Geopolitical Risk Premiums in Crude Oil: Uncovering Mispriced Opportunities in Turbulent Regions

- 2025 global oil markets face paradoxes: high U.S. shale output vs. underpriced geopolitical risks in unstable oil-producing regions. - Nigeria and Libya's chronic instability limits production despite vast reserves, creating systemic supply constraints ignored by futures pricing. - Investors can exploit mispriced risks via hedging, infrastructure diversification, and "resolution plays" in politically fragile African oil markets. - Long-term opportunities emerge from Nigeria's $10B offshore projects and L

The global crude oil market in 2025 is a theater of paradoxes. While headlines trumpet record U.S. shale output and the rise of petrochemical demand, a quieter but equally potent force is reshaping risk premiums: underappreciated political instability in key oil-producing regions. From the Niger Delta to the Gulf of Guinea, and from Libya's fractured coast to Sudan's fragile pipeline networks, instability is creating mispriced opportunities for investors who can parse the noise of geopolitical chaos.

The Mispricing of Uncertainty

Geopolitical risk premiums—the extra return investors demand for exposure to volatile regions—are often misunderstood. In 2025, the June 13–19 Israel-Iran conflict caused Brent crude to spike from $69 to $79 per barrel in just seven days. Yet by June 23, a ceasefire and U.S. military intervention had calmed markets, sending prices back to $68. This volatility underscores a critical insight: markets frequently overreact to short-term shocks while underestimating the long-term drag of chronic instability.

Consider Nigeria, Africa's largest oil producer. Despite holding 37 billion barrels of proven reserves, pipeline vandalism and oil theft have capped output at 1.5 million barrels per day (bpd), far below its 2.5 million bpd potential. Similarly, Libya's political fragmentation has kept its 6.6 million bpd capacity constrained for years. These bottlenecks are not just operational—they are systemic, creating a persistent drag on global supply that is rarely priced into futures contracts.

The "Unseen" Risks: Where Markets Fail

Calibrated economic models suggest that a 20-percentage-point increase in geopolitical risk (e.g., a 1-in-5 chance of a production disaster) would reduce global output by just 0.12%. Yet this misses the nonlinear reality of oil markets. For example, the 1980 Iran-Iraq War had minimal price impact, while the 1990 Iraqi invasion of Kuwait triggered a 150% price surge. Such inconsistencies reveal a flaw in how investors assess risk: they conflate potential disruptions with actual outcomes.

In 2025, this disconnect is most evident in African oil markets. Sudan's recent pipeline resumption has drawn investor attention, but its political fragility—marked by a 30% chance of renewed civil conflict—remains underpriced. Similarly, Algeria's OPEC membership and 4.28 million bpd production target are contingent on resolving its economic crisis, yet its oil stocks trade at a 20% discount to peers.

Strategic Opportunities for Investors

For investors, the key lies in identifying where political instability is underpriced versus overpriced. Here are three actionable strategies:

- Hedge Against Underappreciated Risks

- Use geopolitical risk indices (e.g., the EIU Geopolitical Risk Index) to identify undervalued volatility in regions like Nigeria or Libya.

Allocate to energy infrastructure in stable regions (e.g., Brazil's offshore projects) to offset exposure to volatile basins.

Target "Resolution Plays"

- Invest in companies poised to benefit from political normalization. For example, if a Sudanese ceasefire holds, its 1.2 million bpd production could rebound, boosting shares of firms like Sudan Energy Corp.

Monitor African Energy Week 2025 for policy announcements that could unlock $50 billion in stalled upstream projects.

Leverage Derivatives for Asymmetric Gains

- Buy out-of-the-money put options on Brent crude during periods of geopolitical calm. If instability erupts (e.g., a new Gulf crisis), these options could yield 200%+ returns.

- Short overhyped "safe haven" assets (e.g., U.S. shale ETFs) during periods of exaggerated geopolitical optimism.

