Taxes eat up more than half of the profits? 3 legal profit-preserving strategies for crypto whales

Wealthy investors almost never sell cryptocurrencies directly; instead, they use methods such as collateralized lending, immigration strategies, and offshore entities to protect their profits.

Wealthy investors almost never sell their cryptocurrencies directly; instead, they protect their profits through collateralized loans, immigration strategies, and offshore entities.

Written by: JetStart

Translated by: Chopper, Foresight News

If you sell your cryptocurrency the wrong way, you could end up paying more than half of your gains in taxes. Imagine earning $200,000 and having to hand over $110,000 directly to the IRS. Here’s how wealthy investors legally keep their profits.

Big money comes with big headaches. Banks will scrutinize every transaction, and tax authorities will keep a close eye on your every move. Even buying a car or a house can turn into a nightmare. Without advance planning, your gains could disappear quickly.

Strategy 1: Borrow Instead of Selling

Use your bitcoin or ethereum as collateral to borrow cash or stablecoins. This way, you can unlock liquidity without touching your holdings.

For example: With $1,000,000 in bitcoin, at a 30% collateralization rate, you can borrow $300,000. You get to keep your tokens and access funds tax-free.

This method works for a simple reason: loans are not considered income.

When you borrow money, the IRS does not treat it as a taxable event. Your crypto remains under your control and does not trigger capital gains tax.

Major players borrow conservatively by using low collateralization rates.

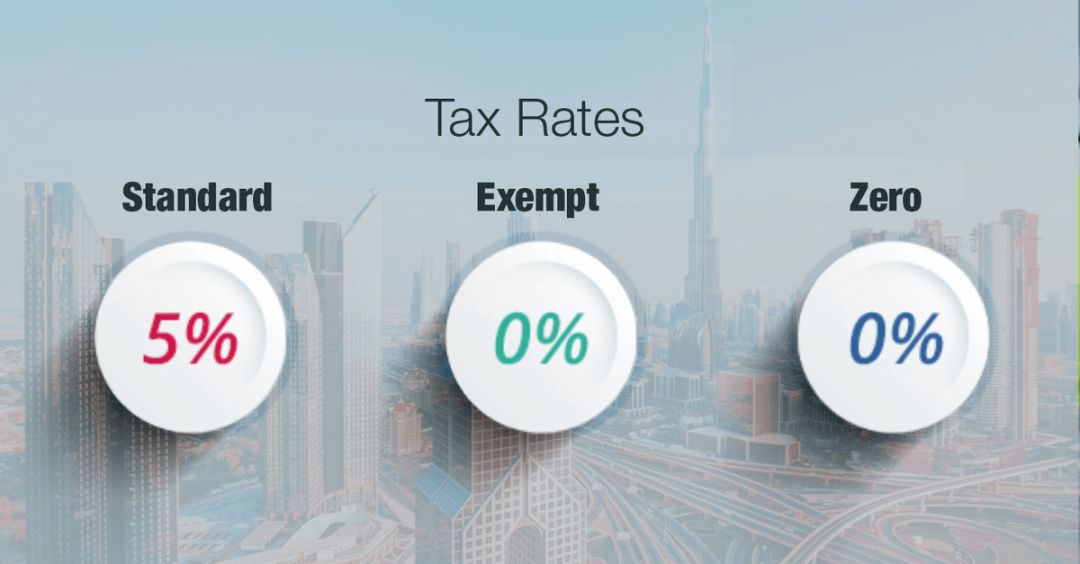

Strategy 2: Relocate Before Selling

Different countries have different tax rules for crypto gains. Moving to these places before cashing out could save you millions in taxes.

Popular choices include Puerto Rico (0% tax rate under Act 60) and the UAE (no tax on income or capital gains).

