Hunting in Contradictions: Saying Goodbye to Narratives, Embracing Volatility

Source: Crypto Coconut

Original Title: A Market Dominated by Narrative Games: Volatility as a Core Asset

The Current Multi-Narrative Game Framework of the Market

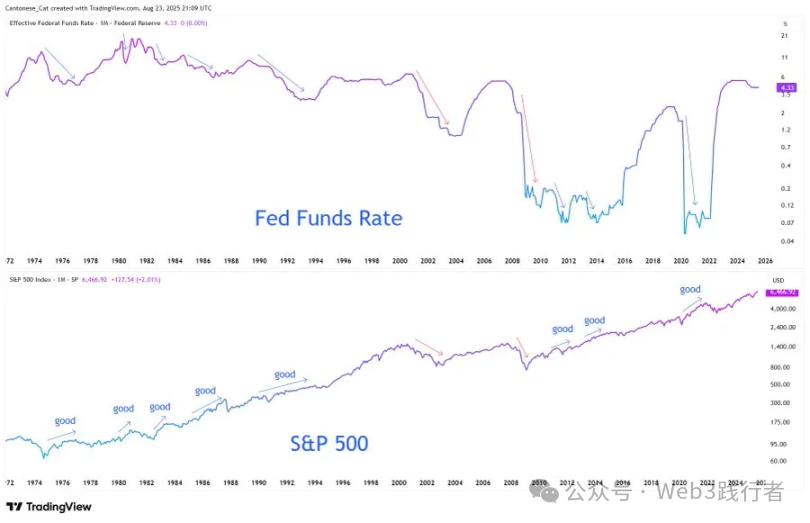

Every round of economic and financial cycles has its dominant narrative logic. The current market is caught in a web of conflicting narratives: the seasonal volatility pattern of Bitcoin and the post-halving cycle characteristics are hedging each other; the Federal Reserve’s ambiguous policy statements and sticky inflation create tension; the steepening of the bond market yield curve simultaneously signals both economic relief and recession warnings. This “tearing” at the narrative level is not just short-term market noise, but a concentrated reflection of the current macro environment’s complexity and structural contradictions. It also determines that the market will seek new balance points amid intense volatility.

From a time dimension perspective, the current market volatility logic presents clear stratification:

-

Short-term (1-3 months): The “September effect” of Bitcoin and the post-halving cycle’s uniqueness form the core contradiction. Historical data shows September is traditionally a weak month for Bitcoin, with repeated declines triggered by long liquidations. However, 2025 is a post-halving year for Bitcoin, and historically, the third quarter of post-halving years tends to be bullish. The conflict between this seasonality and cycle characteristics is likely to trigger the first significant volatility of the year.

-

Mid-term (3-12 months): The credibility crisis of Federal Reserve policy becomes a key variable. Forced rate cuts under inflationary pressure will break the traditional monetary policy transmission path, reshaping the valuation logic of stocks, bonds, and commodities. The ambiguity of policy signals and the sensitivity of market expectations will further amplify asset price volatility.

-

Long-term (over 1 year): The structural demand pillar of the cryptocurrency market faces a test. Unlike previous cycles that relied on retail or institutional capital flows, the current core support for crypto demand comes from corporate crypto treasuries (such as MSTR, Metaplanet, and other institutions’ BTC and ETH holdings). If this structural pillar reverses due to balance sheet pressures, it will trigger a transmission from the demand side to the supply side, reshaping the crypto cycle logic.

For investors, the core cognitive framework of the current market needs to shift from “single narrative validation” to “multi-narrative collision”—effective signals are no longer hidden in isolated data points (such as single-month inflation data or one-day Bitcoin gains), but exist in the contradictions and resonances among different narrative dimensions. This also means that “volatility” is no longer a byproduct of risk, but a core value carrier that can be mined in the current environment.

