Bitcoin Braces for Another Dip as On-Chain Data Warns of Spot and Futures Selloffs

Bitcoin faces renewed sell pressure from spot and futures traders, with key indicators warning of a dip below $110,000 if momentum holds.

Bitcoin may be gearing up for another downturn as on-chain data signals sustained selling pressure. A recent report from CryptoQuant shows an uptick in selloffs among spot and futures traders.

If this trend persists, BTC risks sliding below the critical $110,000 price mark.

Bitcoin Sell Pressure Intensifies

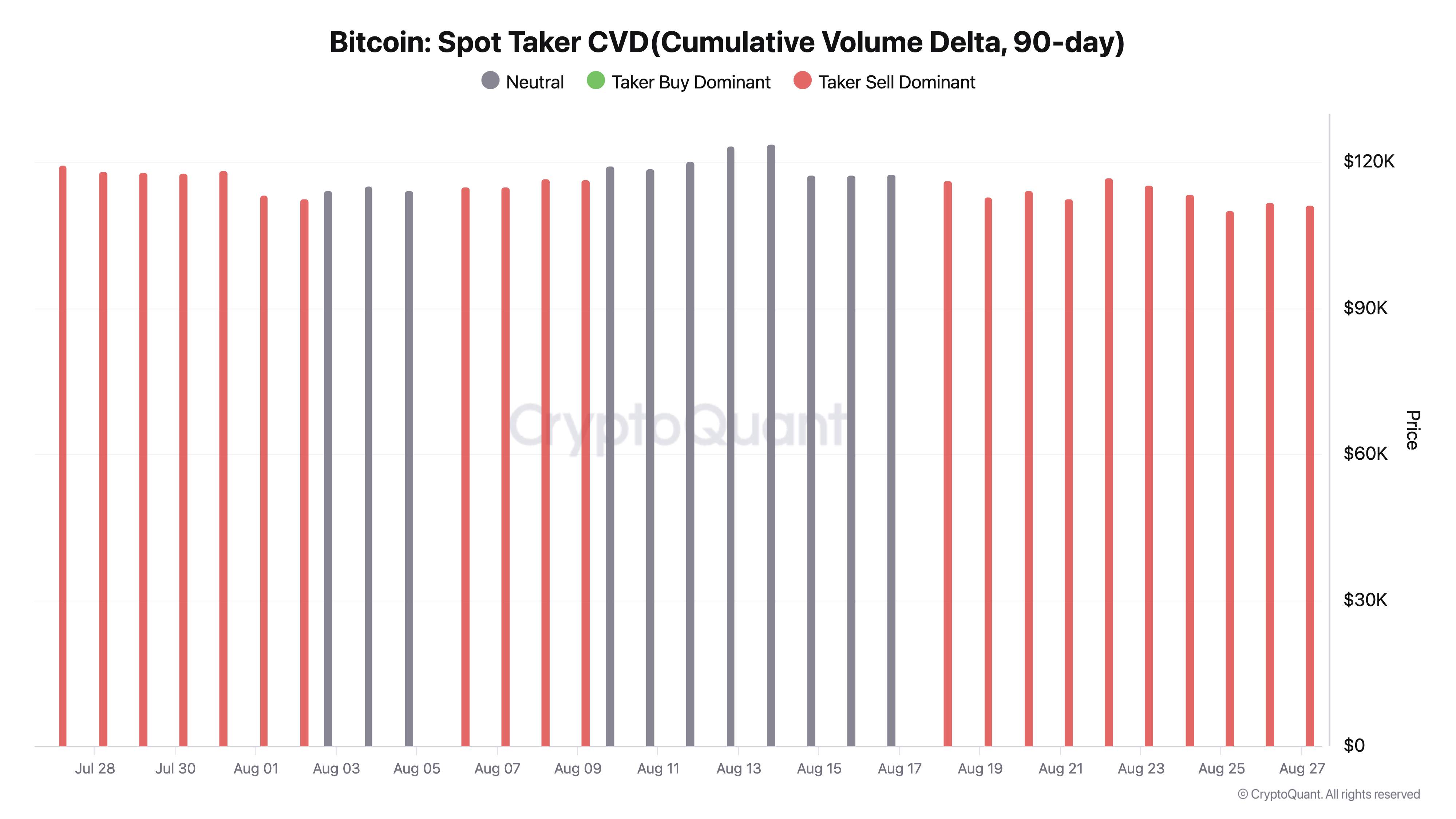

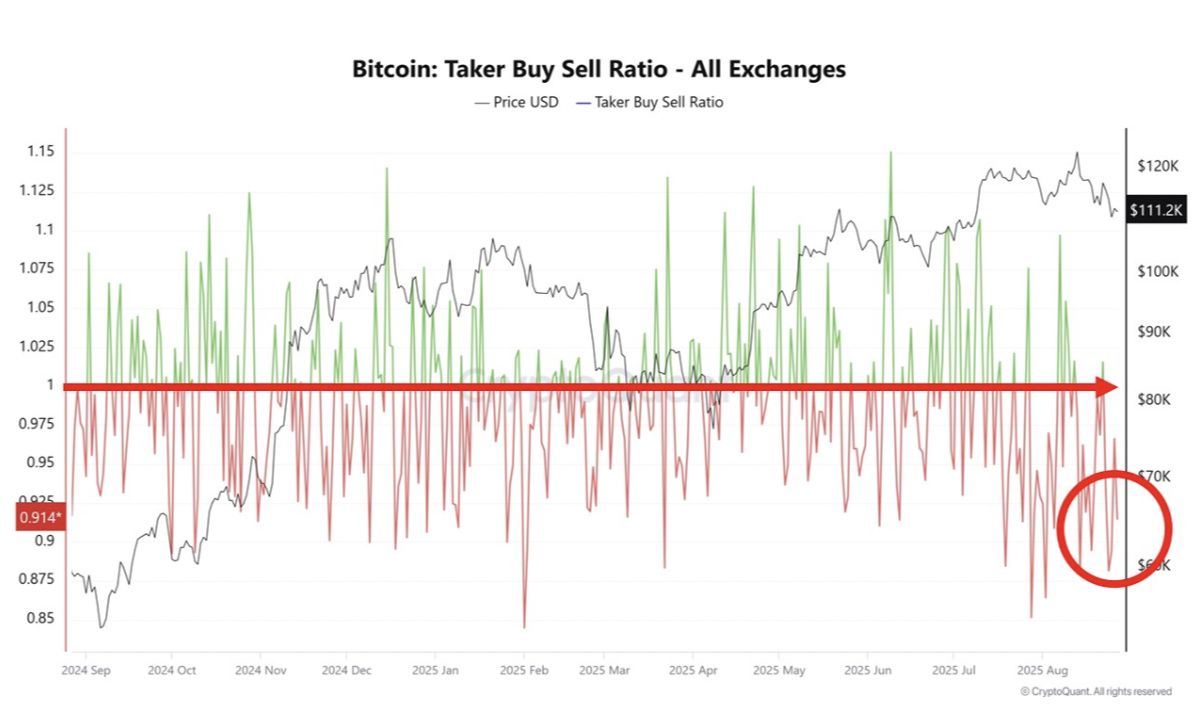

According to a recently published report on CryptoQuant, Bitcoin has seen a surge in selloffs from both spot and futures traders, as reflected in two key indicators—the Spot Taker Cumulative Volume Delta (CVD, 90-day) and the Taker Buy/Sell Ratio.

The Spot Taker CVD, which tracks whether market takers are predominantly buyers or sellers, has flipped red after months of buy-side dominance. This shift signals renewed selling pressure, a pattern that has historically preceded corrections.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

BTC Spot Taker Cumulative Volume Delta. Source:

CryptoQuant

BTC Spot Taker Cumulative Volume Delta. Source:

CryptoQuant

It reflects a cooling of aggressive buying interest and a growing willingness among BTC spot traders to offload positions, signaling exhaustion in the market.

Further, according to the report, BTC’s Taker Buy/Sell Ratio has slipped to 0.91, falling below its long-term baseline of 1.0. This indicates that sell orders now consistently outweigh buy orders across the coin’s futures market.

BTC Taker Buy/Sell Ratio. Source:

CryptoQuant

BTC Taker Buy/Sell Ratio. Source:

CryptoQuant

