Solana Price Prediction: Can SOL Break $215 and Surge Toward $300?

Solana (SOL) is once again in the spotlight, testing critical resistance levels around $205–$215 amid a surge in institutional flows. Analysts are projecting that a breakout could propel its price toward the $300 zone if key technical thresholds hold. At the same time, Solana treasuries remain modest in staking activity, adding a layer of strategic caution to the bullish narrative.

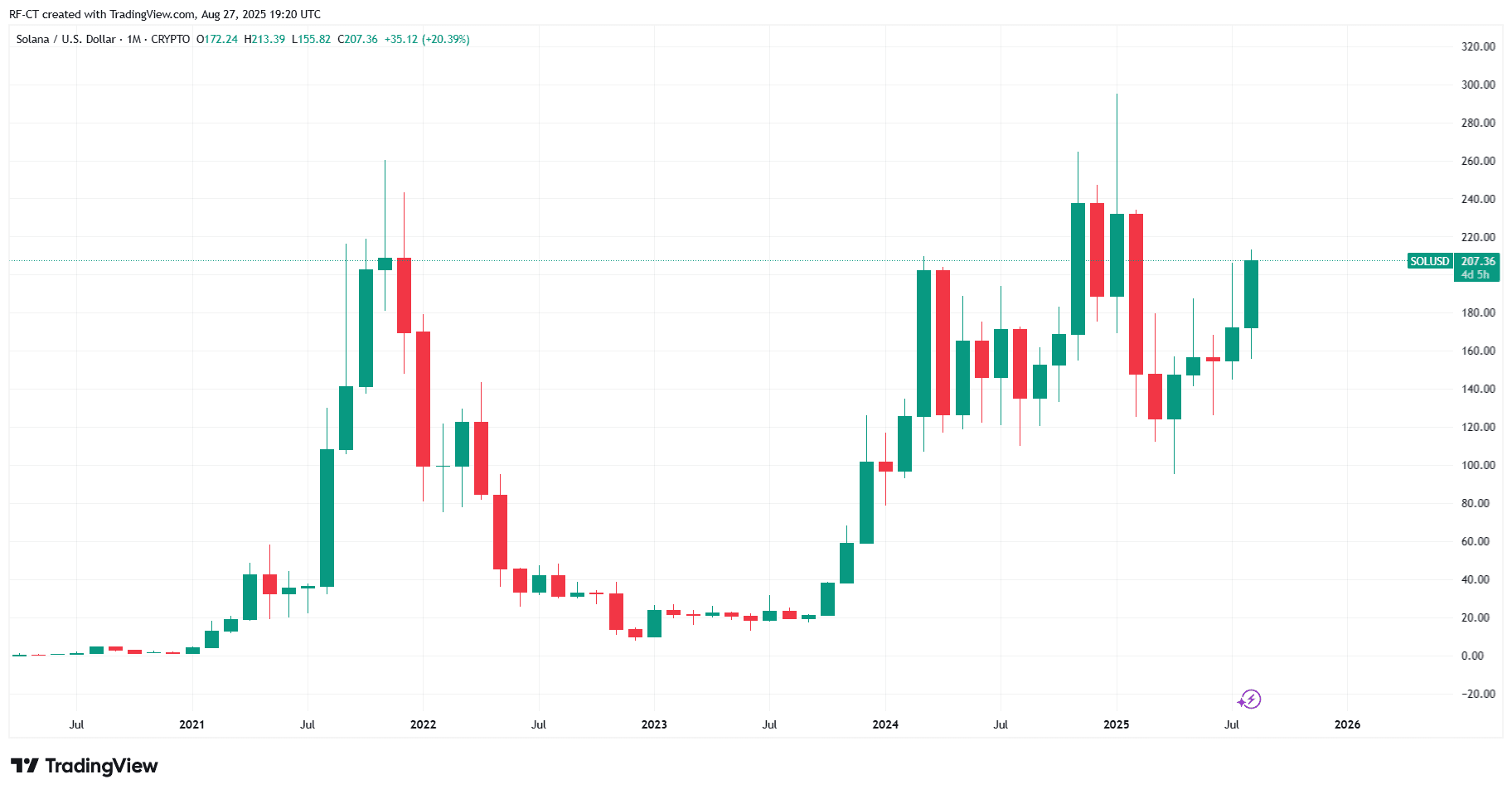

By TradingView - SOLUSD_2025-08-27 (YTD)

