Date: Fri, Aug 29, 2025 | 08:30 AM GMT

The cryptocurrency market is once again under pressure as Ethereum (ETH) slid to $4,375 from its 24-hour high of $4,613, marking a sharp 5% intraday drop. The weakness has rippled across the major memecoins, with SPX6900 (SPX) among the hardest hit, tumbling by more than 11% today.

Source: Coinmarketcap

Source: Coinmarketcap

Yet, beneath the surface, SPX may be showing signs of a potential turnaround. A key harmonic pattern has emerged on the charts, hinting that a rebound could soon be in play.

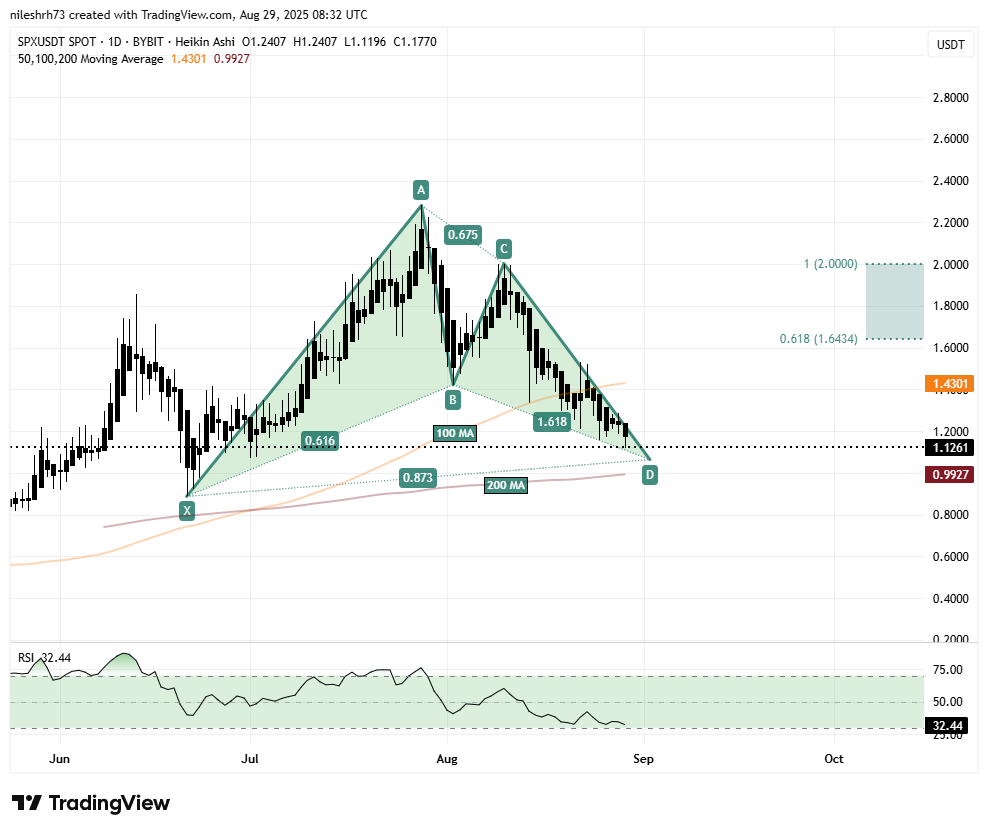

Bullish Gartley Harmonic Pattern in Play?

On the daily chart, SPX appears to be completing a bullish Gartley harmonic pattern. With the latest decline, the price is now approaching the final leg of the structure (CD), nearing the Potential Reversal Zone (PRZ) around the 0.886 retracement of the XA leg, which aligns closely with the $1.06 level.

SPX Daily Chart/Coinsprobe (Source: Tradingview)

SPX Daily Chart/Coinsprobe (Source: Tradingview)

This area is critical because it often acts as a launchpad for bullish reversals if buyers step in with conviction.

What’s Next for SPX?

If SPX confirms a bounce from the $1.06 PRZ, the bullish Gartley could trigger a rebound toward higher Fibonacci extension levels. Initial resistance lies near the 0.618 retracement at $1.64, with a further upside target around the 1.0 retracement at $2.00. These zones align with previous supply levels and would represent a meaningful recovery from current prices.

On the downside, however, caution is warranted. A failure to hold above $1.06 would put focus on the next major support around the 200-day moving average near $0.99. A breakdown below this level could invalidate the bullish setup and expose SPX to deeper losses.