Major Comeback! Deutsche Bank (DB.US) Returns to the Euro Stoxx 50 Index After Seven Years

According to Jinse Finance, Deutsche Bank (DB.US) has finally returned to the Euro Stoxx 50 index after being excluded from the core eurozone stock benchmark for seven years. Index compiler ISS Stoxx announced on Monday that the German banking giant, along with Siemens Energy and Belgian biotech company Argenx SE (ARGX.US), will be added to the index, replacing Nokia (NOK.US), Stellantis NV (STLA.US), and Pernod Ricard. This adjustment is due to the impact of U.S. tariff policies on the earnings of some companies, as well as the strong performance of the European energy and financial sectors.

Deutsche Bank was removed from the index in 2018 due to performance pressures and has finally made its comeback after seven years of ups and downs. Current CEO Christian Sewing faced the index adjustment just months after taking office, and it was not until the overall rebound of European bank stocks in 2025 and Deutsche Bank's share price doubling over the past 12 months that the bank regained recognition from the index compiler.

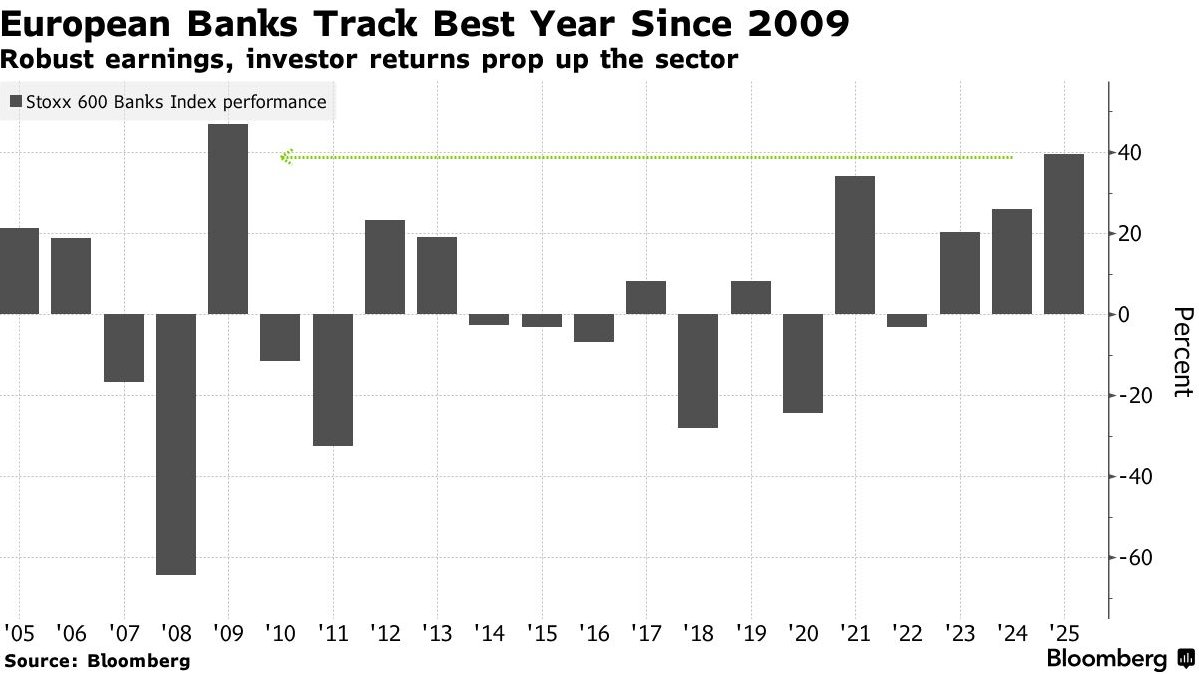

Figure 1

It is worth noting that the strongest rally in European bank stocks since 2009 is now facing multiple challenges, with market sentiment cooling significantly in recent days. The Stoxx 600 Banks Index fell 4.5% last week, marking its largest weekly drop since April. Institutions such as Commerzbank, Denmark's Sydbank, NatWest Group, and Société Générale were among the hardest hit by the sell-off.