Bitcoin: Dual Pricing of Seasonal Games and Halving Cycles

(1) The Conflict Between Historical Patterns and Current Uniqueness

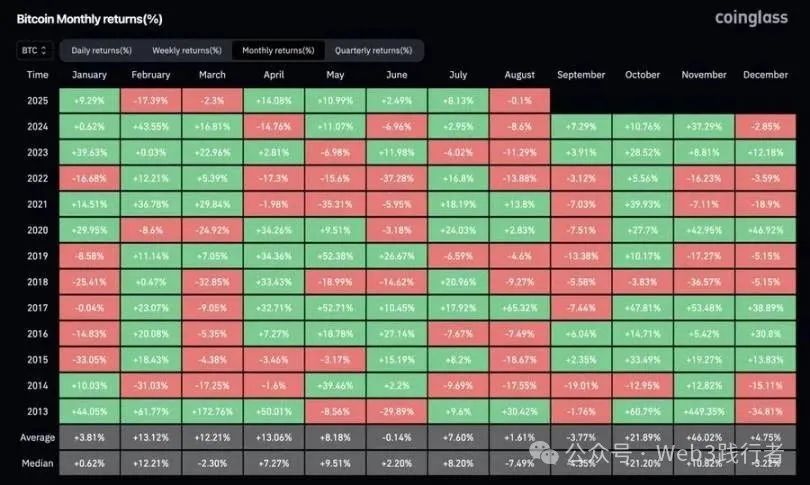

Reviewing Bitcoin’s monthly returns from 2013 to 2024, September has consistently been weak: down 9.27% in September 2018, down 13.88% in September 2022, down 12.18% in September 2023, with the “long liquidation → price correction” transmission path repeatedly appearing. But the uniqueness of 2025 lies in it being a key post-halving year for Bitcoin—historical data shows that the third quarter (July-September) of post-halving years often exhibits strong performance: Q3 2020 rose 27.7%, Q3 2024 rose 16.81%. The collision between “seasonal weakness” and “cycle strength” forms the core contradiction in Bitcoin’s current pricing.

(2) The Reversion Logic After Volatility Compression

As of August 2025, Bitcoin has yet to see a single-month gain exceeding 15%, significantly lower than the “30%+ monthly gains” typical of historical bull cycles, reflecting that current market volatility is in a phase of compression. From a cyclical perspective, bull market surges are characterized by “concentrated releases” rather than even distribution—November 2020 saw a 42.95% gain, November 2021 saw 39.93%, and May 2024 saw 37.29%, all confirming this pattern.

This leads to the current investment logic: within the remaining four months of 2025, the return of volatility is a certainty, with disagreement only on timing. If September sees a correction due to seasonal factors, it will form a dual support of “post-halving cycle support + volatility recovery expectations,” likely becoming the last entry window before a Q4 rally. This “correction as opportunity” logic is essentially a rebalancing of the weights between “seasonal short-term disturbances” and “cycle long-term trends,” rather than a simple linear extrapolation of historical patterns.

