When Kanye West unveiled his YZY token on August 20, hype surged across the Solana network. Thousands of fans and traders piled in, hoping to ride the momentum of a celebrity-backed memecoin. But within hours, the excitement turned into a painful reality for most.

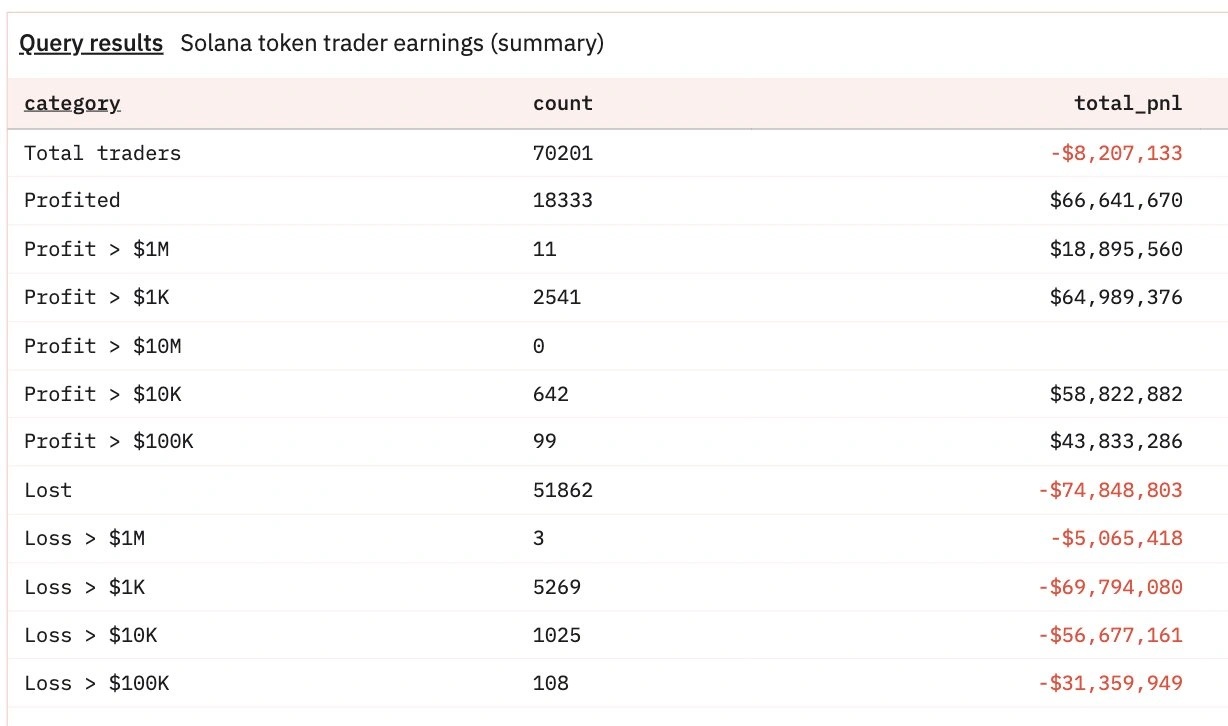

According to blockchain analytics firm Bubblemaps, a few days after launch, updated data show that out of more than 70,000 wallets that traded YZY , nearly three-quarters ended up in the red. That’s over 51,000 wallets collectively losing around $74.8 million.

Meanwhile, a handful of early movers walked away with staggering profits; just 11 wallets pocketed over $1 million.

Breakdown of earnings of YZY trading data. Source: Bubblemaps via X .

Breakdown of earnings of YZY trading data. Source: Bubblemaps via X .

Analysts report disproportionate ledger of losses and gains

Bubblemaps’ breakdown shows just how uneven the results were for YZY investors. Out of 70,201 total traders, 51,862 wallets lost money. The majority, over 50,000 wallets, saw losses between $1 and $1,000.

Another 5,269 wallets dropped between $1,000 and $10,000, while more than 1,000 wallets lost anywhere from $10,000 to $100,000. At the high end, 108 wallets were down six figures, and three wallets lost over $1 million each.

On the green side, over 18,300 wallets came away with profits, but the vast majority gained very little. Bubblemaps reported that 15,792 wallets made less than $1,000, while about 30% of all profits were concentrated in just 11 wallets, which together netted millions.

Allegations of YZY manipulation

Just hours after launch, YZY price collapsed by nearly 70%. Investigators quickly pointed to market manipulation as a likely cause.

Bubblemaps alleges that sniping bots and well-known “insiders” positioned themselves to scoop up supply before the general public could buy. One pseudonymous trader, known as “Naseem,” who had previously made tens of millions from Donald Trump’s TRUMP token, was reportedly among YZY’s first buyers.

Another figure identified was Hayden Davis , a serial participant in controversial token launches. Bubblemaps claims Davis walked away with $12 million by sniping YZY, and it follows a similar pattern to his involvement in past projects like LIBRA and MELANIA tokens that also collapsed soon after launch.

“The past week truly exposed the failures of our industry,” Bubblemaps said in a post on X . “Despite our collective efforts as investigators, builders, and communities – the same names keep running the same scams. The playbook is simple: infiltrate big launches, get in early, and extract millions. It’s happening in plain sight, and no one is stopping it.”

The celebrity crypto token trap strikes again

Kanye West has not commented publicly on YZY’s collapse or the allegations of manipulation. In fact, he had previously rejected the idea of launching a token, saying memecoins “prey on the fans with hype.”

That stance seemed to change with YZY’s debut, which he promoted heavily.

With nearly $75 million in losses spread across tens of thousands of small traders, the episode has reignited debate about whether regulators should step in more aggressively to curb manipulation in the memecoin sector and have more backing of the law to punish bad actors such as Hayden Davis.