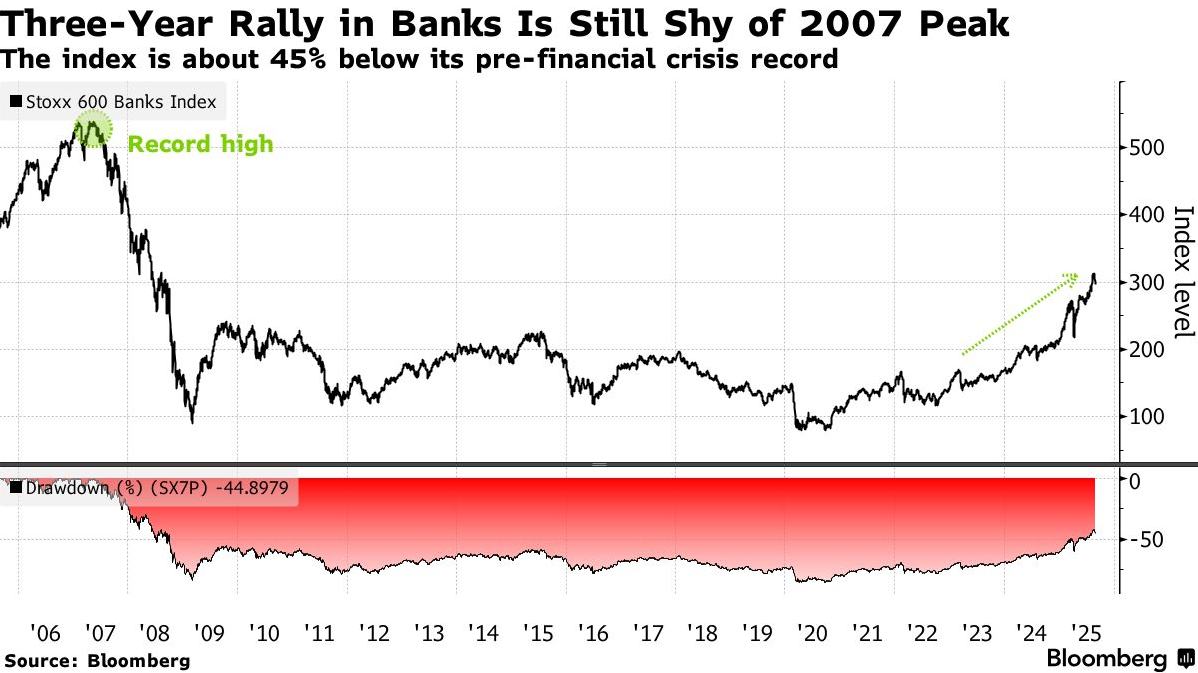

Figure 2

This pullback is the result of multiple negative factors: political turmoil in France has heightened sovereign risk, the UK is once again discussing the proposal of a windfall tax on banks, and concerns about potential tax policy adjustments in Italy have all combined to undermine investor confidence in the sustainability of European banks' profitability.

Despite the correction, some market participants still believe that, with strong capital positions and optimistic business activity in the U.S. and Europe, European banks will be able to withstand rising sovereign risks. Deutsche Bank strategist Maximilian Uleer emphasized that aside from short-term factors such as the French political situation, the strong fundamentals of the banking sector remain unchanged, and he continues to list it as one of his most favored sectors.

However, market divergence has clearly intensified. Bank of America strategists warn that if the global economy slows, falling bond yields and widening risk premiums could put pressure on financial stocks, and historical data shows that this sector tends to underperform in such environments.

Nevertheless, current business activity data from Europe and the U.S. still send positive signals, and in the absence of major external shocks, the rally in bank stocks may still be supported. Daniel Murray, CEO of Asset Management at Swiss J. Safra Sarasin, believes that although policies such as windfall taxes may weaken profit prospects, credit demand and net interest margins remain resilient. Whether banks can maintain their attractiveness will depend on their ability to cope with tax challenges.

It is worth noting that the current European bank stock index is still about 45% below its pre-2007 financial crisis peak, and the ongoing rally for the third consecutive year has yet to reach historical highs. This valuation gap, along with the tug-of-war between policy risks and sovereign debt concerns, will be key variables determining the sector's future trajectory.

Figure 3

In addition, Siemens Energy, another beneficiary, has seen its share price soar more than 200% since September last year, making it a star company amid surging European electricity demand. The company recently reported significant growth in orders for gas turbines and grid equipment, and its full-year performance is expected to reach the upper end of forecasts.

Argenx's inclusion is due to positive progress in its research and development of drugs for cancer and autoimmune diseases. The Belgian pharmaceutical company's share price has risen 30% over the past year and continues to receive "buy" ratings from analysts, with the market generally believing there is still room for its valuation to rise.

In contrast, the three companies removed from the index face different challenges: Nokia's share price fell 7% over the past year due to the impact of U.S. tariff policies and a weak dollar, and it lowered its profit forecast in July; Stellantis' share price shrank 46% in 12 months, with CEO changes and weak sales in the U.S. and European markets exacerbating its difficulties; Pernod Ricard's share price fell 24% since the last review due to global trade frictions, although its August performance still exceeded expectations.

This adjustment is another major change to the Stoxx 50 index following the rapid inclusion of German defense company Rheinmetall in June. In addition, the Stoxx 600 index is being adjusted simultaneously, with French biotech company Abivax (whose share price soared 850% in July) and Frankfurt Airport Group among the new entrants, while companies such as Gerresheimer are being removed. All changes will take effect after the opening of the European trading session on September 22.

As the scale of passive investment funds expands, the status of index constituents is having an increasingly significant impact on stock liquidity. This adjustment not only reflects the market's renewed confidence in the European financial and energy sectors, but also highlights the profound impact of global trade policy fluctuations on the valuations of multinational companies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

IOTA partners with top global institutions to build Africa’s “digital trade superhighway”: a new $70 billion market is about to explode

Africa is advancing trade digitalization through the ADAPT initiative, integrating payment, data, and identity systems with the goal of connecting all African countries by 2035. This aims to improve trade efficiency and unlock tens of billions of dollars in economic value. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated.

Panic selling is all wrong? Bernstein: The real bull market structure is more stable, stronger, and less likely to collapse

Bitcoin has recently experienced a significant 25% pullback. Bernstein believes this was caused by market panic over the four-year halving cycle. However, the fundamentals have changed: institutional funds such as spot ETF are absorbing the selling pressure, and the structure of long-term holdings is more stable. Summary generated by Mars AI. The accuracy and completeness of this content are still being iteratively improved.

Young Bitcoin holders panic sell 148K BTC as analysts call for sub-$90K BTC bottom

Rare Bitcoin futures signal could catch traders off-guard: Is a bottom forming?