By TradingView - SOLUSD_2025-08-27 (YTD)

SOL Pressing Key Resistance Around $205–$215 Spectrum

Today, Solana’s price finds itself at a strategic juncture . Technicals show heavy trading activity near the $205–$215 range, a zone that, if breached, could unlock significant upside momentum. Futures volumes have soared—one source notes $50 billion in SOL futures exchanged recently—indicating heightened market interest and potential for breakout moves.

Institutional Flows Could Fuel the Next Leg Up

Institutional demand is stepping into the foreground. Pantera Capital’s plan to raise up to $1.25 billion to build a “Solana Co.” public treasury signals deep conviction in SOL’s upward trajectory. This kind of strategic accumulation could provide the launchpad for SOL to breach resistance levels with authority.

SOL Price Prediction: $300 Within Reach

Multiple sources align on a bullish scenario if resistance gives way:

- BraveNewCoin forecasts a breakout above $207 could validate a rally toward $300, with $176 as downside buffer and $210–$215 acting as the defining test.

- CoinStats notes that solid support at $188 and a breakout could take SOL to $215–$220, with longer-term aspirations reaching $295.83.

- FXEmpire points out that with futures surging and SOL exceeding $200, the next leg could be underway ﹘ potentially setting the stage for fresh all-time highs.

