Earnings Preview | Store Renovation and Online Expansion May Help Macy's Restore Gross Margin in Q2

Summary: Macy's will release its Q2 FY2026 results before the market opens on September 3. Amid a complex trade environment, Macy's sales, gross margin, and other metrics may reflect trends in U.S. inflation and the macroeconomy.

Q1 Performance Review

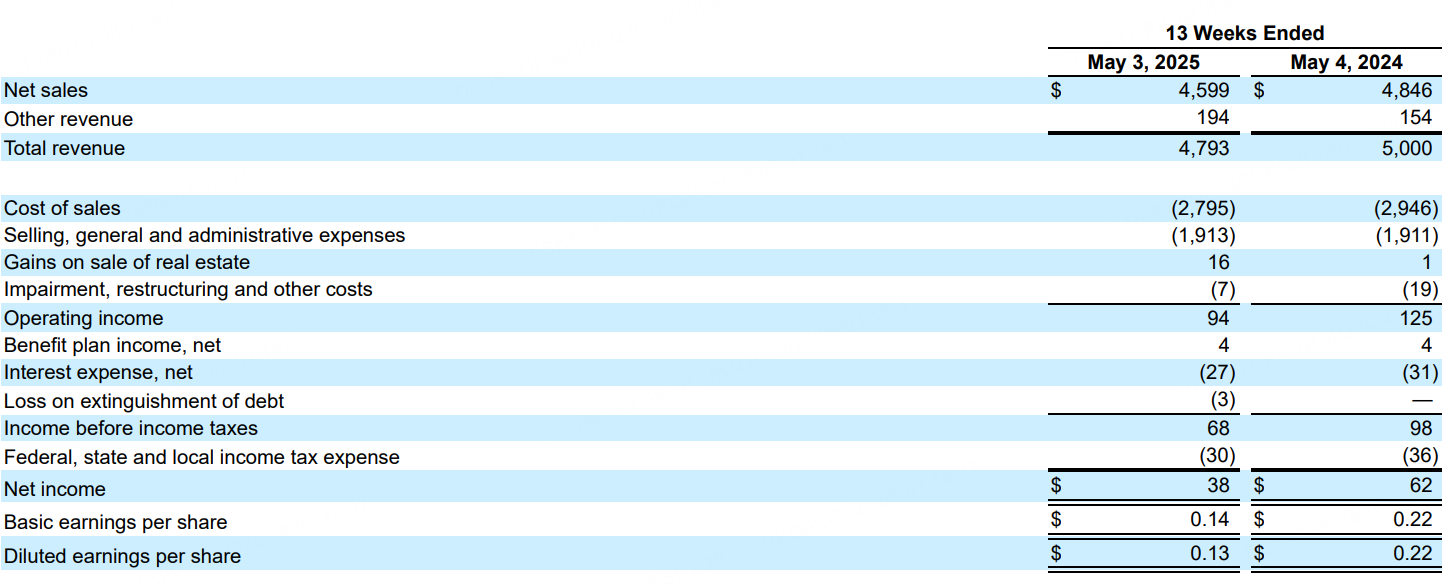

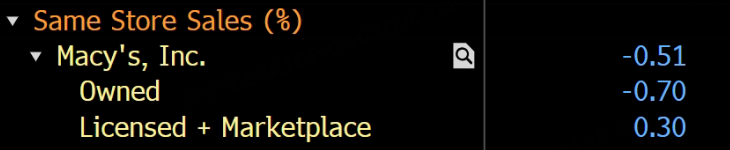

In the first quarter, Macy's achieved net sales of $4.6 billion, exceeding the company's previous guidance range. Comparable sales for owned brands declined by 2.0%, while comparable sales for owned + licensed + marketplace brands fell by 1.2%. Diluted earnings per share for Q1 were $0.13; adjusted diluted earnings per share were $0.16, both above the company's prior guidance range.

Q2 Outlook

According to Bloomberg data, analysts generally expect Macy's Q2 revenue to be $4.743 billion, with adjusted diluted earnings per share of $0.18.

Macy's comparable same-store sales for owned brands are expected to decline by 0.7% in Q2.

Main Focus Points

Effect of Store Revamps

The strategy of store revamps and "selective investment" has entered the results verification phase. Q2 typically coincides with seasonal promotional windows, making the balance between driving foot traffic and discount levels especially critical. Institutions generally believe that visual merchandising and staffing optimization in revamped sample stores have improved the shopping experience, but conversion rate improvement must occur alongside more precise category assortments. Single-store efficiency is expected to improve quarter-on-quarter in Q2, laying a solid foundation for the peak season in the second half of the year.

Gross Margin Recovery

In Q1, the company adopted more aggressive promotions to boost volume, putting pressure on gross margin; Q2 gross margin is expected to decline slightly year-on-year, but the extent is manageable. The core variables are whether deeper clearance, timing of promotional periods, and an increased share of high-margin categories can offset some of the discount pressure. Gross margin is expected to recover in the second half of the year.

Improving Online Sales Efficiency

The proportion of online orders continued to rise in Q1, and in Q2, attention should be paid to balancing online customer acquisition costs and offline fulfillment efficiency. Improving the efficiency of stores as front-end warehouses, optimizing return and exchange processes, and enhancing the in-store pickup experience will directly impact order fulfillment costs and customer satisfaction. If algorithmic product selection and regional restocking continue to iterate, it will help reduce end-of-season clearance pressure and maintain gross margin. Strengthening the "online first launch + in-store experience" strategy for high-margin small items may result in higher conversion rates and better per-order profitability.

Impact of Tariffs

U.S. consumers are facing a new round of price increases, and major retailers have warned that tariff costs are already being passed on to the retail end. Macy's is expected to hedge the impact of tariffs through "moderate price increases + category substitution + discontinuation of some low-margin products." In the short term, price increases bring sales uncertainty, but optimizing product assortment also helps stabilize overall gross margin.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin 2022 bear market correlation hits 98% as ETFs add $220M

Fed rate-cut bets surge: Can Bitcoin finally break $91K to go higher?

Crypto: Fundraising Explodes by +150% in One Year