Federal Reserve: Narrative Splits and Credibility Risk Repricing

(1) Misreading of Jackson Hole Speech Signals and Real Intentions

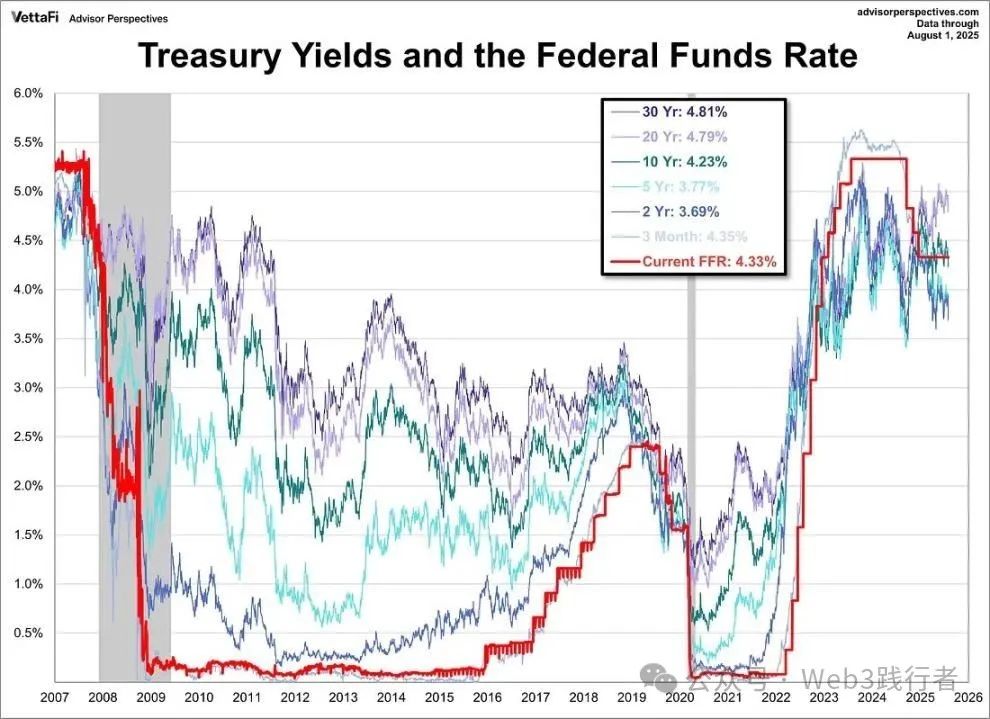

Federal Reserve Chair Powell’s remarks at the 2025 Jackson Hole Global Central Bank Annual Meeting were initially interpreted by the market as a “radical easing signal,” but a deeper analysis reveals the subtlety of the policy logic:

-

Limited Rate Cut Path: Powell explicitly “kept the door open for a September rate cut,” but also emphasized “this does not mark the start of an easing cycle,” meaning a single rate cut is more of a “phase adjustment under inflationary pressure” rather than “the beginning of a new round of easing,” to avoid the market forming an inertia of “consecutive rate cuts.”

-

Fragile Balance in the Labor Market: His mention of “slowing supply and demand in the labor market” implies deeper risks—the current stability in the job market does not stem from economic resilience, but from simultaneous weakness on both supply and demand sides. This balance has “asymmetric risks”: once broken, it could quickly trigger a wave of layoffs, explaining the Fed’s oscillation between “rate cuts” and “recession prevention.”

-

Major Shift in the Inflation Framework: The Fed has officially abandoned the “average inflation targeting” introduced in 2020, returning to the 2012 “balanced path” model—the core change being “no longer tolerating inflation temporarily above 2%” and “no longer focusing solely on the unemployment rate target.” Even though the market has priced in rate cut expectations, the Fed is still reinforcing the “2% inflation target anchor” signal, attempting to restore credibility previously damaged by policy swings.

(2) Policy Dilemma and Asset Pricing Impact in a Stagflation Environment

The core contradiction currently facing the Fed is “forced rate cuts under stagflation pressure”: core inflation remains sticky due to tariff shocks (Powell explicitly stated “the impact of tariffs pushing up prices will continue to accumulate”), labor market weakness is emerging, and the US’s high debt burden (government debt/GDP ratio continues to climb) makes “higher for longer” rates unfeasible both fiscally and politically, forming a vicious cycle of “spending → borrowing → money printing.”

This policy dilemma directly translates into a reconstruction of asset pricing logic:

-

Credibility risk becomes the core pricing factor: If the 2% inflation target degenerates from a “policy anchor” to a “vision statement,” it will trigger a repricing of “inflation premium” in the bond market—long-term US Treasury yields may rise due to higher inflation expectations, and the “profit valuation gap” in the stock market will further widen.

-

The hedging value of scarce assets is highlighted: Against the backdrop of rising fiat currency dilution risk, assets with “scarcity attributes” such as Bitcoin, Ethereum, and gold will have their “anti-inflation dilution” function strengthened, becoming core allocations to hedge against the decline in Fed policy credibility.

