Circle USDC adoption is accelerating as Circle partners with Mastercard and Finastra to enable USDC settlement for merchants and banks across EEMEA, Asia and 50+ countries, integrating stablecoin rails into existing payment and banking infrastructure to speed cross-border settlement and liquidity.

-

USDC settlement is being embedded into Mastercard and Finastra payment flows.

-

Mastercard will enable acquirers and merchants in EEMEA to settle in USDC and Euro Coin (EURC).

-

Finastra’s Global PAYplus will support USDC settlement across banks in 50 countries, handling cross-border payments previously dominated by fiat rails.

Circle USDC adoption expands via Mastercard and Finastra partnerships, enabling merchants and banks to settle in USDC globally and boosting cross-border liquidity — read how.

What is Circle’s USDC adoption strategy?

Circle USDC adoption centers on embedding USDC into mainstream payment networks and banking platforms to enable fiat-denominated instructions to settle in stablecoins. The strategy uses partnerships with payment processors and fintech vendors to expand merchant, acquirer and bank access to crypto-native settlement rails.

How will Mastercard enable USDC settlement for merchants?

Mastercard will offer acquirers and merchants in Eastern Europe, the Middle East and Africa the option to settle transactions in USDC and Euro Coin (EURC). Early adopters include Arab Financial Services and Eazy Financial Services, creating the region’s first stablecoin settlement path through Mastercard’s acquiring network.

How does Finastra integrate USDC into bank payment flows?

Finastra has integrated USDC with its Global PAYplus platform, which processes more than $5 trillion in cross-border transactions daily. The integration allows banks across 50 countries to settle international payments in USDC while keeping payment instructions denominated in fiat, preserving existing back-office workflows.

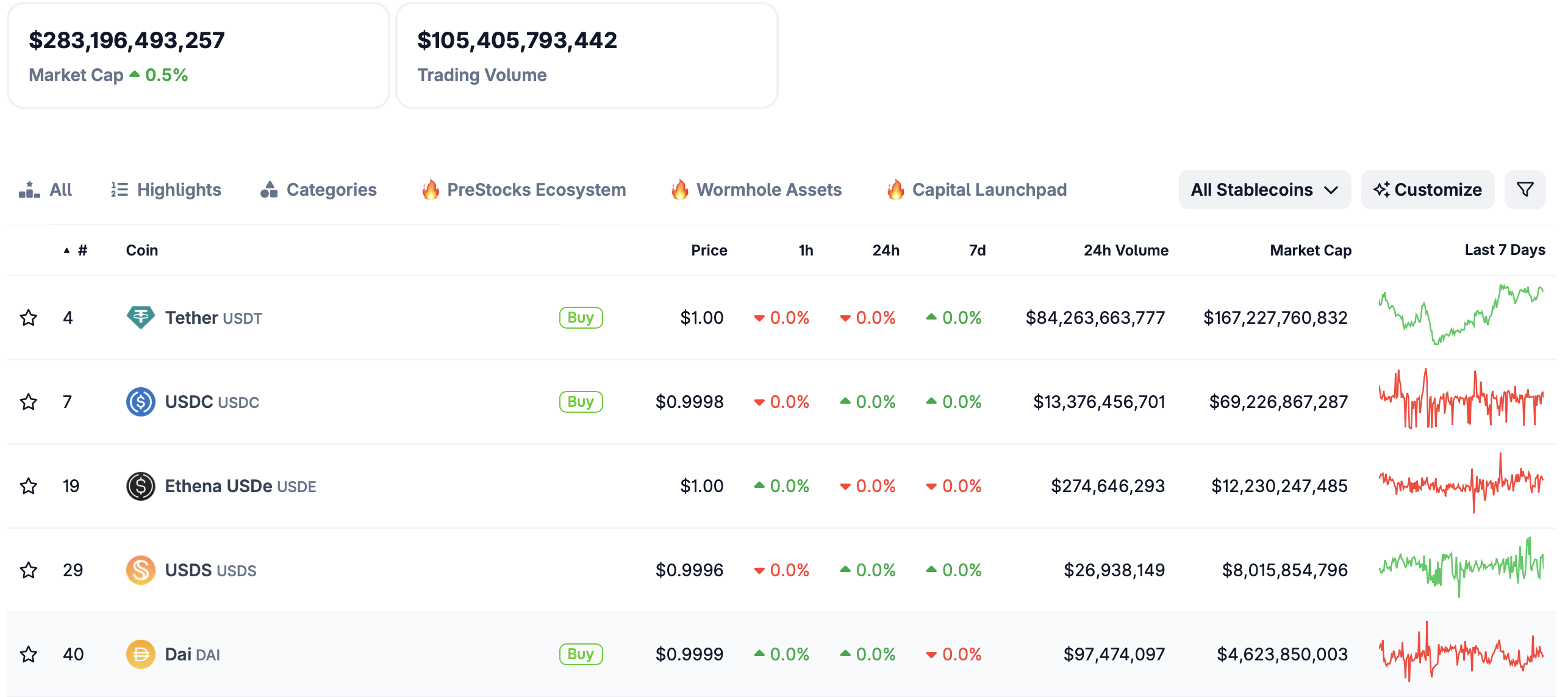

Coingecko: Top stablecoins by market cap

Why does this matter for cross-border payments?

Embedding USDC into established rails reduces settlement times and counterparty credit risk by using a programmable digital dollar. Banks and merchants can benefit from faster finality and improved liquidity management, especially for corridors where fiat settlement is slow or costly.

What recent moves support Circle’s push?

Since the GENIUS Act established a federal framework for stablecoins in July, Circle has expanded partnerships globally. Notable moves include zero-fee USDC-to-USD conversions with major exchanges and engagement with top South Korean banks on onchain integrations and potential won-backed stablecoin initiatives.

Frequently Asked Questions

How will USDC settlement affect merchant fees and reconciliation?

USDC settlement can lower FX and correspondent bank fees by reducing reliance on intermediary banks. Reconciliation will require mapping stablecoin settlement events to fiat-ledger entries, typically handled by payment processors and bank middleware.

Is USDC settlement regulatory-compliant?

Circle emphasizes regulatory compliance and the GENIUS Act provides a federal framework in the U.S. Companies cite official company statements and regulatory filings as the basis for compliance plans, while local regulation varies by jurisdiction.

Key Takeaways

- Partnerships matter: Circle’s deals with Mastercard and Finastra embed USDC into existing payment and banking rails.

- Faster settlement: USDC offers shorter settlement windows and reduced counterparty risk for cross-border flows.

- Operational continuity: Finastra’s design preserves fiat-denominated instructions while enabling stablecoin settlement.

Conclusion

Circle USDC adoption is driving the integration of stablecoin settlement into mainstream payments and banking systems through strategic partnerships with Mastercard and Finastra. This approach aims to speed cross-border settlement, lower costs and preserve existing workflows. Expect incremental rollouts and continued collaboration between fintech vendors, banks and regulators.