Tether's USD₮ on RGB and Bitcoin's Emerging Role as a Global Payments Layer: A Strategic Inflection Point

- Tether integrates USD₮ stablecoin on Bitcoin via RGB protocol, transforming Bitcoin from "digital gold" to a global payments layer. - RGB’s dual-layer model combines Bitcoin’s security with off-chain scalability, enabling private, low-cost transactions without intermediaries. - Tether’s $104B market cap and 5.3M daily transactions position it to dominate stablecoin markets, leveraging Bitcoin’s censorship resistance for cross-border use. - The move strengthens institutional DeFi adoption by enabling Bitc

The integration of Tether’s USD₮ stablecoin onto the Bitcoin network via the RGB protocol marks a pivotal shift in the cryptocurrency ecosystem. By leveraging Bitcoin’s security and RGB’s scalability, Tether is redefining the role of Bitcoin from a "digital gold" store of value to a functional global payments layer. This development is not merely technical but strategic, addressing long-standing limitations of Bitcoin while positioning Tether to dominate the stablecoin market in an era of regulatory scrutiny and institutional demand for privacy and efficiency.

Strategic Infrastructure: RGB’s Dual-Layer Model

The RGB protocol operates as a dual-layer infrastructure, with Bitcoin serving as the base layer for security and RGB/Lightning acting as the scalable transaction layer [1]. This design allows users to transact USD₮ and Bitcoin in the same wallet without intermediaries or wrapped tokens, reducing friction for everyday use cases like cross-border remittances and e-commerce [2]. By anchoring ownership proofs to Bitcoin’s blockchain while storing sensitive data off-chain, RGB minimizes network congestion while preserving privacy—a critical advantage over Ethereum-based stablecoins, which face higher fees and regulatory exposure [3].

Tether’s CEO, Paolo Ardoino, has emphasized that this integration aligns with Bitcoin’s potential to become a “free financial world,” offering intuitive, private, and scalable solutions for global adoption [4]. The RGB protocol’s client-side validation model ensures users retain full control over their assets, eliminating reliance on third-party custodians [5]. This aligns with Bitcoin’s ethos of decentralization while addressing scalability challenges that have historically limited its utility as a payment network.

Competitive Positioning: Tether’s Market Dominance and Financial Resilience

Tether’s dominance in the stablecoin market—processing over 5.3 million daily transactions and holding a $104.1 billion market cap—positions it to accelerate Bitcoin’s transition to a payment network [6]. The company’s Q2 2025 report revealed a $20 billion increase in USDT supply and $127 billion in U.S. debt holdings, underscoring its financial resilience [7]. These metrics suggest that Tether’s RGB-based USDT could rival traditional payment systems in volume and efficiency, particularly in cross-border remittances where Bitcoin’s censorship resistance is a key advantage [8].

By expanding USDT’s infrastructure to Bitcoin, Tether is also diversifying its risk profile. Unlike Ethereum-based stablecoins, which face regulatory headwinds in jurisdictions like the U.S., Bitcoin’s decentralized nature provides a censorship-resistant alternative [9]. This strategic move reduces Tether’s exposure to centralized chains while capitalizing on Bitcoin’s growing institutional adoption.

Institutional and DeFi Implications

The integration of USD₮ on Bitcoin via RGB introduces a new layer of functionality for decentralized finance (DeFi). Institutions can now hedge risk with a stablecoin that operates natively on Bitcoin, leveraging its $167 billion market capitalization for tokenized real-world assets and decentralized lending platforms [10]. For users in low-connectivity regions, RGB’s reduced on-chain footprint and Lightning Network compatibility enable real-time micropayments at near-zero fees, addressing a critical barrier to adoption [11].

Moreover, Tether’s Q2 2025 profits of $4.9 billion signal a long-term commitment to infrastructure development, positioning the company to overcome challenges like wallet adoption and regulatory scrutiny [12]. As of August 2025, Tether has already demonstrated a test transfer of USD₮ via RGB, confirming the protocol’s operability [13].

Conclusion: A Catalyst for Bitcoin’s Global Adoption

Tether’s RGB-enabled USDT represents a compelling opportunity to expand Bitcoin’s utility beyond a store of value into a functional payment system. By combining Bitcoin’s security with RGB’s scalability and privacy, Tether is creating a hybrid model that balances decentralization with real-world usability. For investors, this development signals a strategic inflection point: Bitcoin is no longer just a hedge against inflation but a foundational layer for a decentralized financial future. As institutional adoption and DeFi innovation accelerate, the integration of USD₮ on Bitcoin could cement Tether’s position as the dominant stablecoin while redefining Bitcoin’s role in the global economy.

Source:

[1] Tether's Strategic Expansion of USDT on Bitcoin and RGB [https://www.bitget.com/news/detail/12560604937525]

[2] Tether's USDT Expansion into Bitcoin Ecosystem via RGB [https://www.bitget.com/news/detail/12560604937498]

[3] Tether Announces Plan to Bring USD₮ to RGB

[4] Tether Brings USDT to Bitcoin with RGB Protocol

[5] Tether's RGB-Enabled USDT Expansion [https://www.bitget.com/news/detail/12560604938085]

[6] Tether’s Q2 2025 Profit and Market Capitalization

[7] Tether Expands Native USDT Support on Bitcoin via RGB [https://www.bitget.com/news/detail/12560604938085]

[8] Tether's USDT Expansion into Bitcoin Ecosystem via RGB [https://www.bitget.com/news/detail/12560604937498]

[9] Tether's Strategic Move to Bitcoin: How Stablecoin Infrastructure is Fueling Institutional Adoption [https://www.bitget.com/news/detail/12560604937482]

[10] Tether's USDT Going Native on Bitcoin: A New Catalyst for ...

[11] Tether brings USD₮ to Bitcoin with RGB

[12] Tether’s Q2 2025 Profit and Market Capitalization

[13] Tether brings USD₮ to Bitcoin with RGB

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[English Long Tweet] Understanding the Evolution of the Crypto Market with an Integrated Framework

[Long English Thread] "Stablecoins" Are Not Stable at All: Why Do Stablecoins Always Die in the Same Way?

5 Charts to Understand the Current State of the Bitcoin Market

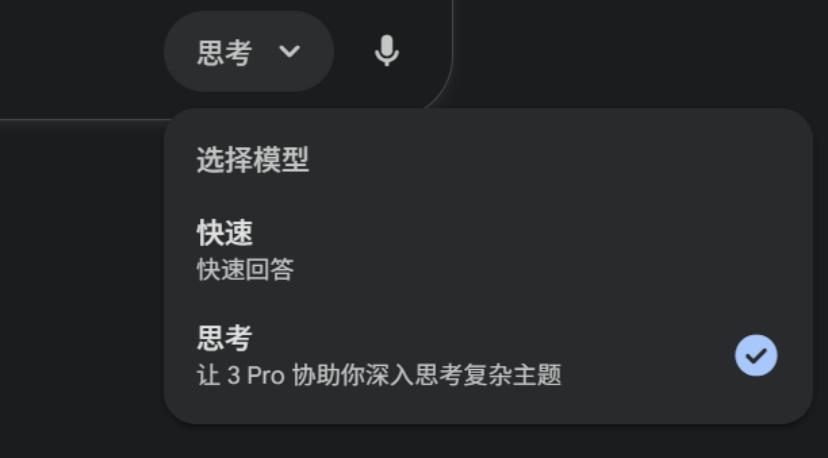

Even Altman gave it a thumbs up: What makes Google Gemini 3 Pro so powerful?

After 8 months of pretending to be asleep, Google suddenly dropped a bombshell with Gemini 3 Pro.