The Long Game: Beyond Short-Term Volatility

While tactical trades in oil derivatives can capitalize on immediate shocks, the long-term mispricing of geopolitical risk lies in infrastructure and policy. For instance, Nigeria's planned $10 billion offshore project (expected to add 500,000 bpd by 2027) is discounted at 30% due to security concerns. Yet if the government successfully deploys private security forces—a $200 million annual cost—this project could deliver 25% IRR, outperforming U.S. shale.

Similarly, Libya's 2025 political stabilization could unlock $15 billion in foreign investment, with production rising from 1.2 million to 2.5 million bpd. Investors who position early—via local partnerships or ESG-focused funds—stand to capture outsized returns as markets reprice these "solved" risks.

Conclusion: Navigating the Fog of Geopolitics

The 2025 oil market is a mosaic of contradictions: abundant supply, constrained demand, and a geopolitical undercurrent that defies easy modeling. For strategic investors, the challenge is not to predict every conflict but to identify where markets are systematically underestimating the cost of instability. By combining granular risk analysis with agile portfolio construction, investors can transform geopolitical uncertainty into a source of alpha.

As the IEA warns, energy security is no longer a binary issue—it's a spectrum of risks and opportunities. Those who master this spectrum will find themselves at the vanguard of a market where mispricing is the rule, not the exception.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 Crypto Prediction Review: 10 Institutions, Who Got It Wrong and Who Became Legends?

We can consider these predictions as indicators of industry sentiment. If you use them as an investment guide, the results could be disastrous.

SEC launches innovative exemption policy—Has U.S. crypto regulation entered a new era?

The door to exploration has just opened.

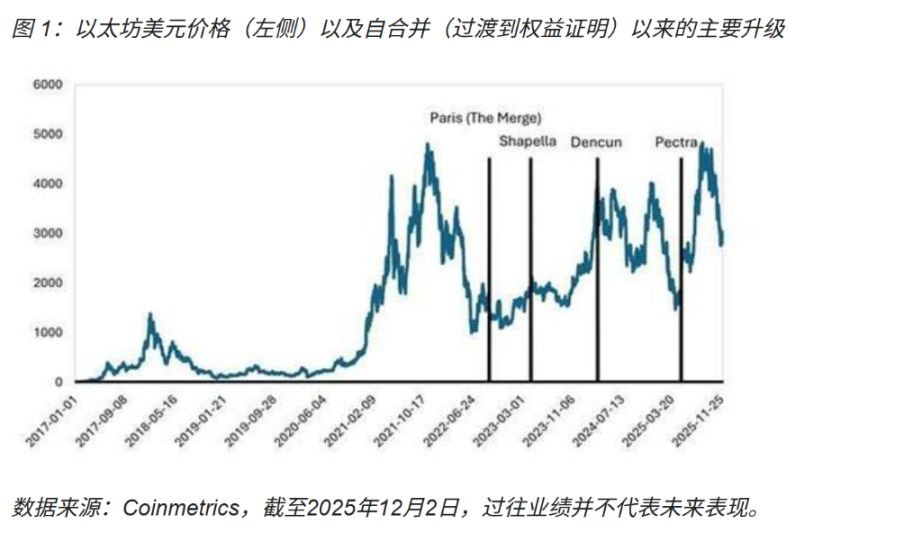

Ethereum undergoes "Fusaka upgrade" to continue "scaling and improving efficiency," strengthening on-chain settlement capabilities

The Fusaka upgrade will consolidate its position as a settlement layer and drive Layer-2 competition towards improvements in user experience and ecosystem depth.

Space Review|Inflation Rebounds vs Market Bets on Rate Cuts: How to Maintain a Prudent Crypto Asset Allocation Amid Macroeconomic Volatility?

In the face of macro volatility, the TRON ecosystem offers a balanced asset allocation model through stablecoin settlements, yield-generating assets, and innovative businesses.