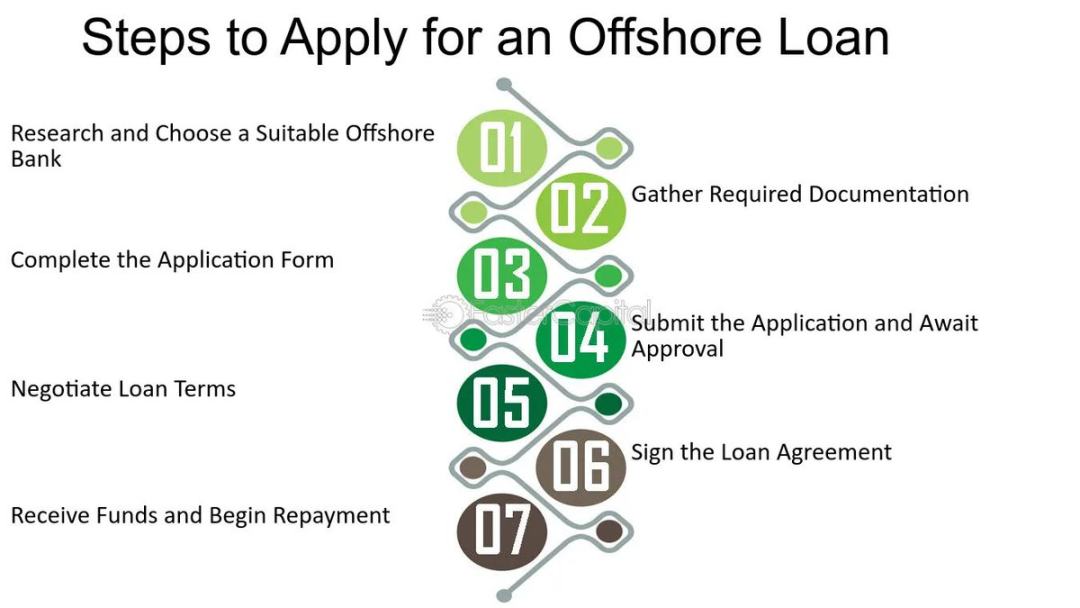

Strategy 3: Use Offshore Entities

Set up a company in tax havens like the Cayman Islands, British Virgin Islands, or Seychelles. Let the company, not you personally, hold the crypto. When the company sells crypto, it doesn’t trigger your personal capital gains tax. As long as the structure is set up properly, this method is completely legal.

You don’t have to withdraw profits yourself; your offshore company can lend you the funds. Loans are not considered income, so there’s no tax liability. You can use these funds to buy real estate, pay salaries, or invest.

This approach brings a series of benefits for crypto whales:

- Personal wallets remain private and are harder to trace.

- Bank statements show loan repayments, not taxable income.

- On-chain activity avoids direct traces of crypto sales.

- If the structure is set up correctly, taxes can be minimized or even eliminated legally.

Conclusion

Wealthy investors almost never sell their crypto directly. They protect their profits through collateralized loans, immigration strategies, and offshore entities. Today, understanding these rules is more important than ever.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Faces Intensifying Sell-Off as ETF Outflows and Leverage Unwinds Pressure Markets

Solana ETF Hit 18-Day Inflow Streak

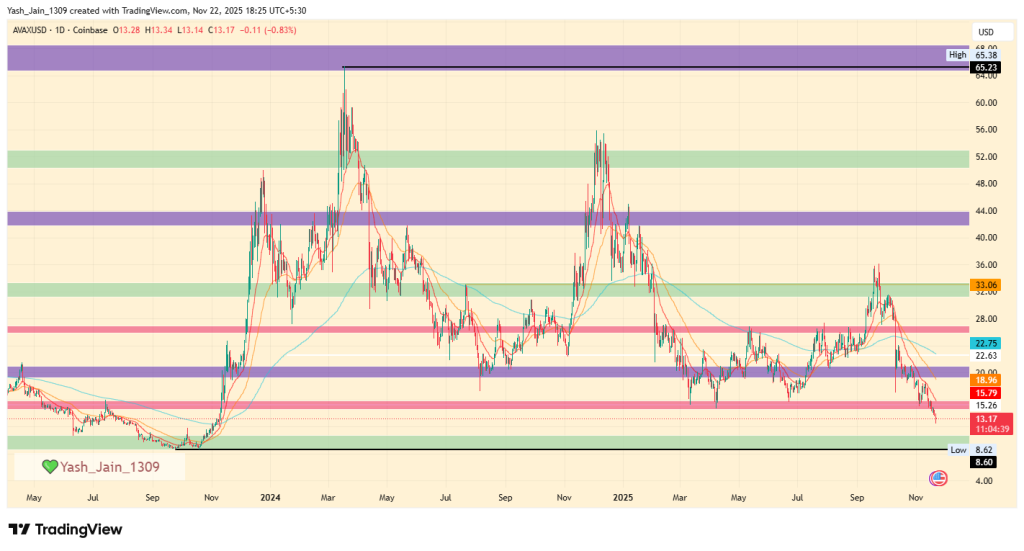

Avalanche Price Prediction 2025, 2026 – 2030: Will AVAX Price Hit $100?

PEPE Price Prediction 2025, 2026 – 2030: Can Pepe Memecoin Reach 1 Cent?