Date: Fri, Aug 29, 2025 | 06:20 AM GMT

The cryptocurrency market is experiencing notable volatility as Ethereum (ETH) briefly dipped to $4,475 from its 24-hour high of $4,629, marking a 2% drop and adding slight pressure across major altcoins.

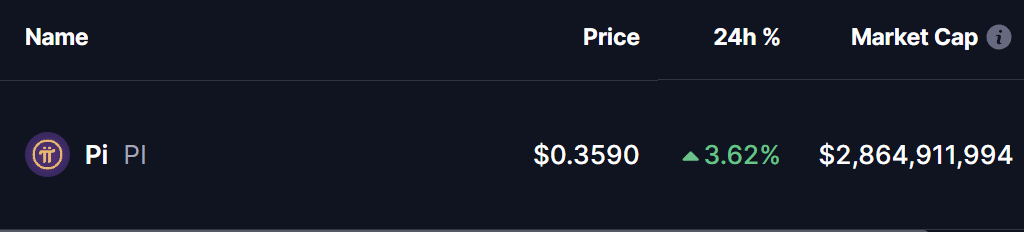

However, Pi Network (PI) has managed to stay in the green today. More importantly, its latest chart structure has printed a hidden bullish divergence on the daily RSI — a technical signal that may hint at a continuation of its upward trend.

Source: Coinmarketcap

Source: Coinmarketcap

Hidden Bullish Divergence on RSI

On the daily chart, PI is currently flashing a hidden bullish divergence on the Relative Strength Index (RSI). This occurs when price forms higher lows while RSI posts lower lows — a pattern that typically suggests the broader uptrend remains intact despite short-term weakness in momentum.

In PI’s case, the price has been holding above the $0.33 support level, forming a series of higher lows, while the RSI slipped near the 42 mark. Such a setup frequently precedes a continuation move higher, provided buyers regain control.

Pi Network (PI) Daily Chart/Coinsprobe (Source: Tradingview)

Pi Network (PI) Daily Chart/Coinsprobe (Source: Tradingview)

At present, PI trades around $0.3593, just beneath its 50-day moving average near $0.4028, which has acted as a key resistance level in recent weeks.

What’s Next for PI?

The hidden bullish divergence setup remains valid as long as PI defends the $0.33 support. On the upside, a confirmed breakout and daily close above the 50-day moving average at $0.4028 could open the path to higher levels. The next resistance sits near $0.4661, followed by $0.5212, both zones that previously acted as supply areas. If momentum strengthens, PI could extend its rally further into the mid-$0.60 range over the coming sessions.