PCE Price Index in Line with Expectations: What It Means for Inflation Outlook and Equity Valuations

- July 2025 PCE data shows core inflation at 2.9%, highest since February, driven by Trump-era tariffs and supply chain issues. - Fed maintains 4.25–4.50% rates amid 4.1% unemployment, but markets price 75% chance of 25-basis-point cut in September. - Tech sectors (AI, semiconductors) outperform while healthcare struggles; investors favor high-quality equities and inflation-hedging commodities. - Fed prioritizes core PCE over growth, balancing inflation control with soft-landing risks as late-cycle strateg

The July 2025 PCE Price Index report delivered a mixed message for investors: headline inflation held steady at 2.6% year-over-year, while core inflation climbed to 2.9%, the highest since February 2025 [1]. These figures, in line with consensus forecasts, underscore the persistent inflationary pressures stemming from Trump-era tariffs and supply chain bottlenecks [1]. For late-cycle investors, this data signals a critical juncture where macroeconomic signals and sector positioning must align to navigate a Fed poised to act—and markets already pricing in that action.

The Fed’s Tightrope: Inflation Control vs. Growth Risks

The Federal Reserve’s July policy meeting left rates unchanged at 4.25–4.50%, reflecting its cautious stance amid inflation above its 2% target [2]. While core PCE inflation has risen to 2.9%, the labor market’s resilience—with an unemployment rate of 4.1% in June—has tempered immediate rate-cut expectations [2]. However, weaker job growth in July has reignited fears of a soft landing gone sideways, with markets now pricing in a 75% probability of a 25-basis-point cut in September [2]. This duality—higher inflation but softening labor data—creates a volatile backdrop for equities.

The key takeaway for investors is that the Fed is unlikely to tolerate inflation much above 3% for long. Tariffs, which are now fully embedded in the economy, have pushed goods prices upward, with businesses passing costs to consumers [1]. Yet, the central bank’s focus on core PCE (excluding food and energy) suggests it remains committed to a data-dependent approach, prioritizing price stability over growth [2].

Sector Positioning: Winners and Losers in a Late-Cycle Environment

July’s market performance highlighted stark sector divergences. Information Technology led the S&P 500, driven by AI-driven demand for semiconductors and cloud infrastructure [4]. Conversely, Health Care lagged, with United Health Group’s struggles reflecting broader concerns about inflation eroding margins in a sector reliant on fee-for-service models [4].

Late-cycle investing demands a focus on high-quality, less cyclical equities. Sectors like semiconductors and pharmaceuticals offer resilience due to their pricing power and demand inescapability [1]. For example, companies like Nvidia and Roche benefit from structural trends (AI and aging populations) that insulate them from short-term inflationary shocks. Meanwhile, sectors like industrials and consumer discretionary face headwinds as tariffs and higher borrowing costs dampen demand [4].

Commodities and precious metals also gained traction in July, with the S&P GSCI Precious Metals index rising amid macroeconomic uncertainty [4]. Gold and silver act as natural hedges against inflation and geopolitical risks, making them compelling additions to diversified portfolios.

Equity Valuations in an Inflationary World

While the PCE data does not directly correlate with equity valuations, historical patterns suggest that high inflation erodes corporate margins and increases discount rates, pressuring stock prices [5]. However, the current environment differs from past inflationary periods: the Fed’s focus on core PCE (which excludes volatile items) and the rise of high-quality, cash-generative equities have created a buffer against valuation compression [5].

For late-cycle investors, the priority is to avoid overexposure to interest-rate-sensitive sectors like real estate and utilities. Instead, favor companies with strong balance sheets and pricing power, such as those in the S&P 500’s Information Technology and Communication Services sectors [4]. Additionally, private credit and high-yield corporate bonds offer attractive yields in a high-rate environment, complementing equity allocations [3].

Conclusion: Navigating the Tightrope

The July PCE report confirms that inflation remains a stubborn challenge, but the Fed’s measured response and market expectations for rate cuts provide a floor for equities. Late-cycle investors should focus on quality over growth, diversify into inflation-hedging assets like commodities, and remain agile in response to shifting macroeconomic signals. As the Fed inches closer to its 2% target, the key will be balancing the risks of tightening too late with the costs of tightening too soon.

**Source:[1] Core inflation rose to 2.9% in July, highest since February [2] Federal Reserve Calibrates Policy to Keep Inflation in Check [3] Seizing Late-Cycle Opportunities [4] Investment Commentary | July 2025 [5] United States PCE Price Index Annual Change

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 Crypto Prediction Review: 10 Institutions, Who Got It Wrong and Who Became Legends?

We can consider these predictions as indicators of industry sentiment. If you use them as an investment guide, the results could be disastrous.

SEC launches innovative exemption policy—Has U.S. crypto regulation entered a new era?

The door to exploration has just opened.

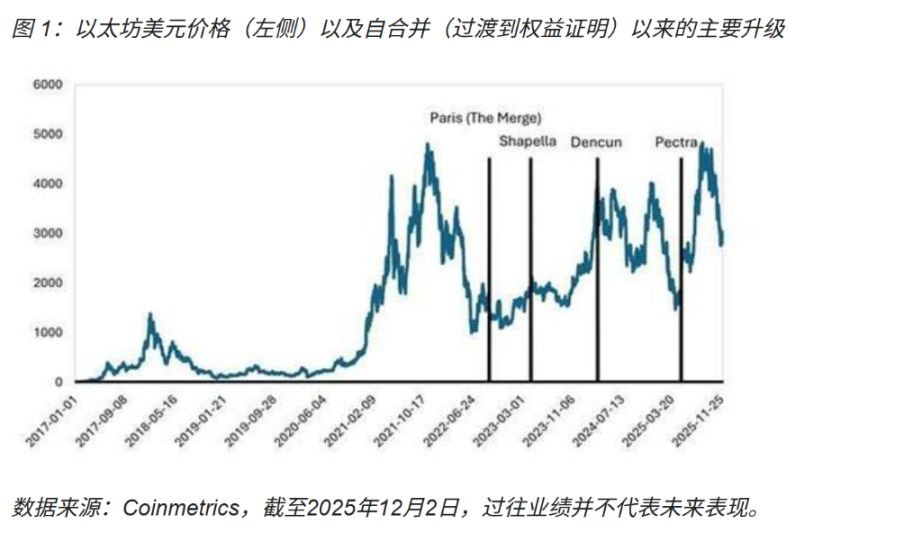

Ethereum undergoes "Fusaka upgrade" to continue "scaling and improving efficiency," strengthening on-chain settlement capabilities

The Fusaka upgrade will consolidate its position as a settlement layer and drive Layer-2 competition towards improvements in user experience and ecosystem depth.

Space Review|Inflation Rebounds vs Market Bets on Rate Cuts: How to Maintain a Prudent Crypto Asset Allocation Amid Macroeconomic Volatility?

In the face of macro volatility, the TRON ecosystem offers a balanced asset allocation model through stablecoin settlements, yield-generating assets, and innovative businesses.