound to $0.389 by the end of the session. Simultaneously, $0.393 emerged as a formidable resistance zone after 46.16 million tokens were exchanged at that level, reinforcing its significance in the price structure.

The movement was partly driven by broader institutional sentiment in the crypto space, with a U.S.-based ETF filing spotlighting homegrown digital assets like XLM. This development has drawn increased corporate and institutional interest, contributing to surging trading volumes. Over the past 24 hours, daily turnover for XLM reached $402.21 million, with trading activity intensifying as the market anticipated potential regulatory approvals for cryptocurrency ETFs.

Analysts remain divided on the token’s future trajectory. A technical breakdown of XLM’s chart suggests that the price is currently in a consolidation phase, having formed an inverse Head 'n' Shoulders pattern. This pattern implies a potential dip before a breakout to $1, with $0.33 serving as a critical support level. Analysts like Ali Martinez highlight that as long as the price remains above $0.33, the bullish case remains intact. Meanwhile, institutional selling pressure remains a risk, particularly if the token fails to maintain its position above $0.38, potentially leading to further downward momentum.

Institutional flows have also played a pivotal role in shaping the token’s near-term dynamics. On August 27, XLM traded in a 4% range between $0.38 and $0.40, with elevated volumes exceeding 45 million tokens exchanged. The 115% surge in daily turnover underscored the growing influence of institutional participants, who continue to shape technical levels despite intraday volatility. This period also saw a 1% rebound from $0.38 to $0.39 in under an hour, indicating that institutional flows may still provide a floor for the token.

Market indicators, however, suggest a mixed outlook. The Chaikin Money Flow (CMF) index dipped below zero at -0.10, and other metrics like the Bull Bear Power (BBP) index and the Parabolic SAR indicated bearish dominance. These signals contrast with the optimism fueled by recent developments in the broader crypto market, particularly as Ethereum ETFs gain traction. While XLM trails behind in terms of trading volume—collecting $320 million on Tuesday—compared to lower-ranked altcoins like HBAR and DOT, it remains a key contender in the race to be included in new ETF products.

Looking ahead, the success of XLM’s price recovery will depend on its ability to reclaim momentum above $0.50. This level represents a critical resistance that, if broken, could unlock substantial upside potential. Traders and analysts are closely monitoring the token’s behavior around this threshold, with the potential for an ETF listing further amplifying interest in Stellar . The broader crypto landscape, particularly Bitcoin’s recent dip below $109.5K, also poses a headwind for XLM, as it has dragged down many altcoins by 10% in monthly terms.

Stellar’s long-term prospects remain tied to its expanding ecosystem and strategic partnerships. Recent updates, such as the launch of Stellar Anchors, aim to bridge traditional banking systems with blockchain-based currencies. These initiatives underscore the project’s commitment to facilitating cross-border transactions and improving financial inclusion. With continued adoption and ecosystem growth, XLM could benefit from sustained institutional interest, even amid short-term volatility.

Source:

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Even Altman gave it a thumbs up: What makes Google Gemini 3 Pro so powerful?

After 8 months of pretending to be asleep, Google suddenly dropped a bombshell with Gemini 3 Pro.

Research Report|In-Depth Analysis and Market Cap of GAIB AI (GAIB)

Debt Leverage Amid the AI Frenzy—The Fuse for the Next Financial Crisis?

If the prospects of AI falter, the financial system may face a "2008 crisis-style" shock.

Bitcoin Surrenders Early as Market Awaits Nvidia’s Earnings Report Tomorrow

Behind the simultaneous sharp decline in the US stock and cryptocurrency markets, investors' fears of an "AI bubble" and the uncertainty surrounding the Federal Reserve's monetary policy are creating a double blow.