ETH Inflows Smash Bitcoin: Price Breakout Coming?

Ethereum price just got its biggest validation yet. Over the past week, spot Ether ETFs in the US have pulled in more than $1.8 billion in inflows, outpacing spot Bitcoin ETFs by a factor of ten. Investors are voting with their wallets, and right now they’re choosing ETH over BTC. The question is whether this enthusiasm can fuel another leg up in Ethereum’s price , which is currently trading around $4,550.

Ethereum ETF Inflows vs Market Sentiment

When new financial products attract such strong demand, it signals that institutional and retail investors alike are building confidence in the asset. The fact that ETH ETFs are bringing in ten times more inflows than Bitcoin funds highlights a shift in perception: Ethereum is no longer playing second fiddle. This capital flow builds liquidity, lowers volatility over time, and sets up ETH ETF as a stronger competitor to Bitcoin as a store of value and yield-generating asset.

Ethereum Price Prediction: Is ETH Price Ready for a Breakout?

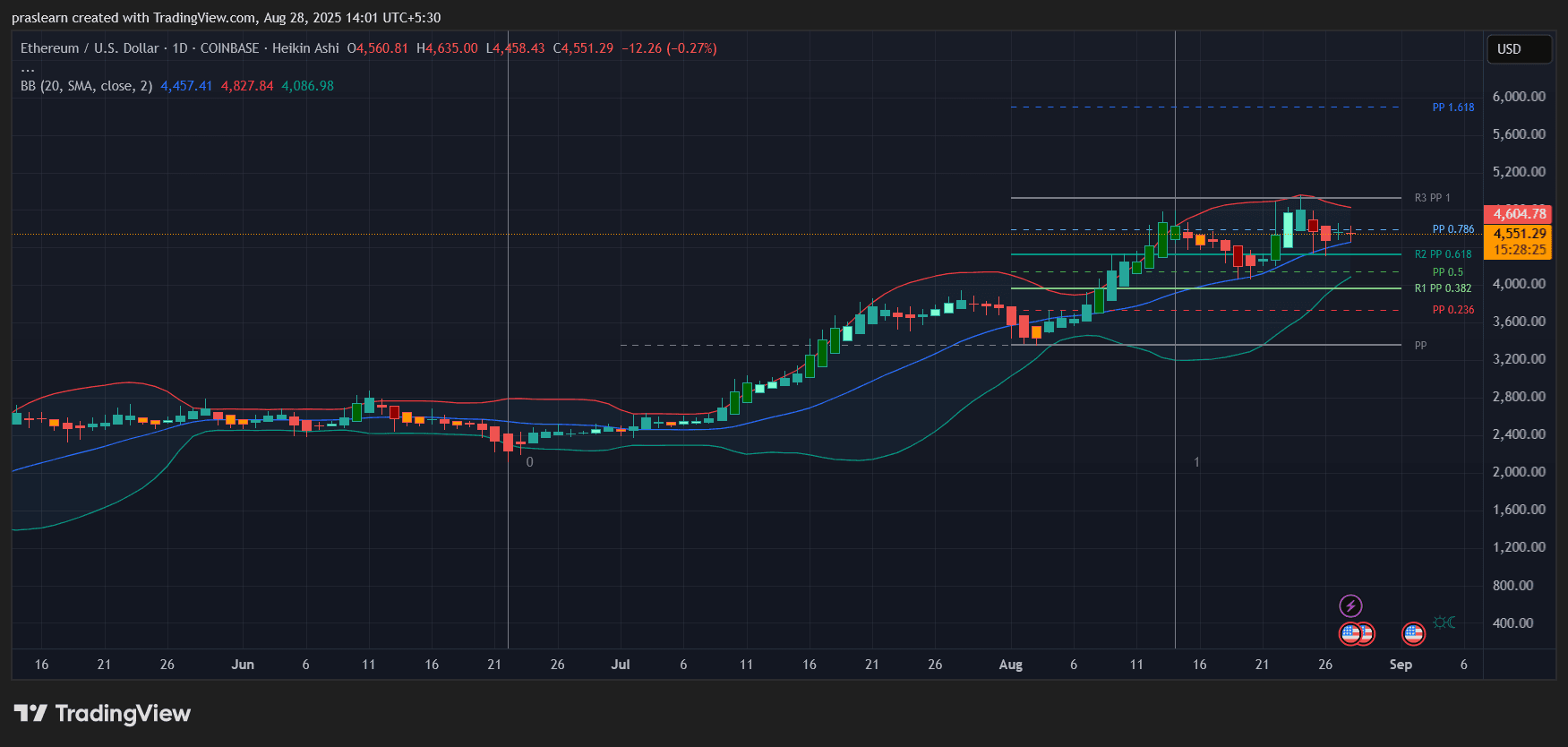

ETH/USD Daily Chart- TradingView

ETH/USD Daily Chart- TradingView

Looking at the daily chart, ETH price is consolidating just under resistance at the $4,600–$4,700 zone. Bollinger Bands are tightening after a strong rally in August, which typically precedes a sharp move. The price is holding above the mid-band ($4,450), showing bulls are still in control.

The Fibonacci retracement levels from the recent swing indicate $4,300 as strong support and $5,200 as the next upside target. If inflows continue, ETH could retest $5,000 in the short term and potentially aim for $5,600 (the 1.618 Fibonacci extension).

Why This Inflow Surge Matters More Than Price Action Alone

Unlike speculative rallies, Ethereum ETF i nflows represent sticky institutional capital. These investors typically hold longer-term positions, meaning the $1.83 billion isn’t hot money that disappears overnight. If this momentum continues, Ethereum’s narrative as both an infrastructure play and an investment-grade asset strengthens. In simple terms, the floor for ETH price gets higher with every billion flowing in.

Ethereum Price Prediction: Can ETH Price Break Into a New Range?

Given the chart structure and the ETF-driven demand, $Ethereum looks set for a bullish continuation. Short-term pullbacks toward $4,300 should be seen as healthy resets, not signs of weakness. If Ethereum ETF inflows maintain their current pace, ETH price has a strong chance of reclaiming $5,000 within weeks and pushing toward $5,200–$5,600 before September ends.

Unless inflows dry up or macro conditions reverse sharply, the balance of probability points to $ETH rising further. Bitcoin may still lead the market, but Ethereum just proved it can dominate the inflow race—and that’s a bullish shift investors can’t ignore.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025

QNT Price Breaks Falling Wedge: Can the Bullish Structure Push Toward $150?

Digital dollar hoards gold, Tether's vault is astonishing!

The Crypto Bloodbath Stalls: Is a Bottom In?