American Bitcoin Merges, Nasdaq Listing in September 2025

- American Bitcoin merges with Gryphon Digital, set for Nasdaq listing.

- Trump brothers hold minority stake.

- Hut 8 becomes majority owner with 80% stake.

American Bitcoin, affiliated with the Trump family, finalized its merger with Gryphon Digital Mining and plans a Nasdaq listing in September 2025, with Hut 8 as the majority owner.

This merger reflects a significant intersection of political influence and cryptocurrency, potentially impacting market dynamics and investor interest, particularly given the substantial Bitcoin holdings involved.

American Bitcoin, a company linked to the Trump family, has successfully merged with Gryphon Digital Mining , paving the way for a Nasdaq listing in September 2025. The merger includes approval from Gryphon’s board of directors.

Hut 8, a major North American mining company, becomes the majority owner with an 80% stake. Eric Trump and Donald Trump Jr. collectively hold an 18–20% minority stake in the newly formed public entity.

The immediate effect positions Hut 8 as a dominant player in the Bitcoin mining industry. This partnership leverages political connections while expanding market influence through substantial Bitcoin treasury assets.

The merger raised $220 million from investors, alongside an additional $10 million in Bitcoin. This financial influx and treasury accumulation create shifts in market dynamics, challenging competitors within the mining sector.

The listing process involved a 5-for-1 reverse stock split to meet Nasdaq’s requirements. Market participants speculate on potential impacts, with comparisons drawn to companies like Marathon Digital.

Analyses suggest that this merger could lead to increased Bitcoin mining focus, potentially influencing Bitcoin’s market position. The involvement of political figures in crypto raises questions about regulatory and financial outcomes.

“Hut 8, Eric, and his brother Donald will own 98% of the entity … the Trump brothers found it more advantageous to create and list the company, rather than go for a public IPO, which would give it access to multiple financial avenues anyway,” Asher Genoot, CEO, Hut 8.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pyth announces the launch of Pyth Pro: Reshaping the market data supply chain

Pyth Pro aims to provide institutions with a transparent and comprehensive data perspective, covering all asset classes and geographic regions in global markets, eliminating inefficiencies, blind spots, and rising costs in the traditional market data supply chain.

Stablecoins + Quality Tokens + New Perpetual DEX: An Investment Portfolio Sharing from a Humble Airdrop Hunter

How to build an all-weather cryptocurrency investment portfolio in both bull and bear markets?

Boom, Bust, and Escape: The Disillusionment of Traditional VCs in Web3

Crypto is never about belief; it's merely a footnote to the cycle.

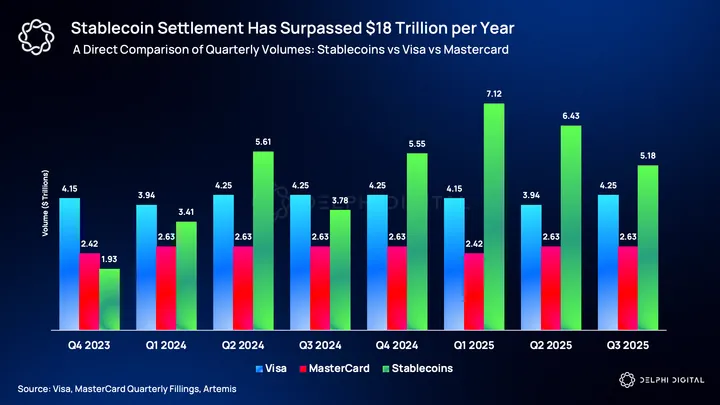

Delphi Digital Research Report: Plasma, Targeting Trillion-Dollar Market Opportunities

A zero-fee stablecoin public chain targets the trillion-dollar settlement market.