How CME crypto futures records reflect broader altcoin demand

This is a segment from the Forward Guidance newsletter. To read full editions, subscribe.

As the crypto market (and the investor base within it) continues to evolve, the latest demand for derivatives can help us define some broader segment trends.

With CME Group’s crypto derivatives lineup breaking records of late, I thought it was worth catching up with Giovanni Vicioso, the company’s crypto products head.

You already know that increasing institutional adoption and a clearer regulatory environment has fueled more trading activity this year. Investors might use derivatives (over spot trading, for example) to try to amplify returns and/or hedge risk.

Some stats that Vicioso said stood out to him include:

- Year-to-date average daily volume for full crypto derivatives suite is 230,000 contracts — up 158% year over year.

- YTD average open interest (the number of contracts held by market participants at the end of the trading day): 243,000 contracts — up 80% YoY.

- The crypto futures lineup, for the first time, reached $30 billion in both notional volume traded and open interest — led by BTC ($16 billion) and ETH ($10.5 billion).

- The 985 large open interest holders (LOIHs) for crypto futures on Aug. 11 marked a new record.

The last metric is key for measuring institutional interest, as LOIHs hold at least 25 contracts open.

With those general stats out of the way, we can pinpoint the demand for specific products and what it means — starting with renewed enthusiasm for the second-largest crypto asset.

CME Group’s ETH futures LOIHs hit a record of 118 during the week of Aug. 19 — signaling “a strengthening of the professional ecosystem around ether,” Vicioso said.

The company’s micro ether futures complex hit an all-time high of ~490,000 contracts on Aug. 22. Year-to-date micro ETH futures volumes have roughly quadrupled on a year-over-year basis.

“As far as broader trends around the surge…increased network activity, corporate treasury accumulation of ether and positive regulatory developments have further contributed to a broad-based rally around ether and ether-based derivatives,” Vicioso noted.

In a Monday update, BitMine Immersion said it held about 1.7 million ETH (today worth around $7.5 billion). That crypto treasury is the largest one focused on ether and second in size only to Strategy’s bitcoin stack worth ~$71 billion.

BitMine said Monday it added 190,500 tokens over the prior week alone. Fundstrat’s Tom Lee (also BitMine’s chair), said the firm is leading crypto treasury peers “by both the velocity of raising crypto NAV per share and by the high trading liquidity of our stock.”

Others are choosing to get ETH exposure via the US spot ETFs. Net inflows into those products (since their July 2024 launches) hit $13.7 billion on Thursday. That’s about a quarter of the $54.3 billion of net inflows that the US bitcoin ETFs have seen — roughly matching the ratio of those assets’ respective market caps.

Nearly $9.5 billion of the net inflows into ETH products have come since July 1 — outpacing bitcoin ETF inflows of $5.4 billion over that span.

We also have an update on CME Group’s newish solana and XRP futures — launched in March and May, respectively. Those piqued industry interest — in part given that CME futures launches historically precede SEC approval of respective spot ETFs.

Not to mention these tools — like ETFs — help create the necessary infrastructure (and credibility) for TradFi to dive into such altcoins. The prices of SOL and XRP are up 35% and 31%, respectively, from three months ago.

XRP futures crossed the $1 billion in open interest in just over three months — faster than any other CME crypto futures offering, Vicioso noted.

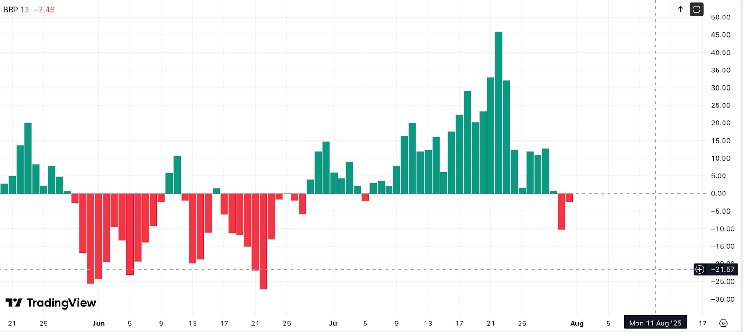

Roughly five months after SOL futures debuted, those had open interest rise to a record 11,600 contracts on Aug. 26. That same day, XRP futures open interest eclipsed 8,000 contracts (also an all-time peak).

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum undergoes "Fusaka upgrade" to further "scale and improve efficiency," strengthening on-chain settlement capabilities

Ethereum has activated the key "Fusaka" upgrade, increasing Layer-2 data capacity eightfold through PeerDAS technology. Combined with the BPO fork mechanism and the blob base price mechanism, this upgrade is expected to significantly reduce Layer-2 operating costs and ensure the network’s long-term economic sustainability.

Down 1/3 in the first minute after opening, halved in 26 minutes, "Trump concept" dumped by the market

Cryptocurrency projects related to the Trump family were once market favorites, but are now experiencing a dramatic collapse in trust.

Can the Federal Reserve win the battle to defend its independence? Powell's reappointment may be the key to victory or defeat

Bank of America believes that there is little to fear if Trump nominates a new Federal Reserve Chair, as the White House's ability to exert pressure will be significantly limited if Powell remains as a board member. In addition, a more hawkish committee would leave a Chair seeking to accommodate Trump's hopes for rate cuts with no room to maneuver.

From panic to reversal: BTC rises above $93,000 again, has a structural turning point arrived?

BTC has strongly returned to $93,000. Although there appears to be no direct positive catalyst, in reality, four macro factors are resonating simultaneously to trigger a potential structural turning point: expectations of interest rate cuts, improving liquidity, political transitions, and the loosening stance of traditional institutions.