Will Bitcoin Crash Below $100K in September 2025?

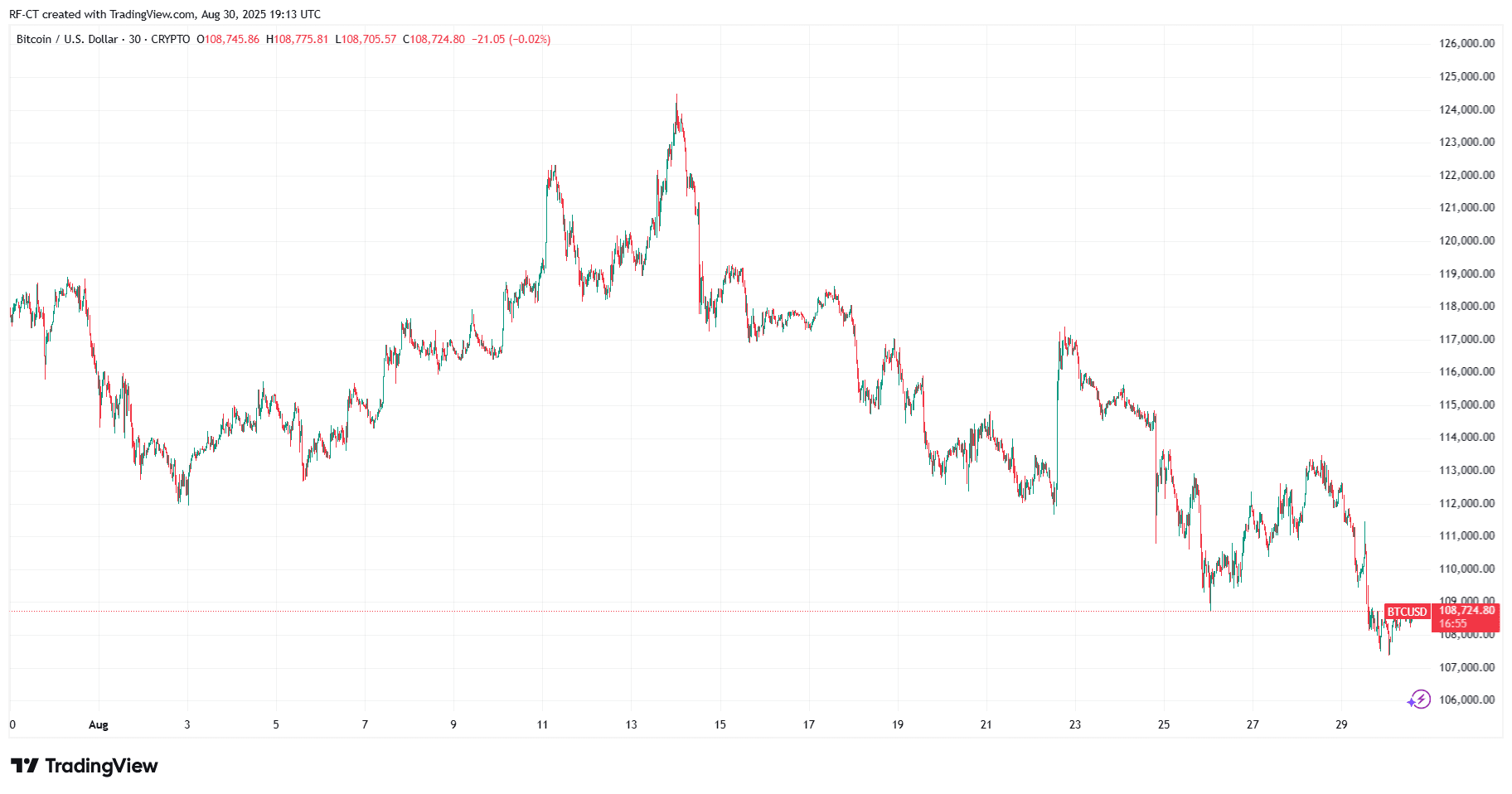

A Bloody End to August 2025

Bitcoin (BTC) and Ethereum (ETH) are feeling the heat. BTC has dropped to nearly $110K, while ETH slipped below $4,360 amid a $15 billion options expiry and the looming monthly close. Traders are calling this a manipulation play by whales to flush out leverage, but the fear is real: could BTC actually break below the $100K psychological line in September 2025?