An asset’s taker buy-sell ratio measures the ratio between the buy and sell volumes in its futures market. Values above one indicate more buy than sell volume, while values below one suggest that more futures traders are selling their holdings.

This confirms the mounting sell-side pressure and weakening sentiment, which could worsen BTC price declines if it continues.

Can the $112,000 Support Fuel a Fresh Rally?

BTC trades at $112,906 at press time, resting above the support floor at $111,920. If demand grows and this price floor strengthens, it could propel BTC’s price toward $115,764. A successful breach of this level could open the door for a rally to $118,922.

BTC Price Analysis. Source:

TradingView

BTC Price Analysis. Source:

TradingView

Conversely, if sell-side pressure mounts, BTC risks plunging below $111,920 and falling toward $109,267.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Volatility Weekly Review (November 17 - December 1)

Key metrics (from 4:00 PM HKT on November 17 to 4:00 PM HKT on December 1): BTC/USD: -9.6% (...

When all GameFi tokens have dropped out of the TOP 100, can COC reignite the narrative with a Bitcoin economic model?

On November 27, $COC mining will be launched. The opportunity to mine the first block won't wait for anyone.

Ethereum's Next Decade: From "Verifiable Computer" to "Internet Property Rights"

Fede, the founder of LambdaClass, provides an in-depth explanation of anti-fragility, the 1 Gigagas scaling goal, and the vision for Lean Ethereum.

The reason behind the global risk asset "Tuesday rebound": a "major change" at asset management giant Vanguard Group

This conservative giant, which had previously firmly resisted crypto assets, has finally compromised and officially opened bitcoin ETF trading access to its 8 million clients.