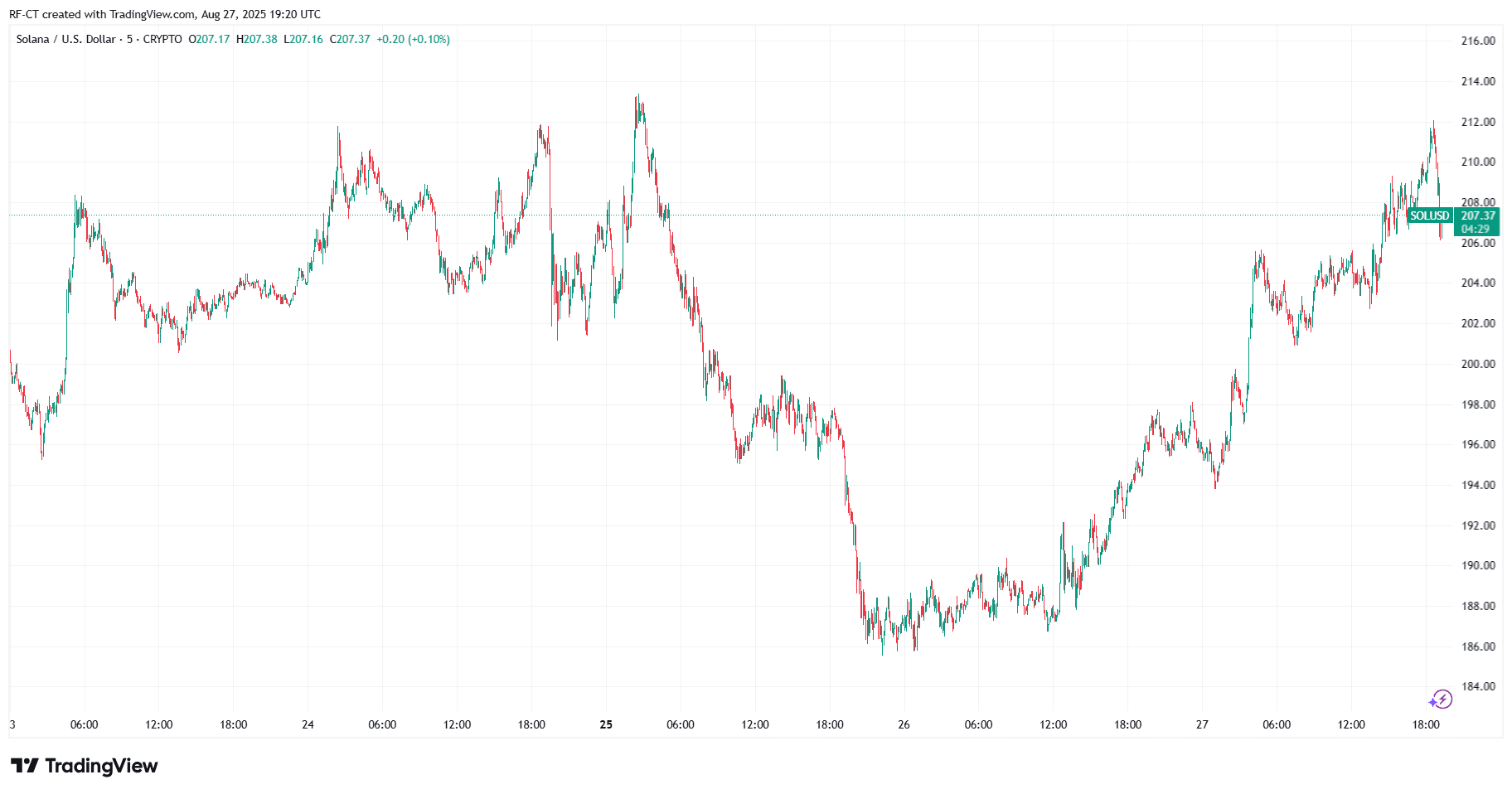

By TradingView - SOLUSD_2025-08-27 (5D)

By TradingView - SOLUSD_2025-08-27 (5D)

Putting it all together, if SOL clears the $215 barrier decisively , a move toward $300 seems fully within the realm of possibility.

Staking Activity Remains Surprisingly Low

Even as price action heats up, Solana treasuries continue to underutilize staking opportunities. The majority of institutional SOL remains un-staked, potentially limiting passive yield accumulation and pointing to cautious treasury strategies in a volatile environment.

Balancing Bullish Momentum with Risk Factors

Although optimism runs high, the downside risk remains if SOL fails to hold the $200–$202 level:

Analysts warn that dropping below this threshold could keep SOL rangebound—or worse, lead to a dip toward $150, with a break below $190 possibly targeting $170.

Meanwhile, others highlight strong whale accumulation and ecosystem buybacks pushing toward $250–$295 levels, reinforcing the bullish thesis if momentum sustains.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Decoding VitaDAO: A Paradigm Revolution in Decentralized Science

Mars Morning News | ETH returns to $3,000, extreme fear sentiment has passed

The Federal Reserve's Beige Book shows little change in U.S. economic activity, with increasing divergence in the consumer market. JPMorgan predicts a Fed rate cut in December. Nasdaq has applied to increase the position limit for BlackRock's Bitcoin ETF options. ETH has returned to $3,000, signaling a recovery in market sentiment. Hyperliquid has sparked controversy due to a token symbol change. Binance faces a $1 billion terrorism-related lawsuit. Securitize has received EU approval to operate a tokenization trading system. The Tether CEO responded to S&P's credit rating downgrade. Large Bitcoin holders are increasing deposits to exchanges. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

The central bank sets a major tone on stablecoins for the first time—where will the market go next?

The People's Bank of China held a meeting to crack down on virtual currency trading and speculation, clearly defining stablecoins as a form of virtual currency with risks of illegal financial activities, and emphasized the continued prohibition of all virtual currency-related businesses.