Options Expiry and Market Games

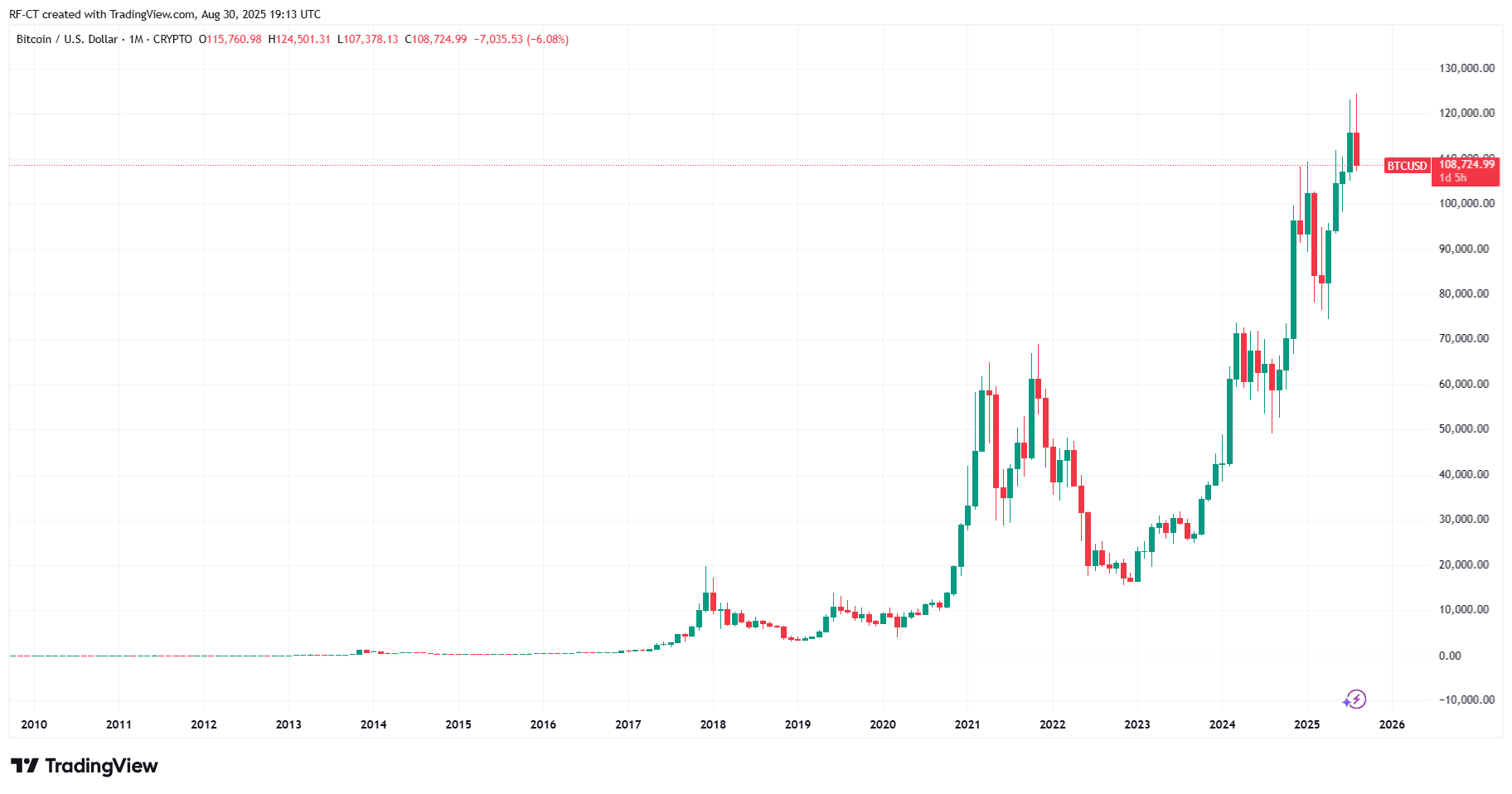

Historically, big expiry days create sharp, sudden dumps as market makers hedge positions and force liquidations. With BTC open interest sky-high, the timing of this sell-off is no coincidence. Similar setups in past cycles (2017, 2021) show that once expiry passes, markets often stabilize—but only after a brutal shakeout. September could open with this same scenario, leaving traders on edge.

Macro Picture: Global Liquidity is Rising

Despite the panic, there’s a powerful bullish force lurking in the background. Global M2 liquidity just hit a new all-time high, and Bitcoin has historically followed liquidity growth with a slight lag. The divergence we’re seeing now—liquidity pumping while BTC dips—suggests that this correction may only be temporary and that September’s early weakness could set up a stronger rebound later in the month.

September 2025: Bearish Start or Bullish Setup?

Traditionally, September is one of Bitcoin’s weakest months. Post-halving years have seen messy Q3 action before big Q4 rallies. The first days of September may extend the current weakness, with BTC at risk of testing the 107K–103K zone and ETH targeting $4,100–$4,050 if selling pressure continues.

But if BTC reclaims 113.5K–116K , and ETH recovers 4.45K–4.60K , the market could flip fast, turning September into the launchpad for a strong Q4 rally.

What Traders Should Watch

- Bearish Break: BTC slips under 109K, confirming targets at 107K → 103K. ETH risks a slide to 4.10K.

- Bullish Reclaim: BTC breaks 116K, ETH clears 4.60K, confirming renewed momentum.

- Liquidity Signal: Rising M2 suggests that dips in September may be short-lived—positioning matters more than panic.

The headlines may scream crash, but history says this looks more like a shakeout during September rather than the end of the bull cycle. Yes, Bitcoin could briefly flirt with the $100K level in September 2025, but the macro liquidity wave is still pointing higher. If the month starts bearish, the bigger picture remains: Q4 could be the rally that nobody wants to miss.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This Week's Preview: Macro "Flood Release" Week—Delayed CPI and the Bank of Japan's "Rate Hike Pursuit"

Key global market data will be released this week, including the U.S. non-farm payroll report, CPI inflation data, and the Bank of Japan's interest rate decision, all of which will significantly impact market liquidity. Bitcoin prices are fluctuating due to macroeconomic factors, while institutions such as Coinbase and HashKey are striving to break through via innovation and public listings. Summary generated by Mars AI This summary was generated by the Mars AI model. Its accuracy and completeness are still being iteratively improved.

Weekly Hot Picks: The Fed Cuts Rates and Indirectly "Injects Liquidity"! Silver Replaces Gold as the New Favorite?

The Federal Reserve is cutting interest rates and starting bond purchases, while Japan and other regions may turn to rate hikes. Silver repeatedly hits record highs, SpaceX is set for a 1.5 trillion IPO, and Oracle becomes the litmus test for the AI bubble. The Russia-Ukraine peace process is stuck on territorial issues, the US seizes a Venezuelan oil tanker... What exciting market events did you miss this week?

Key Highlights to Watch at Solana Breakpoint 2025

How does Solana seize market share in an increasingly competitive landscape?

Crucial Alert: ZRO Leads This Week’s $100M+ Token Unlocks – What Investors Must Know