Zhou Xiaochuan Warns Against Stablecoin Risks

- Zhou Xiaochuan warns of stablecoins fueling speculation.

- Potential for systemic financial risk is highlighted.

- No immediate regulatory changes announced.

Former PBoC Governor Zhou Xiaochuan warned stablecoins could escalate asset speculation and system risks during a China Finance 40 Forum seminar in July 2025.

These warnings highlight ongoing skepticism from Chinese authorities, suggesting potential delays in liberalization and the introduction of yuan-backed stablecoins across global financial systems.

Zhou Xiaochuan stressed the necessity of being vigilant against possible instability risks from stablecoin usage. He indicated concerns about some industry players exploiting stablecoin hype for valuation boosts. Systemic risk accumulation has been marked as detrimental. “We need to be vigilant against the risk of stablecoins being excessively used for asset speculation, as misdirection could trigger fraud and instability in the financial system,” Zhou noted, underscoring the importance of careful monitoring.

The regulatory environment remains cautious regarding stablecoins , deterring any immediate liberalization in China. Zhou’s comments underline skepticism towards unfettered stablecoin growth, signaling a balanced approach towards innovation and financial stability.

The financial implications highlight a potential stagnation in stablecoin-related projects within China. The emphasis on stability over rapid technological adaptation mirrors historical preclusions in the country’s cryptocurrency policies.

Current stablecoins like USDT and USDC continue to dominate without immediate disruption from Zhou’s statements. These stablecoins account for over 99% of global market share, underscoring their importance in cross-border settlements amidst regulatory scrutiny.

Potential technological outcomes may unfold based on China’s regulatory responses. Monitoring on-chain data and historical trends might reveal shifts as further actions are defined. Zhou’s warning is pivotal for financial analysts and policymakers closely watching the sector.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ripple Price: How the CFTC Settlement and XRP ETF Speculation Are Reshaping Institutional Sentiment and Fueling Bullish Momentum

- CFTC's 2025 settlement reclassified XRP as a commodity, resolving a 3-year legal battle and enabling U.S. institutional trading. - XRP ETF applications (e.g., ProShares' $1.2B Ultra XRP ETF) signal $5-8B potential inflows, with 95% approval probability. - Post-settlement XRP surged to $3.32, showing strong institutional support through futures volume and whale accumulation. - Regulatory clarity and cross-border payment innovations position XRP as a strategic asset for diversified crypto portfolios.

The Legal Framework Divide: How Civil Law Jurisdictions Shape Platinum's Price Stability and Investor Confidence

- Civil law jurisdictions like Quebec mandate public beneficial ownership registries, boosting ESG scores and investor trust in platinum producers. - Common law regions face higher volatility due to opaque governance, exemplified by South African producers lagging 18% in risk-adjusted performance. - The 2025 platinum-to-gold ratio surge reflects legal regime impacts, with Quebec firms insulated from tariffs and regulatory shocks. - Investors are advised to prioritize civil law-compliant firms and hedge aga

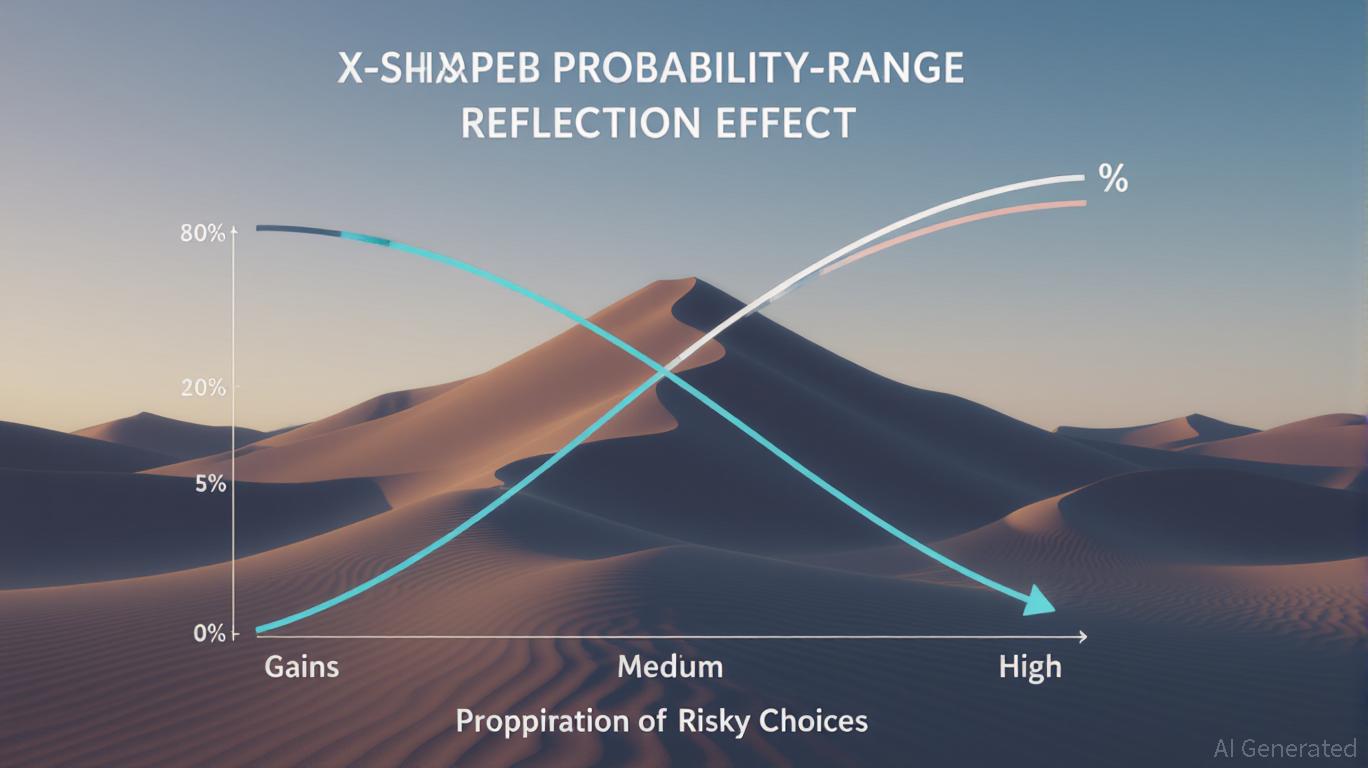

The Reflection Effect and MSTY: Navigating Investor Psychology in Volatile Markets

- The reflection effect explains how investors show risk aversion in gains and risk-seeking in losses, reshaping portfolio strategies for assets like SLV and MSTY. - MSTY's 2025 volatility highlights behavioral shifts: risk-averse selling during gains and risk-seeking buying during 30% declines, aligning with prospect theory predictions. - Tactical approaches like hybrid portfolios (MSTY + TIPS) and RSI-based trading reduced volatility, generating 42.22% returns vs. 37.32% benchmarks in 2022-2025. - A 2025

CME XRP Futures: A New Era for Institutional Adoption and Strategic Crypto Trading

- CME Group's May 2025 XRP Futures launch institutionalized digital assets, offering regulated liquidity and validating XRP's financial role. - SEC's August 2025 ruling cleared XRP's legal status, enabling $17M reallocation from Bitcoin to XRP by Gumi Inc. and boosting institutional adoption. - XRP Futures' $1.6B July 2025 notional volume and transparent pricing mechanism demonstrate growing utility-driven demand over speculation. - Experts project $2.80 XRP price by 2025, citing ETF approval potential, Ri