Chainlink (LINK) Price Uptrend Likely To Reverse as Charts Hint at Exhaustion

LINK price is showing cracks after a 100%+ year-long rally. On-chain and technical signals now suggest the uptrend may be fading.

Chainlink (LINK) has been one of the stronger performers in the market, rallying more than 109% over the past year. Even in the last three months alone, the LINK price has gained about 68.5%.

But the past week has revealed weakness, with the token slipping more than 9%, and both on-chain metrics and technical charts now suggest the year-long uptrend may be losing steam, at least for now.

Profit-Taking Pressures Mount As Holders Sit in Gains

One of the clearest signs comes from the percentage of LINK supply in profit, which is still hovering at historically high levels.

As of August 29, nearly 87.4% of the circulating supply is in profit, close to the recent peak of 97.5% seen on August 20. That peak coincided with the LINK price rally to $26.45, which quickly retraced by over 6% to $24.82 the following day.

Chainlink Price And Supply In Profit:

Glassnode

Chainlink Price And Supply In Profit:

Glassnode

A look further back shows the same pattern. On July 27, the supply in profit stood at 82.8%, just before LINK corrected from $19.23 to $15.65, making a 19% dip. The current reading near 87% is again uncomfortably high, hinting at elevated risks of profit-taking.

LINK Capital Inflows Showing Bearish Signs:

LINK Capital Inflows Showing Bearish Signs:

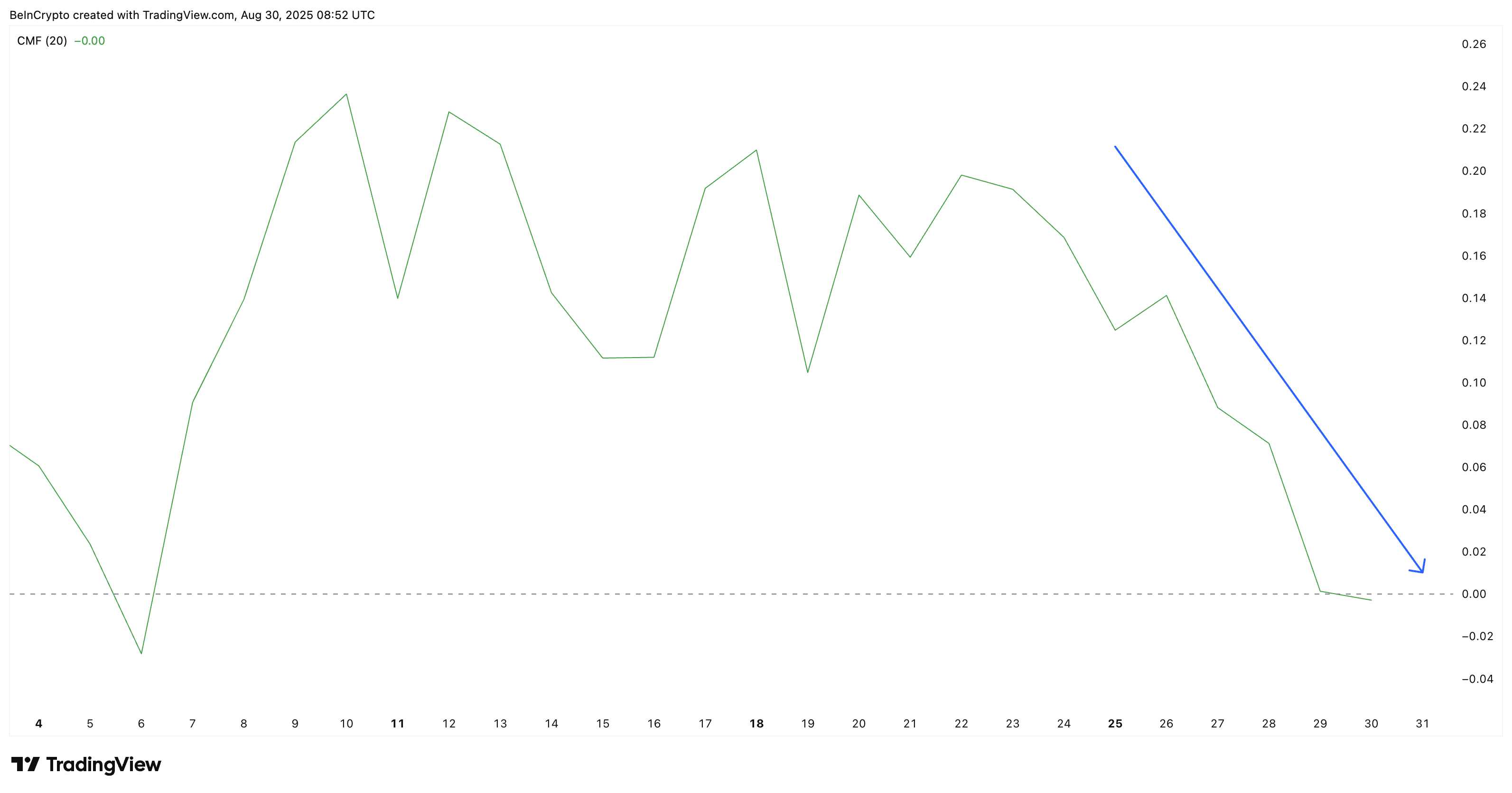

Additionally, the Chaikin Money Flow (CMF), which tracks capital inflows and outflows, has trended downward since August 22 and finally slipped below zero on August 29 for the first time since August 6. This shift into negative territory signals fading buying pressure and capital inflows, strengthening the case for a potential pullback.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Chainlink (LINK) Price Action Points To Bearish Exhaustion

The daily chart reinforces this caution. The LINK price is currently trading at $23.31, sitting inside an ascending broadening wedge pattern — a structure often associated with loss of upward momentum near the end of a bullish phase. This “megaphone” like pattern is infamous to kickstarting bearish reversals, a risk that now looms over LINK.

LINK Price Analysis:

LINK Price Analysis:

The key support to watch is $22.84. A decisive break below this level would expose the next downside target at $21.36, and falling beneath that could risk a deeper retracement. That could be anywhere in the 6% to 19% percent range, as experienced during the local “Supply In Profit” peaks.

On the other hand, if the LINK price manages to reclaim $25.96, it may still attempt another move higher.

But even such a recovery would not fully overturn the broader exhaustion signs unless the token can break convincingly above $27.88.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin ’rallies are for selling‘: Top 3 arguments from BTC market bears

XRP bulls grow louder: What will spark the breakout toward $2.65?

Bitcoin gives up $90K at US open as two-week exchange outflows near 35K BTC

Refuting the AI bubble theory! UBS: Data centers show no signs of cooling down, raises next year's market growth forecast to 20-25%

The structural changes in the cost of building AI data centers mean that high-intensity investment will continue at least until 2027, and AI monetization has already begun to show signs.