Bond Market: Recession Warning Signals Behind the Steepening Curve

(1) The Surface and Essence of Curve Steepening

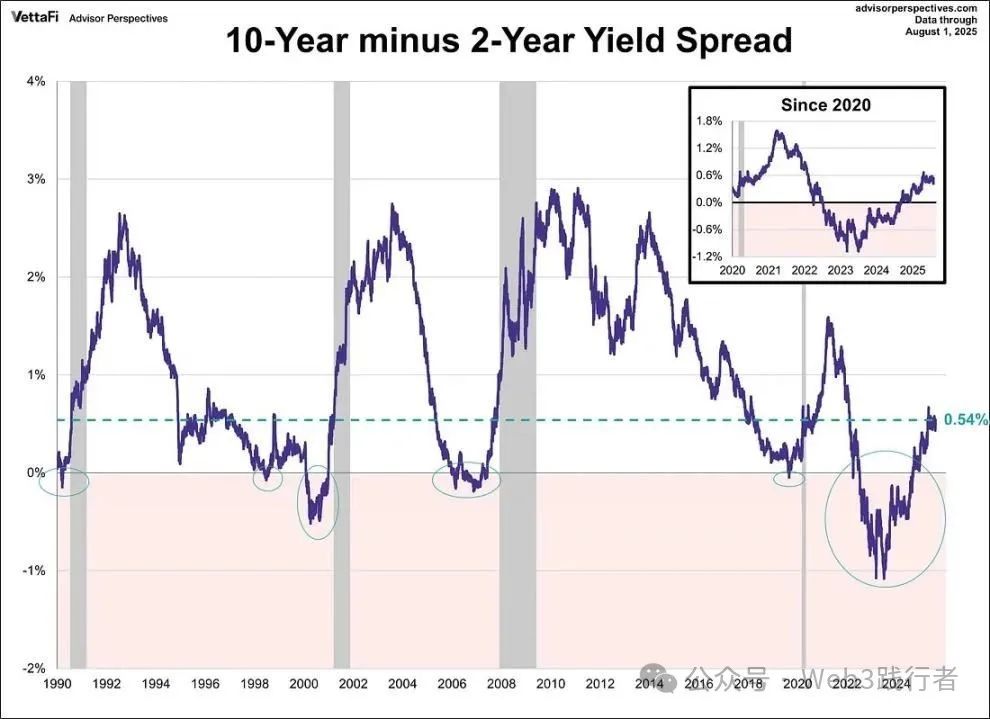

In August 2025, the spread between the 10-year and 2-year US Treasury yields rebounded from a historically deep inversion to +54 basis points, superficially showing “curve normalization,” which some market views interpret as a signal of “economic risk relief.” However, historical experience (especially in 2007) warns that post-inversion steepening can follow either a “benign” or “malignant” path:

-

Benign steepening: Stems from improved economic growth expectations, with better corporate profit outlooks driving long-term rates up faster than short-term rates, often accompanied by rising stock markets and narrowing credit spreads.

-

Malignant steepening: Stems from rapid short-term rate declines due to easing expectations, while long-term rates remain high due to sticky inflation expectations. Essentially, it is a warning that “policy easing cannot offset recession risk.” The 2007 steepening followed by the subprime crisis is a typical example of this path.

(2) Determining the Risk Attributes of the Current Steepening

Looking at the current US Treasury yield structure, the 3-month yield (4.35%) is higher than the 2-year yield (3.69%), and the 10-year yield (4.23%) is higher than the 2-year, but mainly supported by long-term inflation expectations—the market interprets the Fed’s September rate cut expectations as a “passive response to stagflation” rather than an “active adjustment under economic resilience.” This combination of “falling short-term rates + sticky long-term inflation” fits the core characteristics of “malignant steepening.”

