What to Expect From Solana in September

The Solana price is hovering near $205, down 4.5% in 24 hours. While yearly gains remain strong, supply in profit and exchange balances point to selling pressure. Technicals suggest bearish risks unless SOL breaks above $217, which would invalidate the downside bias.

Solana has had a turbulent August. The token repeatedly tried to hold above $210 but failed to sustain momentum, slipping back into range. At press time, the Solana price trades near $205, down 4.5% over the last 24 hours and about 1% lower in the past week. Monthly gains remain above 13%, and the yearly trend is still positive at nearly 50%.

However, September could challenge this uptrend as on-chain and technical signals point toward potential weakness.

Supply in Profit Near Six-Month High

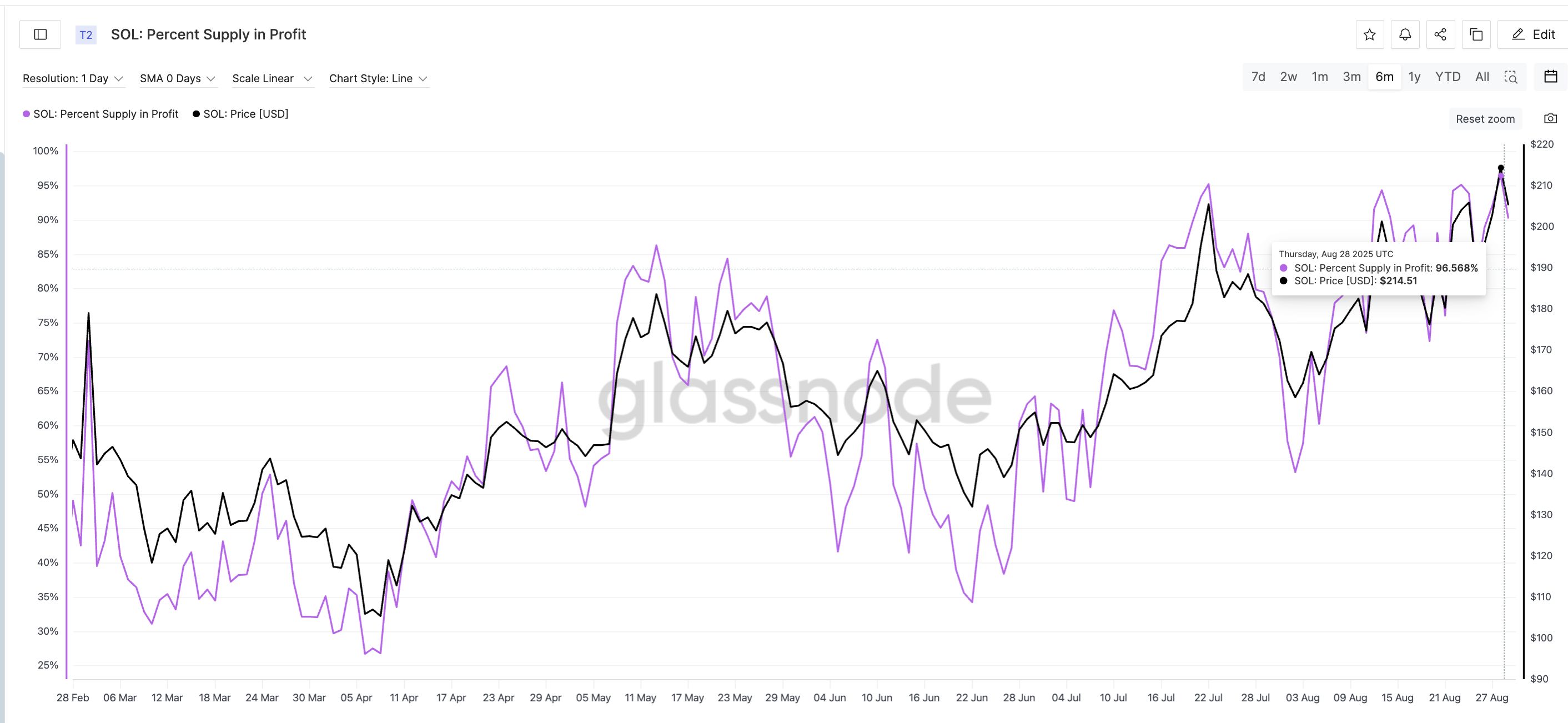

One of the most important metrics is the percentage of supply in profit, which measures how many coins are currently worth more than their cost basis.

This metric hit a six-month high of 96.56% on August 28 before easing slightly to around 90% now.

Solana Price And Profitability:

Solana Price And Profitability:

History shows that such highs often precede corrections in the Solana price. On July 13, the metric touched 96% while the Solana price traded around $205, followed by a 23% drop to $158.

Again, on August 13, the metric peaked at 94.31%, triggering a 12% correction from $201 to $176. Later, on August 23, another peak at 95.13% led to an 8% slide from $204 to $187.

With the metric back near record highs, the risk of a deeper correction in the SOL price in September is increasing.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Exchange Balances Reinforce Selling Risk

That selling risk is reinforced by exchange balances. The amount of SOL held on centralized exchanges surged to more than 32 million tokens on August 28, up from under 30 million earlier in the month. Rising balances usually suggest holders are preparing to sell.

Solana Price And Balance On Exchanges:

Solana Price And Balance On Exchanges:

The correlation is clear. On August 14, when balances peaked above 32 million, the Solana price dropped 8% from $192 to $176 within days.

Now, with balances climbing again, a similar setup is forming, pointing to renewed downside pressure that could weigh on the SOL price in September.

Solana Price Pattern Suggests Bearish Setup Despite Positive History

Technicals also align with this bearish outlook. Solana is moving inside an ascending wedge on the weekly chart — a pattern that often signals weakening momentum and can lead to either a bearish continuation or reversal.

If the Solana price loses $195 and $182, the decline could extend to $160, marking another potential 15–20% pullback. Interestingly, such pullbacks were previously seen when exchange balances and supply in profit percentages spiked. A breach under $182 would even validate the bearish pattern breakdown.

Solana Price Analysis:

Solana Price Analysis:

However, bulls still have a way to regain strength. A weekly close above $217 — the last local high — would invalidate the wedge’s bearish implication and open the way toward higher targets. Until then, the bias remains tilted downward.

This bearish technical setup comes against a backdrop of generally positive seasonality. Since 2021, Solana has delivered September gains of 29%, 5.3%, 8.2%, and 12.5%. But with supply in profit at highs and exchange balances elevated, 2025 may be the year this streak breaks.

Solana Price History:

Solana Price History:

Unless SOL manages a decisive close above $217, the Solana price in September could struggle, even with the positive push of historical performance and ETF-related optimism.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto: Fundraising Explodes by +150% in One Year

Bitcoin Drops $8B In Open Interest : Capitulation Phase ?

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025