Tokenizing Real-World Assets (RWAs): The $10 Trillion Bridge Between Traditional Finance and Crypto

- RWA tokenization has grown to $26B, projected to reach $10T by 2030 through regulatory clarity and institutional infrastructure. - U.S. SEC exemptions, EU MiCA, and Asia's CRS 2.0/VARA frameworks enable compliant tokenized bonds, treasuries, and cross-border operations. - Platforms like Lightspark (LRC-20) and Centrifuge (multichain V3) scale institutional-grade tokenization, with $7.2B+ in managed assets. - Investors should prioritize compliance-first custodians (Zoniqx), multichain protocols (Libertum)

The financial system is undergoing a quiet revolution. Over the past two years, the tokenization of real-world assets (RWAs) has transitioned from a speculative experiment to a $26 billion market, with projections suggesting it could reach $10 trillion by 2030. This transformation is driven not by hype, but by a confluence of regulatory clarity, institutional-grade infrastructure, and the relentless pursuit of efficiency in asset management. For investors, the question is no longer whether RWAs will matter, but how to position for the inevitable inflection point .

Regulatory Readiness: The Bedrock of Institutional Adoption

The maturation of RWA tokenization hinges on regulatory frameworks that balance innovation with investor protection. In the United States, the SEC's proposed exemption for DLT-based securities and the passage of the GENIUS Act have created a legal pathway for tokenized bonds, treasuries, and private credit. These measures address a critical bottleneck: the lack of clear rules for on-chain settlement. Similarly, Singapore's adoption of CRS 2.0 and Dubai's VARA guidelines have positioned Asia as a global hub for compliant tokenization, while the EU's MiCA framework harmonizes cross-border operations.

The result is a flywheel effect: as regulators reduce ambiguity, institutional players—banks, asset managers, and insurers—gain confidence to tokenize assets at scale. For example, the U.S. Federal Reserve's recent approval of blockchain-based custody services has enabled banks to offer tokenized asset solutions, accelerating the integration of RWAs into public financial infrastructure. This regulatory readiness is not merely a backdrop; it is the catalyst for a $10 trillion market.

Infrastructure Development: Scaling the Bridge

The technical infrastructure underpinning RWA tokenization has evolved rapidly. Ethereum remains the dominant blockchain, hosting 55% of tokenized value, but layer-2 solutions like Arbitrum and Polygon have expanded its capacity. However, the true innovation lies in platforms like Lightspark and Centrifuge, which are building the rails for institutional-grade tokenization.

Lightspark, for instance, has pioneered the LRC-20 protocol to enable programmable value transfer on Bitcoin , overcoming its native limitations. By integrating compliance-first AML/KYC protocols, Lightspark has attracted regulated financial institutions seeking to tokenize treasuries and commodities. Meanwhile, Centrifuge's multichain V3 platform—spanning Ethereum, Arbitrum, and Avalanche—abstracts the complexity of cross-chain operations, allowing asset managers to deploy tokenized products like AAA-rated CLOs and SP 500 index funds with institutional-grade security.

These infrastructure providers are not just facilitating transactions; they are redefining liquidity. By 2025, Centrifuge's TVL has surged to $1.2 billion, while Lightspark supports over $6 billion in tokenized assets. Their success underscores a critical insight: the future of finance will be built on platforms that combine blockchain's efficiency with traditional finance's rigor.

Actionable Investment Opportunities: The RWA Flywheel

For investors, the next frontier lies in RWA-focused DeFi protocols and asset tokenization platforms that align with regulatory and institutional trends. Three categories stand out:

Compliance-First Custody Platforms:

Platforms like Zoniqx are embedding AML/KYC and tax reporting directly into smart contracts, ensuring real-time compliance. Zoniqx's tokenization of $500 million in U.S. Treasuries and real estate by 2025 highlights its scalability. As tokenized treasuries are projected to reach $4.2 billion this year, Zoniqx's modular architecture (compatible with XRPL and Hedera) positions it to capture a significant share of the market.Multichain Asset Tokenization Protocols:

Libertum and Centrifuge are leading the charge in reducing securitization costs by up to 97% through automation. Libertum's dual-ecosystem model—supporting both ERC-3643 security tokens and ERC-721 unique assets—enables institutions to tokenize private credit and real estate while maintaining liquidity via DeFi integrations. Centrifuge's deRWA initiative, which aims to bring tokenized assets to major exchanges and wallets, further amplifies its growth potential.Interoperability and Yield Platforms:

Protocols like Aave and MakerDAO are integrating tokenized RWAs into their lending and stablecoin systems. For example, Aave's Horizon project allows non-crypto assets to be used as collateral for DAI, enhancing DeFi's stability. Investors should monitor platforms that bridge RWAs with DeFi, as they will unlock liquidity for a $10 trillion market.

The Road to $10 Trillion: A Strategic Outlook

The RWA tokenization market is not a speculative bubble but a structural shift. By 2030, the ability to tokenize real estate, private credit, and commodities will democratize access to assets previously reserved for institutional players. For investors, the key is to focus on platforms that:

- Prioritize compliance (e.g., Zoniqx, Libertum).

- Enable multichain scalability (e.g., Centrifuge, Lightspark).

- Bridge RWAs with DeFi (e.g., Aave , MakerDAO).

The $10 trillion inflection point will be driven by three forces: regulatory alignment, infrastructure scalability, and the demand for yield in a low-interest-rate world. As traditional finance increasingly adopts blockchain, the winners will be those who build the bridges—not just the tokens.

In conclusion, the tokenization of real-world assets is not a passing trend but a foundational shift in how value is represented and transferred. For investors with a long-term horizon, the time to act is now—before the bridge to $10 trillion becomes a superhighway.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Faces Intensifying Sell-Off as ETF Outflows and Leverage Unwinds Pressure Markets

Solana ETF Hit 18-Day Inflow Streak

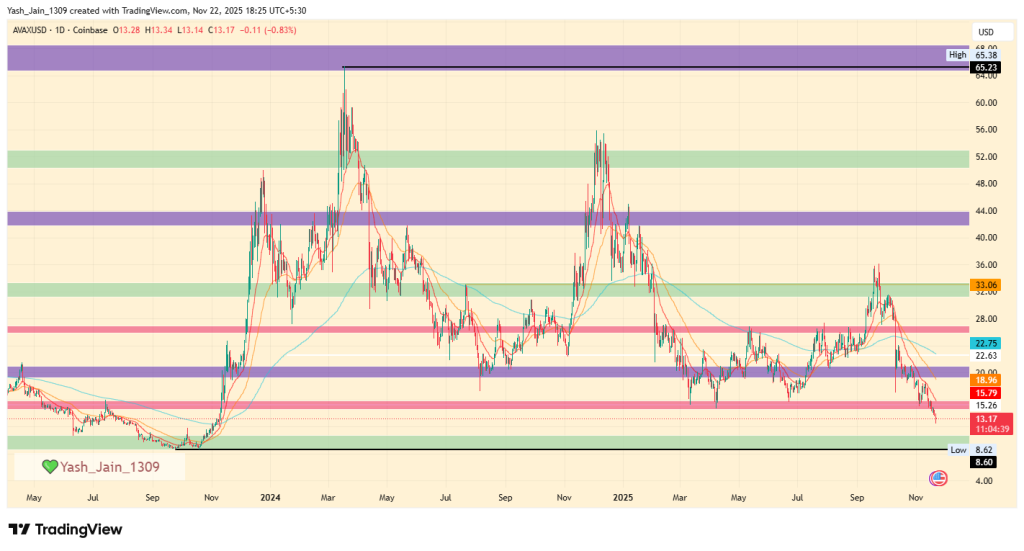

Avalanche Price Prediction 2025, 2026 – 2030: Will AVAX Price Hit $100?

PEPE Price Prediction 2025, 2026 – 2030: Can Pepe Memecoin Reach 1 Cent?