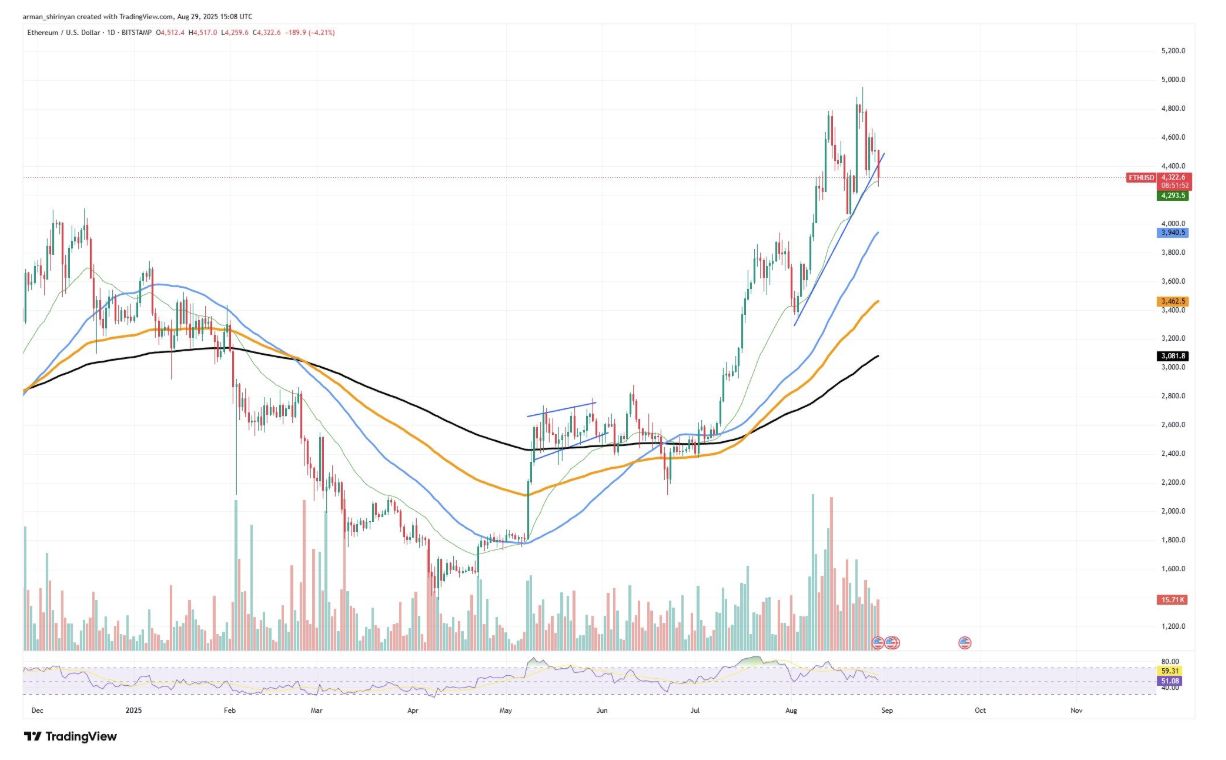

After a sharp correction, Ethereum $4,349 has rebounded, holding strongly above the $4,300 support level. The daily chart structure suggests that ETH could be poised for a new rally toward $5,000, indicating the recent pullback may have ended. Over recent weeks, the 50-day moving average provided dynamic support, aiding ETH’s recovery. Quick buying following minor pullbacks shows investor confidence remains high.

Technical Indicators

With the RSI indicator at 59, there is space for an upward movement as it distances itself from the overbought region. While volume diminished during the correction, it remains relatively high.

In the coming days, ETH might retest the recent peak of $4,800 and could surpass $5,000 if trading volume increases. However, Ethereum rallies have historically been volatile and can end unexpectedly. Should the price fall below $4,200, the correction could extend to the 200-day average at $3,400. Nonetheless, investor interest, momentum gain, and technical support signal a potential breakout for ETH. Achieving $5,000 could happen sooner than anticipated if momentum builds.

XRP Faces a Critical Decline

Currently trading just below the $3.00 level, XRP is technically on the verge of a downward breakout. The symmetrical triangle formation that developed in recent weeks signals a decline rather than an upswing. At present, XRP trades at $2.82 and has started slipping below short-term support, indicating the formation’s weakness and a potential continuation of the downtrend.

The breakout of the triangle alone poses a negative situation, compounded by decreasing volume, increasing the risk. XRP might retreat to $2.50, the 200-day moving average, a significant technical and psychological support. The RSI indicator at 42 reveals the downtrend persists, with buyers yet to intervene. A significant external factor, such as a market-wide recovery, is needed for XRP to escape the decline.

Shiba Inu (SHIB) Stagnant and Constricted

SHIB currently trades around $0.0000122, moving sideways in a narrowing triangle formation. With weak volume and historically low liquidity over weekends, the real direction is likely to emerge with increased volume next week.

Technically, SHIB is surrounded by lower support and the 50, 100, and 200-day averages. If the volume remains low and this squeeze continues, a sudden breakout may occur. However, since resistance levels remained unbroken throughout August, the overall trend leans downward. The RSI indicator at 44 also reveals weak momentum.

If the lower support breaks, SHIB’s price may fall back to the $0.0000110-$0.0000100 range, which served as support earlier this year. Conversely, for a notable recovery, the price needs to rise above the $0.0000135-$0.0000140 range, which seems unlikely without volume increase.

For SHIB investors, the weekend could pass with uncertainty. The true test will begin next week when trading volume increases.