The core basis for this judgment is that the curve steepening does not stem from a restoration of growth confidence, but from the market pricing in “policy failure”—even if the Fed starts cutting rates, it will be hard to reverse the dual pressures of sticky core inflation and economic weakness. On the contrary, it may further exacerbate stagflation risk through the transmission of “easing expectations → rising inflation expectations.” This means that beneath the “surface health” of the current bond market, there are significant recession warning signals.

Cryptocurrency: The Vulnerability Test of Structural Demand Pillars

(1) Differences in Demand Logic in the Current Cycle

Comparing the core drivers of the three crypto bull cycles: 2017 relied on the fundraising boom (retail-driven incremental capital), 2021 relied on DeFi leverage and NFT speculation (leverage resonance from both institutions and retail), while 2025 presents a “structural demand-driven” characteristic—corporate crypto treasuries have become the core buying force.

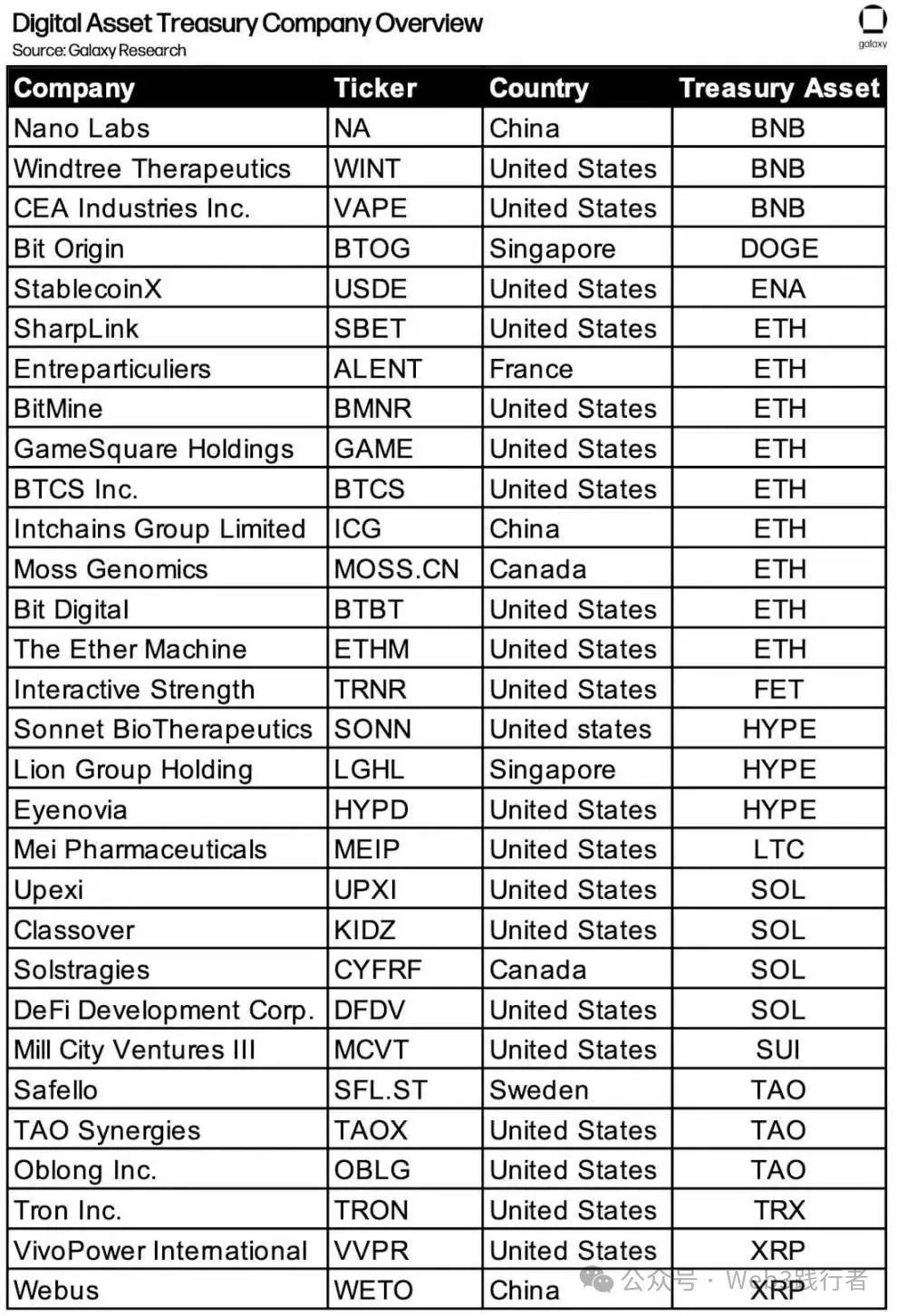

According to Galaxy Research data, as of August 2025, more than 30 listed companies worldwide have included BTC, ETH, SOL, and other crypto assets in their treasury allocations. Among them, MSTR’s BTC holdings exceed 100,000 coins, and the proportion of ETH holdings to circulating supply by institutions like Bit Digital and BTCS continues to rise. This “enterprise-level allocation demand” differs from previous “speculative demand” and is seen as the “stabilizer” of the current crypto market.

(2) Potential Risks of Demand Reversal

The stability of current corporate crypto treasuries relies on “net asset premium” support—if the stock prices of related companies fall due to market volatility or performance pressure, causing an imbalance in the “market value of crypto holdings/total company market value” ratio, it may trigger a chain reaction of “forced crypto asset sales to stabilize the balance sheet.” Historical experience shows that the end of crypto cycles often stems from a “reversal of core demand mechanisms”: regulatory tightening ended the bull market in 2017, DeFi leverage liquidations triggered the crash in 2021, and if corporate crypto treasuries shift from “net buyers” to “net sellers” in 2025, it will become the key trigger for a cycle reversal.

