Bullish on the surface but actually bearish? Netflix (NFLX.US) options market sends a cautious signal with $4.3 million

According to Jinse Finance APP, the options market volatility of streaming giant Netflix (NFLX.US) last Friday provided investors with a window into market sentiment. On that day, the total volume of derivatives trading reached 164,872 contracts, 44.8% higher than the average daily level over the past month. Of these, put options accounted for 76,931 contracts, while call options reached 87,941 contracts, with a put/call ratio of about 0.875. Although this figure is below 1, indicating a surface-level bullish sentiment, it is important to note that options trading includes both buying and selling operations, and the specific trading direction must be considered for analysis. Observing through the options flow screener commonly used by institutions, Barchart, the net trading sentiment on the day leaned bearish, involving nearly $4.3 million.

Specific trading details show that call options with a strike price of $1,200 expiring on September 19 were sold for $2.131 million, with a purchase price of $35.95. If Netflix's stock price does not break through $1,235.95 (strike price + option cost) by the expiration date, the seller will retain the premium; if it does break through, the seller will be required to deliver the stock at the agreed price. This operation suggests that some traders may be reducing their holdings of the underlying stock or using credit strategies to try to profit from stock price fluctuations.

Although the options data sends cautious signals, Netflix's stock price has fallen nearly 3% since August 18, with a 10% decline over the past six months, but still maintains a 79% increase over the past 52 weeks. For fundamentally strong leading companies, short-term pullbacks often breed contrarian opportunities.

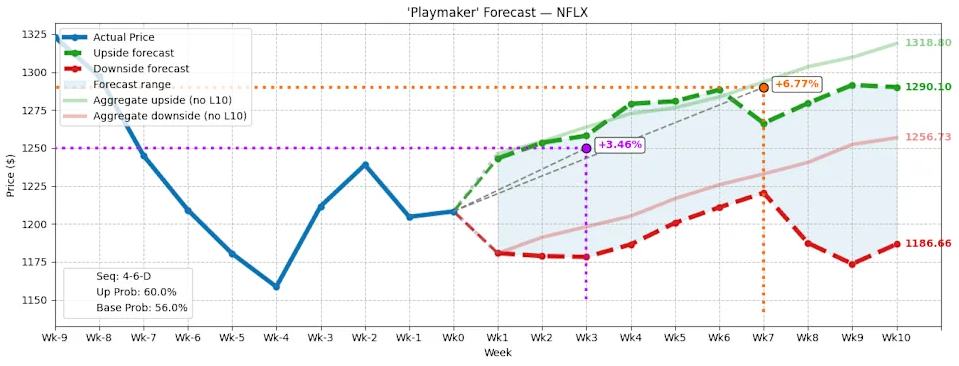

Quantitative models show that under a non-parametric statistical framework, the median natural volatility range for Netflix's stock price over the next 10 weeks is $1,256.73–$1,318.80. If market reversal signals are considered (four buys and six sells in the past 10 weeks, with an overall downward trend), the conditional deviation range may dip to $1,186.66–$1,290.10. It is worth noting that volatility may expand around the October 17 options expiration, and the trading environment may become more complex.

Given the current market conditions, two bull call spread strategies are worth noting: First, the $1,242.50/$1,250 spread expiring on September 19. If Netflix rises 3.46% to $1,250 within the next three weeks, the maximum profit can reach 150%. Second, the $1,280/$1,290 spread expiring on October 17, which requires a higher initial cost ($385), but offers a longer time buffer, with a maximum profit close to 160%. Both strategies reduce the cost of buying by selling higher strike call options, making them suitable for scenarios where a moderate stock price increase is expected.

Although this options anomaly is not a strong bullish signal, combined with the extent of the stock price pullback and long-term growth potential, it may provide a window for cautious investors to position themselves. It should be noted that the expansion of volatility from late October to early November may bring short-term risks, so strict stop-loss levels should be set when operating.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump's CFTC, FDIC Picks Closer to Taking Over Agencies as They Advance in Senate

ETFs are being launched in clusters, but coin prices are falling. Can ETF approval still be considered good news?

On one hand, Vanguard has opened Bitcoin ETF trading, while on the other hand, CoinShares has withdrawn its applications for XRP, Solana Staking, and Litecoin ETFs, highlighting a significant divergence in institutional attitudes toward ETFs for different cryptocurrencies.

ADP employment data "unexpectedly weak", is a Federal Reserve rate cut imminent?