The particularity of this risk lies in its “structural transmission”—corporate selling differs from the short-term trading behavior of retail or institutions, often characterized by “large scale, long cycle,” which may break the “fragile supply-demand balance” of the current crypto market, triggering both price overshooting and liquidity contraction pressures.

Conclusion: Reconstructing the Investment Logic of Volatility as a Core Asset

The essence of the current market is an “era of volatility pricing under narrative collision,” with four core contradictions forming the underlying framework for investment decisions: the collision between Bitcoin’s “seasonal correction” and “post-halving rally,” the collision between the Fed’s “cautious statements” and “stagflation rate cuts,” the collision between the bond market’s “curve normalization” and “recession warning,” and the collision between crypto’s “corporate treasury support” and “demand reversal risk.”

In this environment, investors’ core capability needs to shift from “predicting the direction of a single narrative” to “capturing volatility opportunities in multi-narrative collisions”:

-

Proactively embrace volatility: No longer view volatility as risk, but as the core carrier for excess returns—for example, positioning during Bitcoin’s September seasonal correction, or arbitraging interest rate volatility during the US Treasury curve steepening phase.

-

Strengthen hedging thinking: Against the backdrop of declining policy credibility and rising stagflation risk, allocate scarce assets such as Bitcoin, Ethereum, and gold to hedge against fiat currency dilution and asset repricing risks.

-

Track structural signals: Closely monitor changes in corporate crypto treasury holdings, the enforcement strength of the Fed’s inflation target, and changes in the slope of the US Treasury yield curve—these “structural indicators” are key anchors for judging the direction of narrative collisions.

Ultimately, the investment opportunity in the current market does not lie in “choosing a single winning narrative,” but in recognizing that “volatility itself is an asset”—in the era of narrative collision, the ability to harness volatility, hedge risks, and capture value points amid contradictions is the core logic for building long-term investment advantages.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin 2022 bear market correlation hits 98% as ETFs add $220M

Fed rate-cut bets surge: Can Bitcoin finally break $91K to go higher?

Crypto: Fundraising Explodes by +150% in One Year